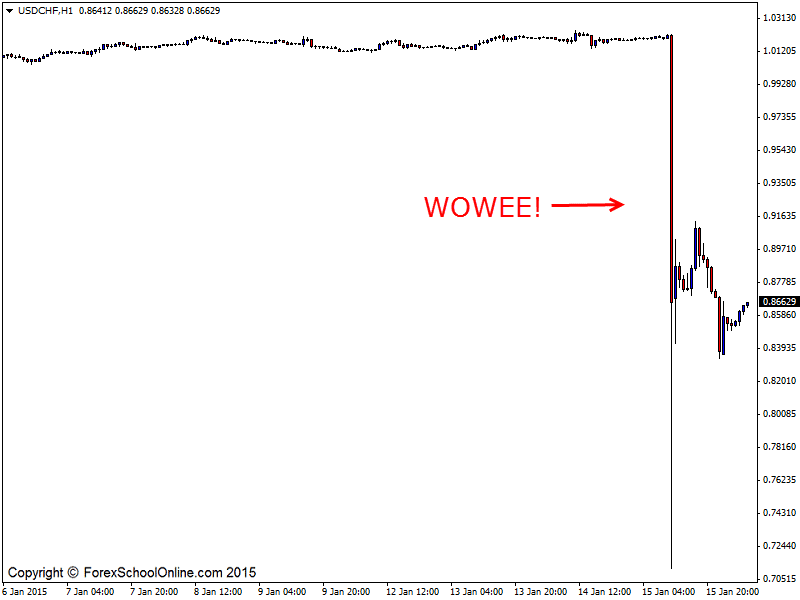

The Swiss Franc soared overnight making as much ground as 30% at one point on some pairs in the blink of an eye. Whilst the Forex market is highly volatile and that is why we love it, this sort of move is unprecedented and only comes around normally once every couple of years. The last two moves anywhere like this were a rumored fat finger trade and the London bombings.

On this occasion it was the Swiss National Bank abandoning their cap on the currency’s value against the euro. As soon as this was announced traders looked for the exits. Just as with the fat finger example; when a huge amount of orders get put into the market at one time it can have a devastating affect. When something like this completely unexpected happens traders panic and quickly follow the heard.

The worst thing you can do if you are a price action trader is try and read the news to help you with your analysis. You quite simply are just not going to catch these moves unless you had already found an opportunity through your price action and were in a trade. By the time the announcement comes out, price has made it’s move. I talk about how this is important and why it is key to building an edge here;

To be a Successful Price Action Trader Concentrate on the Price Action, Not the News

What is important is that you do learn to read the price action and what it is saying so that you can learn to avoid certain moves and take advantage of others. Sometimes however something in the market will happen that you or anyone else can not foresee. This is just going to happen. For example; the president will make a random announcement or some large important world bank will collapse which will affect your positions. Don’t let this affect what you are doing. There is no way you can predict these things even if you were watching the news. This is why we use stop losses and why we never bet the farm on any one trade.

USDCHF 1 Hour Chart

Leave a Reply