All traders want to enter and exit at the very best prices.

There are some important Forex orders you can take advantage of in your trading so that you are able to get the best prices when you enter and exit.

In this post we look at the different types of Forex orders and how you can use them in your trading.

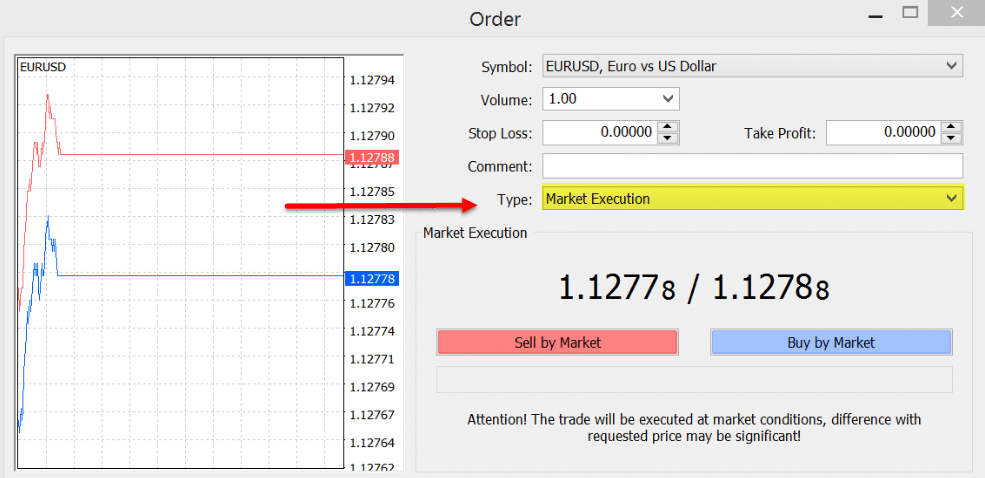

Market Orders

The most common type of Forex order is the market order.

The market order is when you are directly entering the market at the best price on offer.

An example of a market order is; you enter a market order to buy Forex pair ABC/XYZ that has a bid price of 1.3510 and an ask of 1.3515.

After placing your buy market order, the ABC/XYZ would be sold to you at 1.3515.

A market order does not guarantee you will be entered at the same price you attempted to enter at.

You must take into account the potential for slippage.

Using Sell Stop and Sell Limit Entry Forex Order

A sell stop and sell limit order are used to sell above or below the current price.

These are good order types if looking to sell at a certain price, for example; only sell if price breaks lower.

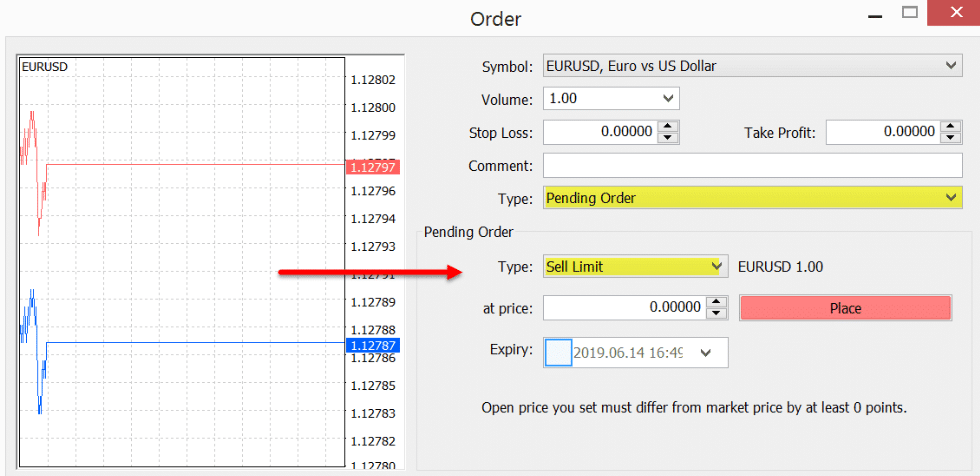

Sell Limit Order

When using a sell limit you are looking to make a short sell when price moves higher.

An example of a sell limit order is; price is currently trading at 1.2500, but you don’t want to sell short until price moves higher into 1.2520. You can set a sell limit order so that if price moves into 1.2520 your short entry will be executed.

The example below shows how to use this order in MT4.

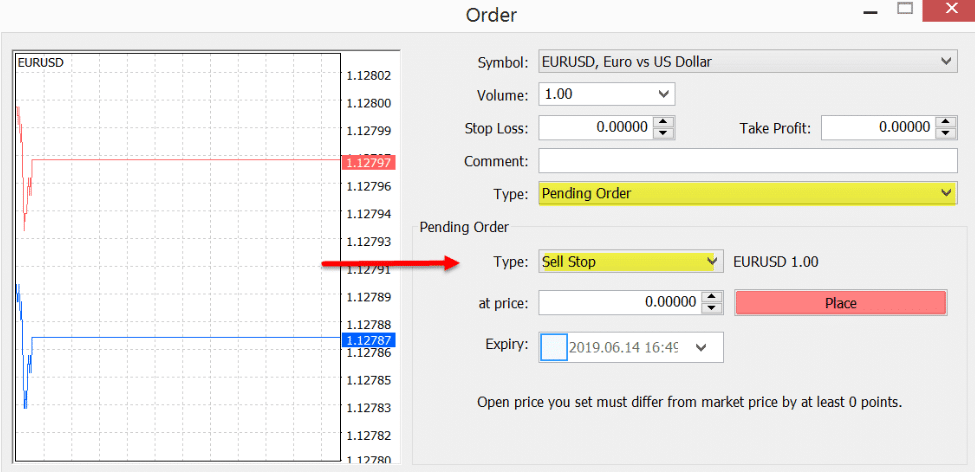

Sell Stop Order

When using a sell stop order type you are looking to sell, but only if the price moves lower.

