Step by Step How to Close the Trading Profit Gap

Do your trading results reach their potential?

When I first came to trading, I was like most people and did not have much of an idea what I was doing. Keep in mind, this was almost ten years ago. There were no online courses back then like there are today. I could not just jump online and freely ask for help in the many forums or the avalanche of information; it just was not like that back then. I remember waiting patiently for the broker to send me out a set of trading education booklets and DVD’s, which also showed me how the platform worked.

That evening, I loaded up the live Forex trading account to start trading, and by the next morning, I had doubled my account. I had only deposited $500 to start with because I was well aware I had no idea what I was doing, but all the same, I had taken that initial deposit and doubled it.

These types of stories where a very new trader will make money when they first start trading are VERY common and it is not just luck at all. It has nothing to do with luck at all.

Before I go on, let me make one thing clear: I do not recommend new traders or any trader for that matter to trade with even one cent of real cash unless they have proven to themselves they are consistently profitable on a demo account first.

Whilst I made money at first, I went on to blow it all super quickly and that is what nearly always happens 99.99999% of the time because, in the end, as I am about to explain, the mindset changes and the market rules.

New Traders Optimum Mindset

I am sure you would have heard a new trader, who is just starting their trading career, make some sort of comment about just how easy this trading thing is and how they are just going into work to tell their boss to stick-it or how they are “only” going to double their account each week because they are not greedy, etc.

The thing is, we all want to be aspiring to have the mindset of the brand new trader. It is the brand new trader who is making trades with the optimum mindset, and that is why so often, you are hearing these so-called “Beginner’s Luck” stories.

What is so great about a new traders mindset? After a trader has been trading for a while, they have taken on a lot of losses. They have had winning streaks and everything in between. This leaves memories and everything on the subconscious mind, good and bad.

The new trader does not have any of that. The new trader is making trades from a completely neutral state of nonbias. The new trader is not affected from previous losses that they have had. The new trader is not affected by the “perfect” setup that looked just the same last week, but did not work out. The new trader is not affected by any current losing or winning streaks.

The new trader’s mindset is perfect because they are looking at the market from a completely objective point of view. When they are analysing the market, they are seeing a blank canvas and just that one setup in front of them for what it is. They simply either pull the trigger or they don’t, and then, they move on.

This mindset also allows them to manage trades incredibly effectively. Because they are not over confident from any current winning streaks, and don’t have the weight yet of any losing streaks, these new traders are mentally FREE, which is the absolute optimum mindset.

The Trading Profit Gap

I can hear you asking me from here, “Johnathon, what on earth is the profit gap?” A common issue and task that traders face is, once they have become consistently profitable on their demo accounts, they then have to move up onto the live trading account.

It is super common for traders to go from having consistent profits on their demo account to a quick drop off when they first move onto a live account. It can often take some time adjusting. This is normal because it is obviously the next step up the ranks.

What you will often find; however, is that there is a difference between what a trader can achieve on a demo account and what a trader can achieve on a live account. This difference in profits between the two accounts, and this discrepancy, is known as the “Profit Gap”.

The late great Mark Douglas was one of the first to discuss this profit gap theory and how there is often a gap between the amount of money traders should be making, compared to how much they actually really are making.

Boring Zzzzzzzz…..

The profit gap is super common. I bet you are nodding your head right about now and have experienced it in some shape or form in your trading like we all have.

So, if it is so common, why does this gap exist between the results we are achieving and the results we should be achieving? Why are we not making the money that our potential says we should?

The number one reason is because of ourselves. We basically get in the way of ourselves. The reason it is known as the profit gap is because it is the gap between our potential.

