How do you make money trading Forex? What is the same basic principle whether you are selling apples, Oil or Currencies? Not sure? Read on…

(Note: This question will be asked again as a quiz at the end of the lesson to see if you can get the answer as well as giving you a really cool FREE Bonus to help you with your trade management ?!)

My grandfather taught me a lot of what I know today and gave me a lot of my lessons. A lot of them were what we would call ‘common’ sense.

My Grandfather & His Advice For Trading ‘Value’

My grandpa loved to refurbish old furniture back to new and sell it again. He had already created a couple of businesses and passed them on to his kids and was retired in his 80’s now, mentoring his grand kids and still working on furniture.

Grandpa’s ideas on stock and share trading were what you may call simplified. He saw my father ‘day trading’ stocks in the business office and just shook his head in bemusement.

Grandpa explained to me that rather than enter and exit all the time, he would rather just enter, then have that company pay him money (dividends) and watch his share price go up over time, making the exact entry price less and less relevant.

In other words; grandpa could navigate a lot of where the stock was entered into by picking a high quality basket of stocks that were at value points and then holding them for a long time.

The entry price of where the stocks are entered into of course is important because it shows if price is way overpriced or if price is super valuable and cheap, but it is not everything and people should not get crazy over entries like they do because it is getting them nowhere.

I obviously did not get it very much at the time and I remember thinking “Oh my goodness my grandpa is worth like a billion dollars because he has Coke sending him money”. I was obviously young, but he explained being a shareholder as owning a slice of the company, which is 100% correct. He said that is why they send him money every year, as a dividend for owning part of Coke. I was like MIND BLOWN!! “My Grandpa owns Coke!”

Mind Blown!!

Now when I look at the strategy my grandfather was employing and compare it to what I am doing, it makes complete sense. I can see why he would do such a thing and why he would look to not worry as much about the actual entry point, but more about the quality of the stocks he is holding. I wish he was still around to give me the adult explanation.

How Good do You Think You Are? Your Challenge For This Week’s Homework

Have you ever heard of the ‘Coin Flip’ trade management exercise?

The goal of this exercise is to show you the power of first; having a trade that is entered at a value area in the market and second; understanding the price action story and it’s clues so you are able to make great decisions time and time again with your trade management.

Often the reason traders are not successful is because the door for success is open for them to walk right through, they just have to stop stepping on their own feet and shoelaces and get out of their own way to walk through it.

This exercise rams home how as traders we get in the way of ourselves by making errors. I explain what I mean by this in just a moment.

How the Coin Flip Exercise Works:

The aim is to double your account balance in as few trades as possible. If you can do it in under 50, then you are going pretty good. Anywhere under or around 30 and that is FANTASTIC. If you can get close to 20 or under NOW WE ARE TALKING ?!

What you are going to notice by doing this trade management exercise is that you very quickly improve and that amount of trades it takes you to turn gets smaller and smaller very quickly.

You will first need to open a FREE New York close 5 day charting account if you don’t have one already. You can get free demo charts with the broker I recommend for price action trading on this page here; Recommended Broker & Charts for Price Action Traders

The next thing is to make sure you open that demo account with an amount that is both a round number like $200 or $5,000, something really simple that you can easily double and it makes the maths super simple and also an amount that is similar to how much you are going to be trading with when you are trading.

If you are going to be trading with a $500 account, then don’t open up a $50,000 demo. Change that amount at the account opening process and make it a $500 demo so everything you do in your trading practice is practicing to be a winner.

You need to take a coin that has both a heads and a tails on in. A heads will mean you will go long and a tails means you are going to short. For this exercise we are on the 1 hour chart. We are using this time frame because it is a happy medium.

As soon as the coin has landed you HAVE to pull the trigger either way, whatever the call comes up. That does not mean you have to remain in the trade though. That is where the exercise and the whole trade management and your decision making begins.

You are going to flip the coin – enter your trade using your money management plan (see notes below) – manage your trade according to your plan and exit. Flip the coin again and repeat the process all over again. You are going to continue doing this over and over again until you either bust your demo account or you double it.

The aim of the exercise is to work on your trade management so you make better decisions that leads to doubling your account in less flips of the coin.

