2 Bar Reversal Price Action Trading Guide

The 2 Bar Reversal is similar to the engulfing bar in that they are both reversal price action signals.

The main difference between the 2 Bar Reversal and the Engulfing Bar is the 2 Bar Reversal does not have to fully engulf the previous candle or bar where as the Engulfing Bar does have to engulf at least one previous bar.

The psychology behind the 2 Bar Reversal is quite simple.

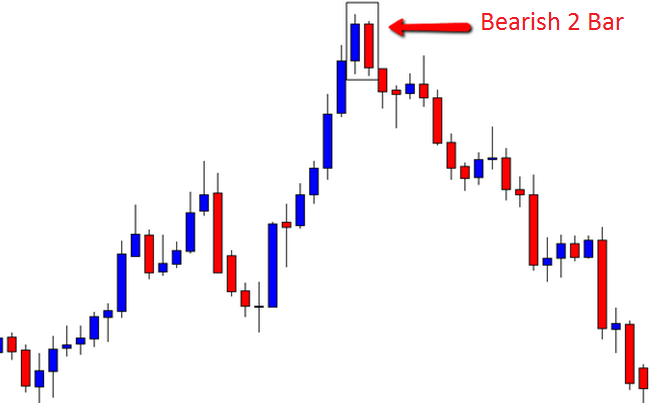

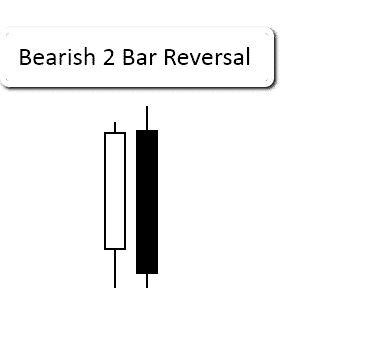

For a bearish 2 Bar Reversal the first bar must go up and close near the sessions highs. This makes the rest of the market think that particular pair is breaking out higher, but this is a lie. When the second bar opens it whips back lower and fakes out the market, taking traders stops along the way.

The second bar must then close near the session’s lows and preferably below the first bars open.

NOTE: You will often notice that if you combine or blend both of the candles together they will make a pin bar reversal as they have a similar reversal price action order flow. You can use an indicator like the Time Frame Change Indicator for MT4 to do this.

An Example of a Bearish 2 Bar Reversal:

