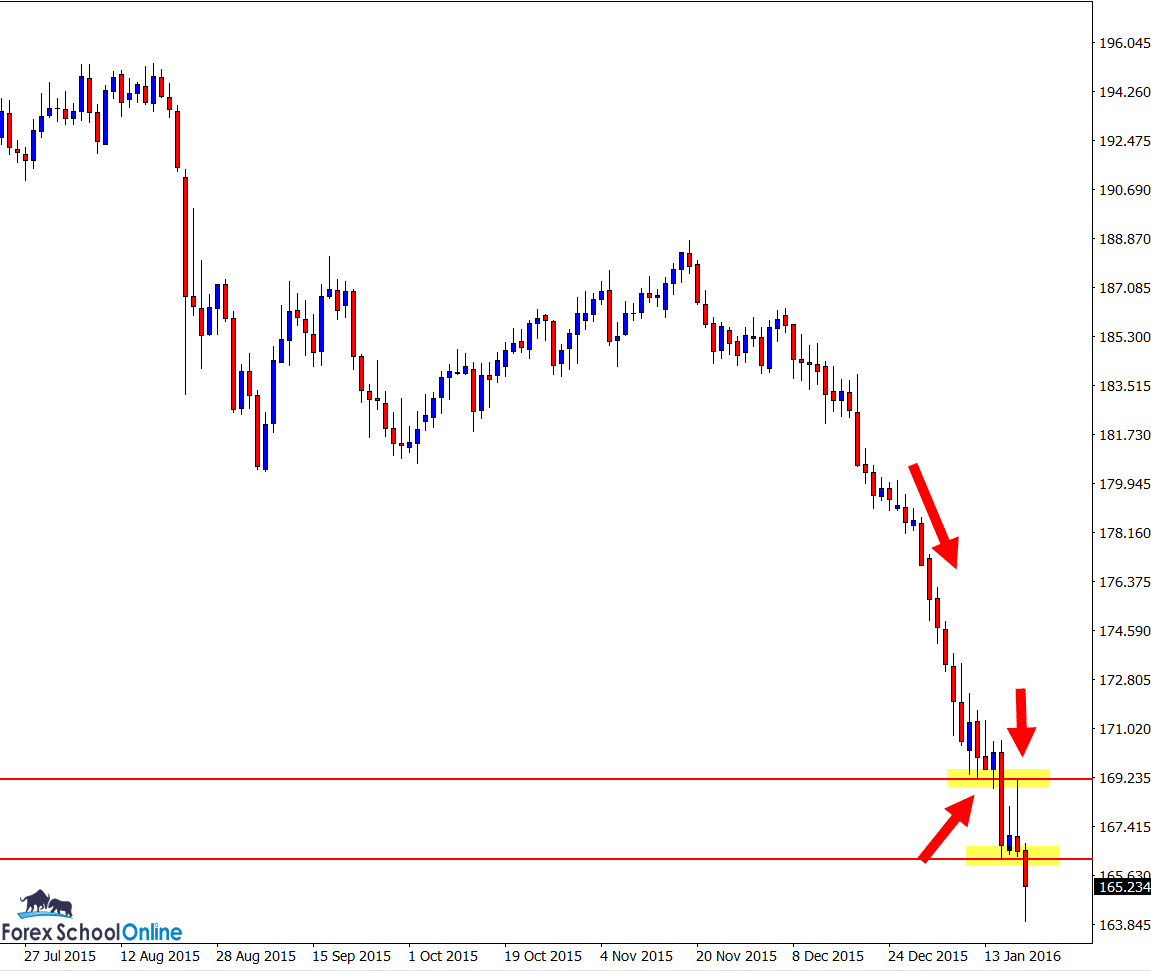

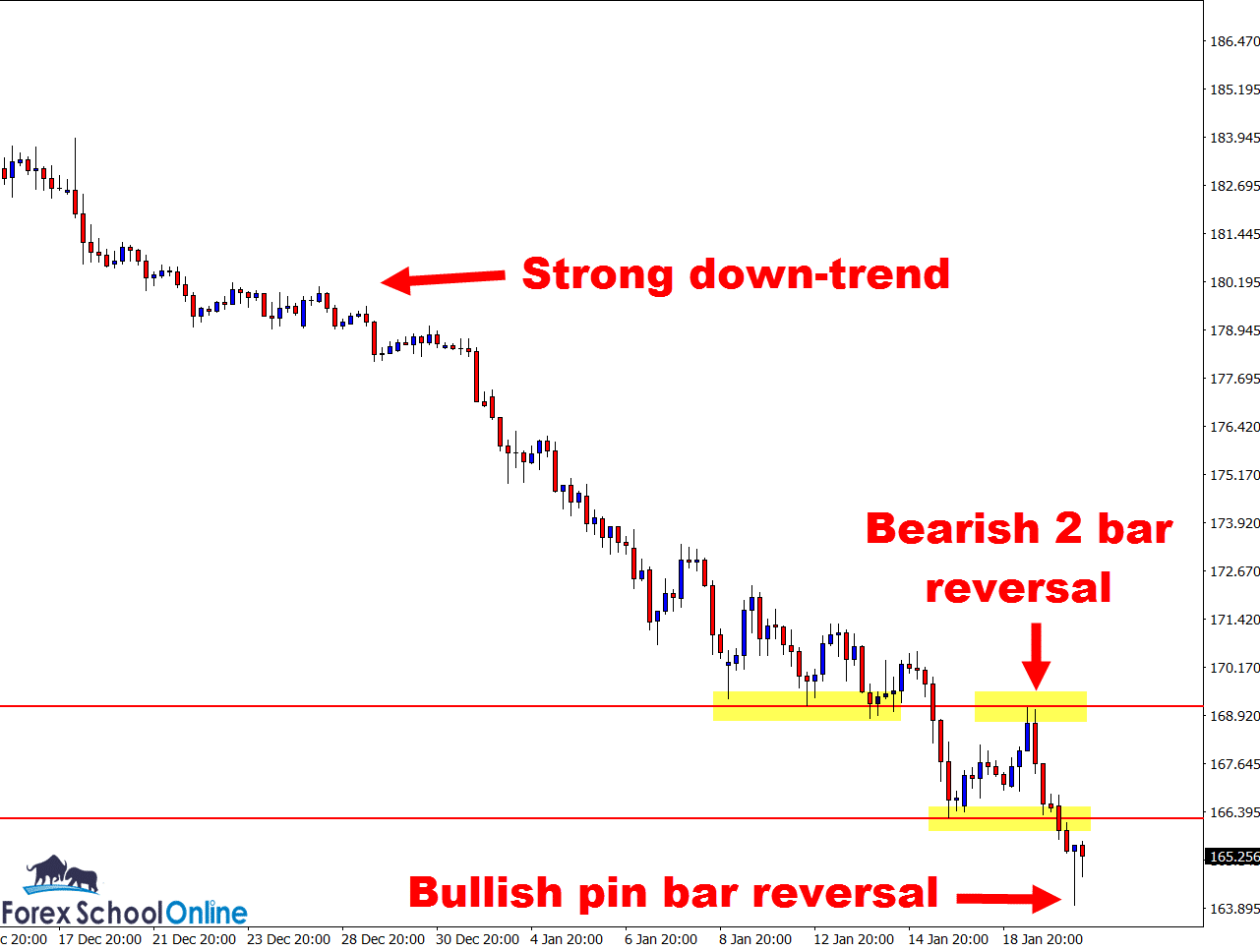

Price has just formed a bullish pin bar reversal on the 4-hour price action chart of the GBPJPY against a huge stream of momentum. If you look at both the daily and 4-hour chart and simply glance from left to right you will see a super obvious trend in play: price is making lower highs and lower lows with a lot of strong momentum. The bullish pin bar reversal that has just formed on the 4-hour chart is going directly against all of that.

What is interesting to note however is that if you zoom out on our daily chart you will see that price is rejecting a longer term support level. This is very OFTEN the case. Price is obviously a reflection of the order flow of everything else that goes on with the traders trading that Forex pair or market. It is not a reflection of the latest big announcements or the latest new release.

Price moves due to the traders trading that market. Price can only ever move because of trades, either buying or selling. No trading would mean no movement in price. That is why the price does not move when the markets are closed. Why can it shoot right up or down when the markets open if something big has happened? Because the traders in that market act on the same principles in every market: fear and greed.

These traders will look to escape a market position really quickly if it looks bad, sending the market lower quickly – this is especially the case if the markets are just opening. You can imagine the opposite effect if everyone is trying to get into the same stock or pair, right?

That brings me back to why this works in the Forex markets. You look and see a pin bar forming, or an inside bar forming, or something else forming. Why are they forming? For no reason? Take this bearish pin bar on the 4 hour chart. By itself it looks completely out of place.

Dig just a little deeper and you can see that actually it is forming because price is rejecting a major daily level and is pushing off the major support level.