NOTE: As I stated above: you need to first open a demo account. After this you should be opening your trades using your money management plan. This means that if you normally risk 2%, then you should be risking 2%. You should be doing the same as what you normally do for this exercise.

If you don’t have a money management plan, now is the time to make one!

Cut Losers & You Know the Rest

Some trades you are going to open and then cut straight away – DON’T CHEAT. Make sure to first open the trade. Other trades you will umm and ahh over whilst prices moves against you just like real life. As price continues to move against you, you will continue to ponder until you are forced to act, only to then watch it move back for a huge winner.

If you do this exercise correctly you will be able to use it to help you create a rule set and plan for your trade management. What is most surprising about this exercise is probably how frustrating it can be for something that involves risking no money. The reason it will help you so much is because it can teach you lessons about yourself and improving your trade management rule set.

This ‘Trade Management Coin Flip Exercise’ can be hugely beneficial and teach you a lot of great lessons – as long as you stick to your plan and trade management as per normal.

It is going to show you just how important ‘value’ in the markets is and how the old saying about cutting your losers quickly and letting your winners run is so true.

You have the choice to cut a trade as soon as you have opened it, if for example it is formed at an extreme low, but if you are in a trend you could look to roll your profits and move to breakeven and see if you can capitalize with a big running profit winner. I went into how to do this in the last lesson on using the breakeven strategy at;

Removing Our Own Feet From the Doorways

As I was just starting to say above, often a MAJOR issue holding you back from achieving all your trading dreams and making all the money you want is yourself.

The fact of the matter is that humans are not built to manage Forex trades. I would go as far as to say that = humans make horrible natural Forex trade managers. We are just not built to think as natural trade managers. All our lives, at school and with everything our teachers and parents drill into us is in direct violation of good trade management.

Just one example of the difference in the two types of thinking and why they are very different is this: growing up you are taught to listen and respect your fears in all shapes and sizes.

You are told that if you see a fire, ring 000 or is it 999 (depending on where you live???). You are told in Australia especially, don’t touch that spider, watch the dog, and don’t go swimming in the water at that time of the year.

You learn other fears like missing out on camping trips or more subtle fears like maybe watching your parents, or your friends’ parents, breakup and divorce.

After learning all these lessons you come to the markets full of ideas, experiences and FEARS before ever putting on a single trade.

This type of thinking is healthy for human living. I mean, if you didn’t have a fear of crocodiles, or you didn’t fear putting your hand on a hot stove, then you would probably get your legs eaten off and burn your hands.

But having fear really, really hurts what you want to do and where you want to go in your trading.

Fear comes in many forms when managing trades in Forex. It’s the…

- Fear of missing out on big profits

- Fear of taking on a big loss

- Fear of cutting the trade too early

- Fear of not cutting the trade early enough

- Fear of wrong levels placement

Never smile at a crocodile…?

So Do We Just Start Waking Up And Entering Trades Randomly Now?

Of course where we enter our trades matters and is a majorly HUGE part of making a successful trade.

The fact is, if you want to manage your trade well, then you can make your job 99% easier by first getting into the trade at the best/correct spot. What am I talking about? I am talking about value areas and making money.

If you were a car salesmen who sold cars for a living and I came to you to sell my car, what would you do after buying my car for $5,000?

Would you go down to the flea market that afternoon and see if you could get $1,000 for it? I hope that’s not your answer, as you would not last long as a car salesman.

What you would do is take my car, put ads on Ebay, Gumtree, etc, and try to sell it for $10,000 to make a profit right? This is the same thing we should be doing in our Forex trading, BUT FAR TOO OFTEN IT’S NOT.

To make money at anything and in any market you have to buy low and sell high, or in Forex you can sell short and buy back, but it’s the exact same principle.

For some reason people are obsessed with either trying to pick the highest high or the lowest low. I have a secret: there is no prize for getting any closer to the top or bottom. If you are 50 pips away you get the same prize as the person who picks the exact top = zilch and zippo, so don’t worry about it.