An example of a sell stop is; price is currently at 1.1220, but you only want to sell if it breaks lower to 1.1215.

You can set up a sell stop so that if price does move lower into 1.1215 your sell trade would be executed.

The example below shows how to use the sell stop order in MT4.

This is a good order type to think about using if you are a breakout trader and only want to enter when price breaks lower.

Using Buy Stop and Buy Limit Orders

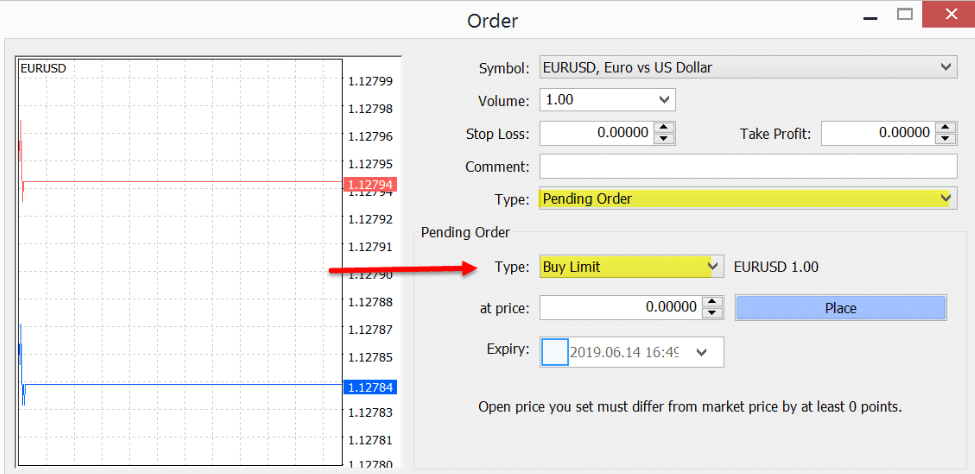

Buy Limit

When using a buy limit order you are wanting to buy only if the price moves below the current price.

An example of a buy limit is; price is currently at 1.1200, but you only want to buy if price moves lower into 1.1215.

You could set up a buy limit order so that if price does move lower into 1.1215 your order to buy would be executed.

This is a good order if you think the price will move lower before then moving back higher.

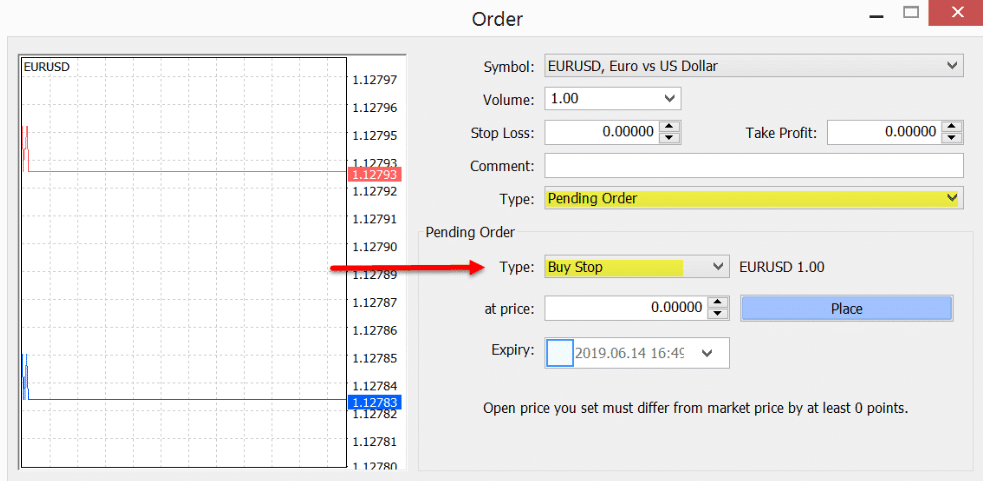

Buy Stop

A buy stop order is used to buy if prices move above the current price.

An example of a buy stop is; price is currently at 1.1220. You want to enter a long trade, but only if the price moves higher to 1.1225.

You could set a buy stop order so that if price does move higher into 1.1225 your buy order would be executed.

Buy stop orders are a solid choice if you are a breakout trader looking to make long trades if price breaks out higher.

Take Profit Order

The take profit order is the order type you will use to set where you want to take profit.

This is a simple order that you can easily place inside your Metatrader charts either at the same time as placing your trade, or afterwards.

You can also amend this order when in your trade if you want to take profit quicker or you think the price will continue going in your direction.

Stop Loss Order

The stop loss order is the order you will use to protect your risk.

Just as the name suggests; the ‘stop loss’ order type will stop your losses and exit your trade.

An example of a stop loss is; you enter the market at 1.1220 in a long trade. If price moves against you lower to 1.1210, then you want to exit this trade.

You could set a stop loss at 1.1210 so if price moves into this level your trade would be ‘stopped’ out for a loss.

The stop loss order prevents the possibility of far bigger losses if prices continue to go against you.

Recap

Whilst some of these order types are more advanced than others, it pays to become very familiar with them.

Different order types will allow you to use different trading strategies and often enter and exit at the best prices.

Leave a Reply