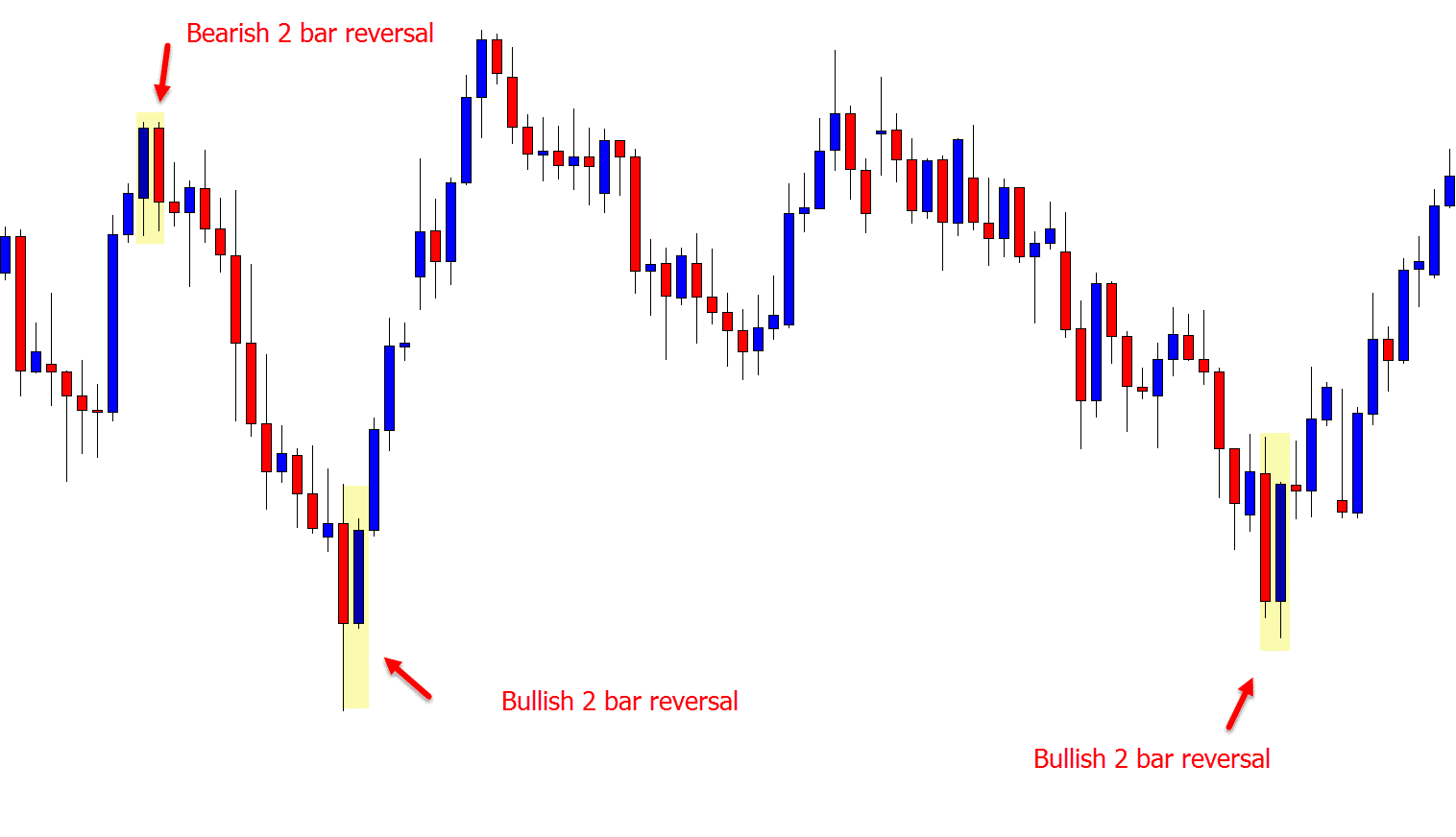

2 Bar Reversals can be found in all markets and all time frames. This does not make all 2 Bar Reversals tradeable however. Not all 2 Bar reversals are created equal.

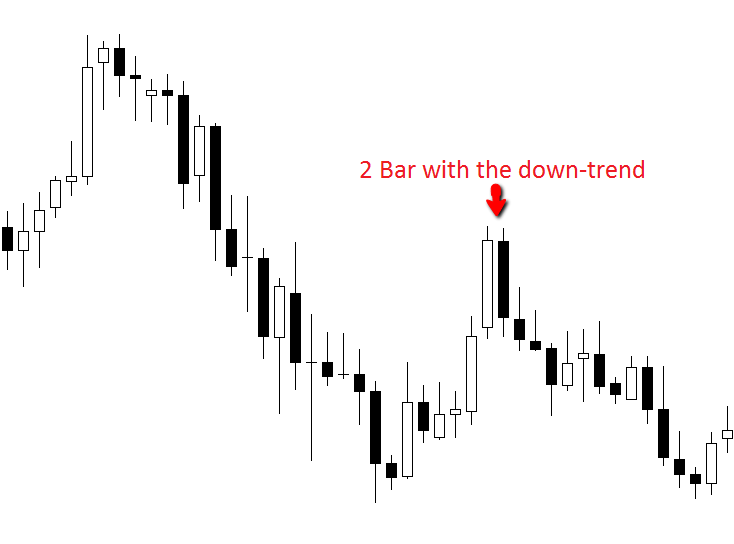

The very best 2 Bar Reversals can be found when a strong trend is in play and a pullback occurs to a logical value area. An example of this can be found below:

Because 2 Bar Reversals are reversals signals it is critical traders look for them at swing points. When looking to trade short traders must look to trade from swing highs and when looking to go long they must look from swing lows. Failure to follow this rule and to trade 2 Bar Reversals as continuations signals would be a risky move.

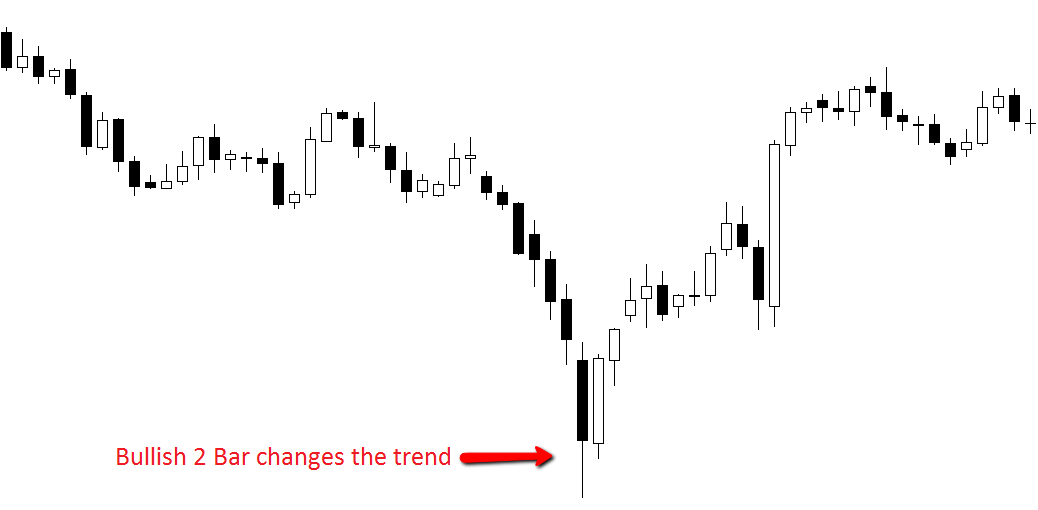

Quite often you will notice 2 Bar Reversals will be the catalyst for a large change in the trend direction.

An example of this can be found below. Notice the trend had been moving very strongly up before a very solid Bearish 2 Bar Reversal formed?