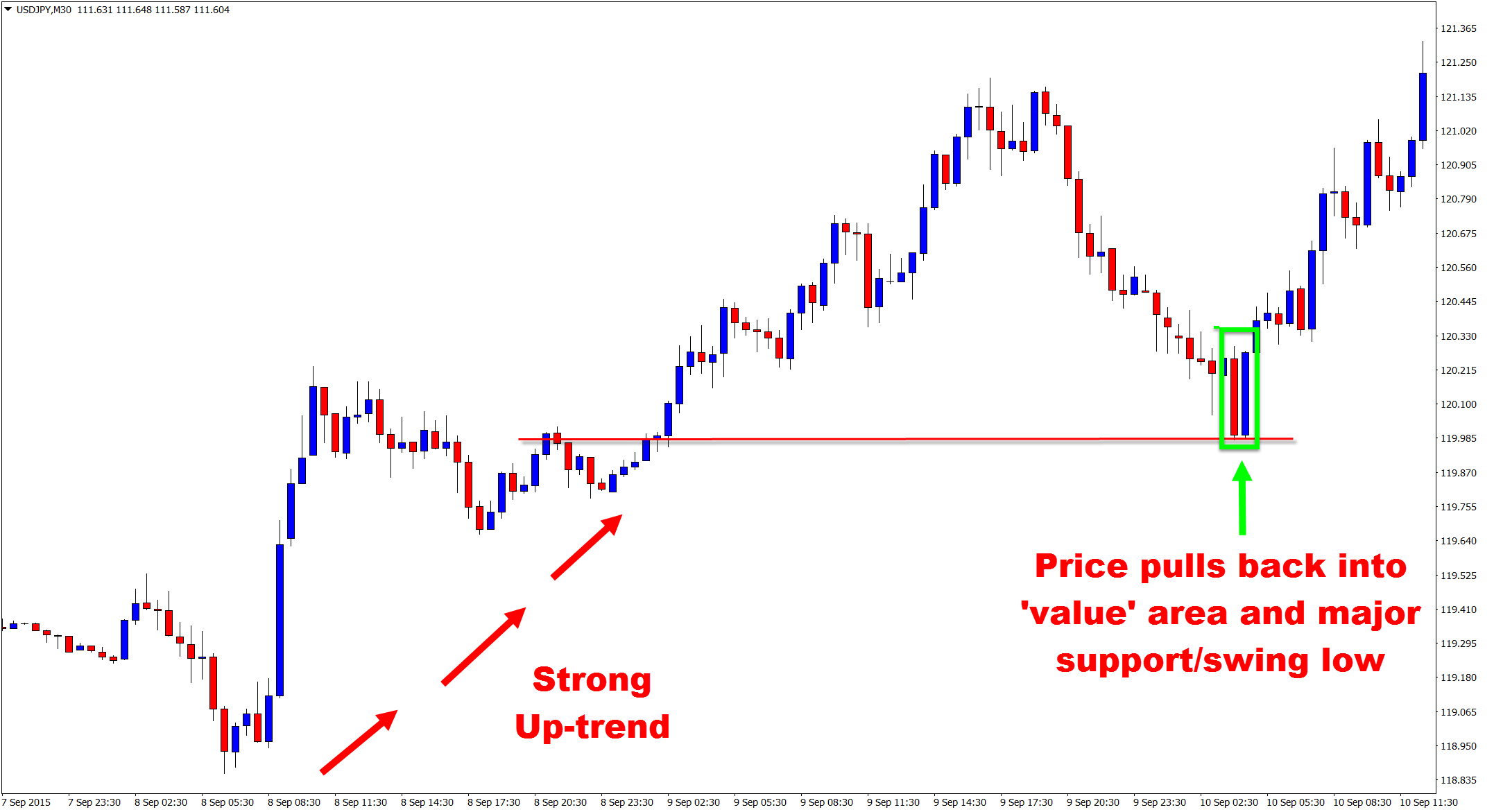

I want to show you a chart example of exactly how this value works within the price action story of a chart. Below is a price action chart that shows you how price is in a strong up-trend moving higher and making higher highs and higher lows.

After the last rejection of the resistance, price has now moved into the ‘value’ area. Why is this a value area?

1: It is in line with the strong up-trend;

2: It is at a pull-back level. Notice how this value level is within the strong trend, BUT price is at the LOW. This is massively important. Even though I am looking to buy I am buying from a low point . This is crucial!