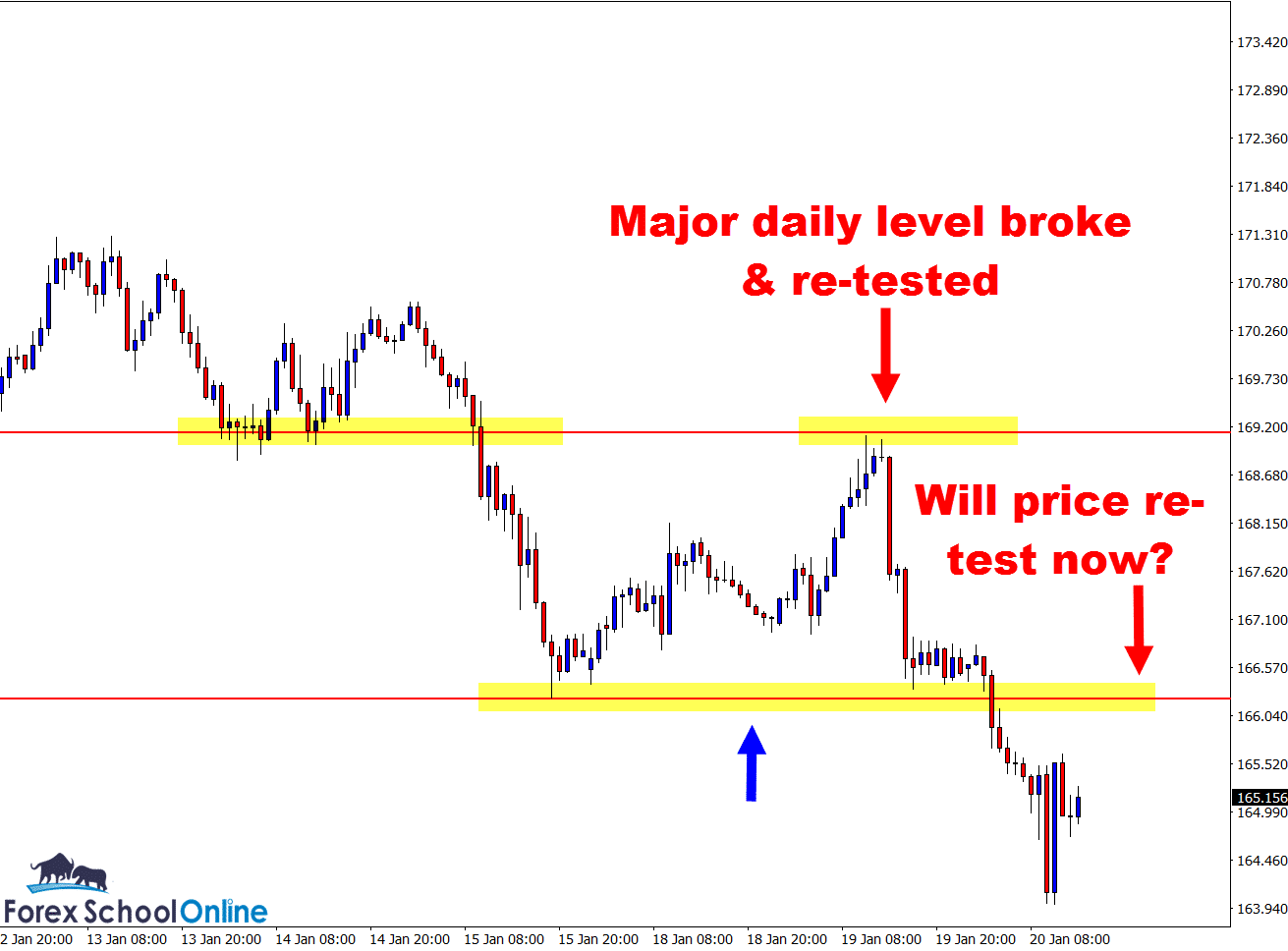

From here, can price now move back higher, into the overhead resistance for potential short trade setups? Looking for short trade setups definitely appears the way to play this market at this stage with the super strong trend. I am not looking to play it any other way until this market shows me otherwise.

As the 1-hour chart below shows, sharp pull-backs or rotations into the overhead level could present opportunities to look for potential short trades at both a key level and with the trend lower.

Any bearish trade setups would need to be confirmed with A+ high probability reversal trigger signals like the ones we teach members on the Price Action Course.

GBPJPY – Daily Chart – Major Levels

GBPJPY – 4 Hour Chart – 2 Bar & Pin Bar Reversals

1 Hour Chart – Will Price Re-test?

Related Forex Trading Education

Leave a Reply