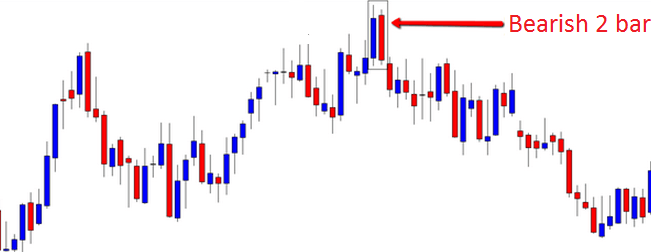

Another Example of a Bearish 2 Bar Reversal From Swing High;

Massive 2 Bar In-line With the Down Trend

The 2 Bar Reversal is a very easy to identify price action formation for traders to spot on their charts. The next step is for a trader to learn where the best spots on the chart the 2 bar should be played from and then the art of managing the trade correctly once they have been entered.

More information on trade management can be found in the Price Action Guide.

Lastly

Before trading the 2 Bar Reversal on a live account traders are advised to first perfect their method on a demo account. There is no reason to lose money whilst learning in Forex. Traders should first prove to themselves that they can make money consistently for a period of a minimum of 3 months before attempting trading live.

You can read about how these setups should be played in live time in our markets trade setups & commentary, that we release each week after here: Forex trade Setups & Market Commentary

Many thanks Johnathan. Much appreciated.

Hi Johnathan,

Please, could you explain the inside-bar candles.

Thanks

Hi Prabha,

yes, you can read how to use the IB here; https://www.forexschoolonline.com//inside-bar/

You can also search for any lesson or topic you need here; https://www.forexschoolonline.com//blog/

Johnathon

hell John

thank you John all clear

Senzo

Hello Johnathan

what do you use to see if the market is overbought or oversold since you not using indicators

Senzo

Hello Senzo,

we use price action.

When trading price action we need to approach the chart as the whole chart and not just the last candle or two like so many traders do. The reason this is so important is because it is the overall story and overall information of where we are entering and managing a trade from that is crucial.

What overbought/oversold indicators try to do is tell traders when price has gone too far and will then revert back to some kind or mean level, but the reason these simply do not work is because they take no account of the market price action situation. Price may be saying it is overbought, but if there is a strong obvious clear trend in place, I am going to be looking for long trades every day of the week and not trying to fight an obvious trend.

These overbought/oversold indicators are built of using the old historical price to make a lagging indicator.

As just mentioned above; when looking for high probability setups; it is much more important to concentrate on looking for hunting for setups at value, then worrying if price is overbought or oversold and you can do this by concentrating or reading the price action.

Johnathon

It’s easy to see loss in momentum using naked price action boss

Thank you for this easy to understand article on 2 bar reversal.

I assume the bar following the 2bar reversal needs to close higher or lower which will be the confirmation candle as we are seeing right now on the EURNZD 4hour chart at 11:05 pm french time, i am not sure if the trend is strong enough to call it a reversal candle.

4/10/2014

Hello,

I can see what you are trying to say here, but let me try and clarify for you. 2 bars can be traded in all markets including against the trend, with the trend, ranges etc; the trend is not part of a 2 bars criteria.

I think what you are getting at is price has not made a strong retracement or pullback higher into a swing high like we would need for a reversal signal and you are correct in saying that.

You don’t need a close above or below for entry, you simply need price to trade above or below to activate orders. Please read the article on entry orders here: https://www.forexschoolonline.com//are-your-entries-blowing-up-your-trading-account-high-probability-price-action-entries/

Safe trading,

Johnathon

I assume the bar following the 2bar reversal needs to close higher or lower which will be the confirmation candle as we are seeing right now on the EURNZD 4hor chart at 11:05 pm french time, i am not sure if the trend is strong enough to call it a reversal candle.

hw do yhu differenciate it frm an inside bar

The higher the time frame, the higher the probability. Will still work in the micro times, just not as well as say the hourly, or daily.

In order to be considered a 2 bar reversal, it only has to close past either the half way point or the 3/4 point of the previous bar (depending on who you ask). You can see it in the last pic in this article.

thanks @@@@@@@@@

In char no. 4 ( Another Example of 2 bar reversal from swing high)

2 bars Looks like a Bullish Pin bar, but price violet it and took bearish journey. Is it right? kindly let me know.

No it is a 2 bar just like the other examples. I am a little unsure how you think this looks like a pin bar as it does not meet any of the criteria of a pin bar? https://www.forexschoolonline.com//pinbar/

hi fox, what is difference between 2 bar reversal and engulfing ……???

The 2 bar does not have to engulf any candles and the engulfing bar has to fully engulf the previous candle and have higher high and lower low.

Thanks

whoah this weblog is fantastic i really like studying your articles.

Stay up the great work! You recognize, many people are looking around for this

information, you can help them greatly.

have any indicator for 2 bar reversl show.

Can u tell me Which time frame is better for 2 Bar Reversal?

4HR. MOSTLY, PA IN THIS TIME FRAME ARE STRONG TO REVERSE.