3: Swing low. If I am to make a reversal trigger signal it would have to be from a swing point; and,

4: This is a major support level which is MASSIVE!

Notice how all those things line up on that chart? But most of all – even though I am trading higher with the trend I am trading from a LOW point. That is what trading from a ‘value’ area is all about.

I have a super in-depth lesson just on trading from value areas you can read at:

How Professionals Trade Forex From Value Areas and Hunt Stops

Most Traders Never Get Past The Entry Phase

You know what the truth is? Exactly as the heading just said, there is a massive share of traders who never get past the trade entry phase.

They could, and they could right this very second. But they choose not to, and they go right on choosing not to. The reason why they do this is the same reason why they don’t study trading psychology or how to make better trade management decisions.

It’s the EXACT same reason why when I make a trade lesson with a title something like “How to Deal With Uncertainty in Your Trading” they skim it or flick past it to the strategy section.

And it’s why their results have not changed in months or years.

Finding entries, new systems, new trigger signals and new strategies is the sexy part of trading. BUT anyway you wrap it, twist it or package it, trading all boils down to making good decisions at the right moments, time after time.

This is why as traders we need to be able to take a good entry and then make great decisions, time and time again following the same rule set and plan.

Why Money & Trade Management Will Always be the ‘Secret’ Weapon You Can Use to Move Above the Pack

Learning how to manage trades and make great decisions will always give you an edge over a huge portion of the market that is stuck looking for that next magic bullet quick fix solution.

Your real secret weapon is in combining really high-probability price action entries found at value areas with a rock solid trade management method that you’re using as part of your overall trading plan.

This Week’s Homework Assignments:

➔ Complete the Coin Flip Trade Management Challenge:

- Either post your results back in the comments section here or send me an email letting me know how you went.

➔ Very Lastly – Quiz Question; How do you make money trading Forex? (what is the main principle for making money in the Forex markets, trading apples, buying and selling cars or anything?)

- Let me know in the comments below; Also let me know any comments, questions or anything else in the comments!

Very, Very lastly… is your FREE bonus. I have built you a ‘Trade Management Tracker’ that you can download as a PDF version which you can then print and fill out or I have also created an Excel version and given you Edit access.

You can use this tracker with the coin flipping exercise to track your progress and perfect your trade management. Any questions, just post them in the comments section below.

Hey Johnathon,

Just wanted to clarify a few things about this coin flipping exercise. Do we randomly pick any pair, flip the coin, and enter? Or de we flip the coin for a pair that has already reached a value area? Is there a limit to how many trades we make in a day or do we follow our trading plan?

Excited to start this challenge!!

HI Farzzaman,

pick any pair, flip and enter. Decide to cut or to stay – repeat until bust or double. (Only to be carried on a demo/virtual account).

Safe trading,

Johnathon

Hi Johnathon,

I´m going to do this challenge and try to learn what is important on trading. I have traded some years ago with negative results. Soon I realized that the only problem was me and I meade the decision to not trade until I grow in the Psychological field. Well I don´t know how I am so I get thi sarticle and I´m goint to take this flip coin test.

I´m going to start a blog on this and I plan to post on a daily basis.

First I need to understand all and get my trading plan that I don´t have.

Can you help me on this Johnathon?

Thanks.

Regards

Nuno Silva

Johnathon,

I have been a member of FSO for some time. I decided to give this a try and the results were fascinating. To this point I have been pretty much a break even trader with a win rate fluctuating around 52%. Without getting into the details of the statistical results of the exercise, I found that a majority of trades were in profit to a significant degree at some point before the trade closed. However, a larger majority of my positions were closed at break even, leaving many pips behind. Intuitively, I knew that the key to profitability surrounds money management, but I needed to experience it for myself. This exercise proved to me that the entry is less important than trade management!

Thank you for the article.

Hi Jim,

nice one.

The more you do this, and the more you practice/improve your trade management the faster and better your decision making and results will become. Like I say above; of course great entries are important, but what often separates the two different outcomes of traders getting in at the same place in the market is the decisions they make and how they manage their trades.

Safe trading Jim,

Johnathon