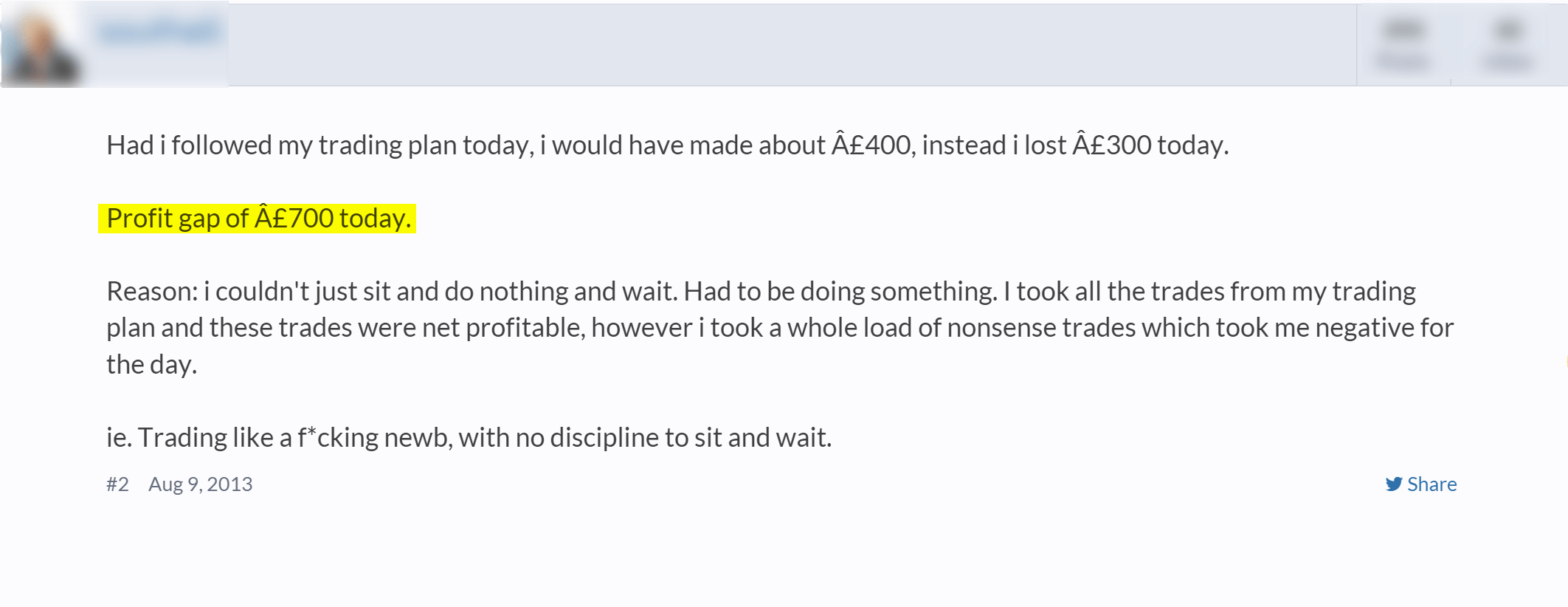

Check out the following public forum post below with the profit gap in action:

This is a textbook case of the profit gap in action. The reason the profit gap is so common and so tricky to close is because it is dealing with the less exciting topics that traders never want to spend time working on; ie, the things that brings results like making great trading decisions, over trading, boredom, trading psychology, sitting on your hands, and learning discipline.

More, More, More is Actually NOT the Way to go!

So, how are you going to fix it? How are you going to start lifting your results so that you can close that gap as much as possible? Even a small closing of the gap and a lift of a few % in your overall output can bring dramatic results. That could be the difference in whether you are break-even or making solid consistent profits.

A huge and repeated mistake time and again that is so easy to fall into because what we do in everyday life is look for more education on your trading edge, doing more testing, doing more and more practice, and basically, thinking that your problem lies within your method or the edge that you are using.

Please let me stress that if you have a profit gap problem, then it is proven you can make profits. Your edge works. Your method works. You are searching in the wrong places for the fix if you continue to work on your method.

The gap lies within YOU and what YOU are doing – plain and simple. It is the decisions you are making. You are making different decisions under similar circumstances and this is creating a gap between the money you are making and the money you should be making. THIS is what you need to spend your time on analysing and working out how to fix.

You Need to Level UP With a Journal & Trading in the Zone

As already explained, the profit gap lies within you. The two best steps for closing this gap are:

- Start a super-detailed trade journal (see below)

- Read Mark Douglas’ “Trading in the Zone”

- The reason why it is so important to have a super-detailed trade journal where you document your thoughts about the trade before you enter, note down any emotions you may be feeling, or any potential doubts etc, is because the only way you are going to be able to see if you are making repeated human error mistakes or if you are doing something that you had no idea about that is costing you money, is through the journal and regular reviews.

- It is by far, the best trading book in the world, and by far, the best book that is going to help you close the profit gap; by the late Mark Douglas – Trading in the Zone.

A Super Detailed Trade Journal Step by Step

A trade journal is something that has helped me a lot in my own trading and is something that can help you as well. It was not until I went from the stock standard just adding the trade numbers, such as entry, stop, and targets, to starting to add the full picture of the trade entry with notes on the chart about the trade, and also, comments in the journal about both the trade and any emotions at the time of entry that things started to change.

Looking back at both the trade entries and the comments was POWERFUL, not just at the exit, but when it came time to do the monthly review, and this is the exact same thing I want you to do because it can literally turn your trading around – that is not an understatement because you can start to notice things through your reviews that you have never seen before!

The best way for you to get started with this is for you to go over and read the lesson about how to use the journal and Download My FREE Journal Here.

Mark Douglas – Trading in the Zone

This book is going to show you how you need to start thinking in probabilities rather than individual trades. The real power of the book is the way that it gets you to think in the bigger picture, which then affects the way you start to make decisions and trade.

Remember what we spoke about at the start of this lesson and how the new trader has the optimum mindset? The new trader, not surprisingly, does not have a profit gap. When the new trader is operating in that carefree attitude and just trading any setup as they come along, they (not surprisingly) do not have a profit gap. They are operating at their optimum output.

Now, don’t get me wrong. You don’t want to stop caring about the markets; that is NOT what a carefree attitude is about. What you are aspiring to is a mindset where you are free or “In the Zone” as a lot of sports people call it.

In this mindset, you are just free flowing and it is like you are a step ahead. You are not being weighted down by previous losses. If a trade comes up and it meets your trading edge, BAM – you pull the trigger without hesitation or without a moment’s doubt. When price moves into your target, BAM – you pull the trigger and take your money off the table. When price moves to your stop loss level, BAM – you cut that sucker.

You are operating at a higher state. This is how you will close the gap.

Go Ahead and Close it

In this lesson, you have been taught about the optimum mindset for how to go about closing the profit gap. We have covered how this gap between the money a trader is making and the money they have the potential to make is a really common trading problem.

During this lesson we looked at the two major steps you can take right now to actively start closing this gap as well as to start making your trading better both now and in the future.

Your Home Work to do RIGHT NOW!

Instead of just reading another useless lesson, walking away, forgetting about it in twenty minutes, and getting nothing out of it, I want to make sure this lesson actually helps you improve your trading and what you are doing, so do this RIGHT NOW!

Step 1:

You are going to go to my FREE Trading Journal and Download it. You are going to read how to use it, and you are going to go from being in the retail trader group to being in the pro trader group using a trading journal.

You are going to review your trades the last Sunday of every month. If you have been journalling correctly, you will start to pick up on early-warning signs, and also, where you can make huge ground in your trading.

Step 2:

You are going to buy Mark Douglas’s Trading in the Zone. The other option is to listen to it on Audio, which you can do through places like Amazon’s www.Audible.com, which also lets you get your first Audio-book download free.

This book is a must and a huge part of your home work. The more you start to trade, the more you are going to realise that the method or strategy is just what is being used to make the trades.

It is the decisions that are what are crucial. It is all about when those decisions are being made and if they are being made at the right times that counts. That’s why some traders can trade with any method and make money and others will never make a dime with anything they try.

Don’t fall into the trap of thinking that if you could just find better setups or if you could just test and find a higher edge you would find the secret. You have the edge and all the clues right within yourself.

You just need to bring the full potential out of yourself.

Safe trading and all the success,

Johnathon

Related Forex Trading Education

Johnathon, out of EVERYTHING I have learned over the last 3 and a half years on how to trade, this, to me, is the most important by miles!!!

I think this should be a prerequisite to ANY trading course. If I knew this when I first started out, I could have cut down on a lot of BS I picked up along the way.

I now realize that the ONLY thing standing between me and making consistent profits, is ME. Im on Chapter 5 now of that Audio book, and Im nodding my head on everything he describes. Guilty as charged and happy to finally see that.

I pulled up trading results from Demo trading and BAM! There it is! THAT is how I should be trading.

Thank you so much for putting this out there. It is going to change my life, not just my trading career.

Heya Josh,

great comments!

I think A LOT of traders look back and after they become successful wish that they knew this stuff earlier. The problem is that those same traders on the way to becoming successful see this stuff, turn their nose up at it and continue looking for how they can make their trading edge 0.0001% better with a better entry.

That’s the funny part because this is the stuff that really can turn the needle in your trading and actually can produce the huge results that traders are after. It is a mindset change that is needed for traders to being successful, not an extra 1% edge on a pin bar.

Safe trading,

Johnathon