How to Win at Forex Trading

If a trader goes into any forum on the internet, they can quickly find many different pockets of information. This can be so overwhelming the trader can at times not know where to start.

A common myth that is often spouted in these forums is that  only 5% of all traders make money and whilst the truth is closer to 30%, it still leaves 70% of traders who are not making money.

only 5% of all traders make money and whilst the truth is closer to 30%, it still leaves 70% of traders who are not making money.

70% of losing traders is still quite a lot of traders, considering how many new traders are coming to trade every single day.

These new traders come to trading looking for information and stumble to the internet and inevitably forums.

The biggest reason forums can be dangerous are they pass on the same myths down the chain like a family passes on something important down the generations. One trader’s passes on a myth to a new trader who does not know or understand any better. Because this trader is new, he/she looks up and respects this more senior trader and takes what he/she says as gospel.

Once this new trader then turns the table and becomes the seniors trader, he/she passes the same myth onto the new beginner trader and you can see how these myths continues on throughout all forums and how the many traders come out of the many forums trading the SAME way, thinking the SAME way and with the SAME trading results, UNLESS; they think and swim against the stream!

This can be really hard for all humans no matter who we are. We are all programmed to want to feel that we are doing the right thing and that what we are doing is the same as everyone else. Traders always want to know that even if their trade lost, that someone else was in the same trade. They feel okay as long as it was not just them. Sound familiar? Taking the contrarian approach or the opposite of what everyone else is doing can be the hardest choice, but often the most profitable.

Stop Following Advice of People You Don’t Know on Forums

Traders need to stop following people on forums that they don’t know. If you know the person, then obviously this doesnot apply, but what I am getting at with this is what I spoke about above and the myths that are continuously spread and continue to hold traders back in their trading for years.

These myths are holding traders back from achieving what they really could. Take everything you read on a forum with a pinch of salt. There is plenty of quality information on some forums that is well worth your time in reading and studying and at the same time there is other stuff that is junk.

The trick is what to read and what to listen to and that can be hard for traders that do not know what the myths are and this is why I say tread carefully.

Controlling Your Emotions and Winning The Battle

Traders all have the same instincts and psychological battles, it’s just some deal with them better and some win this battle and other  lose this battle. These instincts that all traders have are universal and cannot be escaped.

lose this battle. These instincts that all traders have are universal and cannot be escaped.

Some traders try to say they block them out, but the truth is, they can never be blocked out; they can only be dealt with. The best traders acknowledge these emotions and instincts and deal with them. Examples of these universal instincts are;

- Peer pressure – comparing against other traders

- Greed – wanting to go for more and more

- Fear – fear of many things; fear or missing out on a trade, fear of losing, fear of cutting profit short etc

- The 100% trade i.e. wanting a sure thing trade

The deciding factor on whether the trader normally wins this battle comes down to two factors;

1: Discipline

2: A Plan

If you are a disciplined trader with a solid trading plan you can take advantage of these universal trading psychological instincts. These universal instincts create something in the market that gives every trader an opportunity to exploit to their advantage if they are disciplined and have a solid trading plan.

The result of the universal trading instincts is that traders make mistakes.

Traders make all sorts of emotional trading errors because of these universal instincts that all traders have and for as long as humans trade the markets, these mistakes will be there for other traders to exploit and make money from. It is up to you as a trader to do the opposite as most other traders and not follow the pack. You must have the discipline and the strength to go against the crowd and swim and against the stream!

Taking Advantage of Other Traders Emotional Trading Mistakes

If you are going to take advantage of other trader’s emotional trading mistakes and errors you are going to need a trading strategy that can exploit them such as price action trading. The majority of our articles and videos here at Forex School Online are teaching traders how to trade and profit from price action in the Forex markets.

The best thing about price action is whilst it is becoming more and more popular with traders around the world, if traded correctly it allows the trader to enter the market against the herd. A great example of this is with the pin bar.

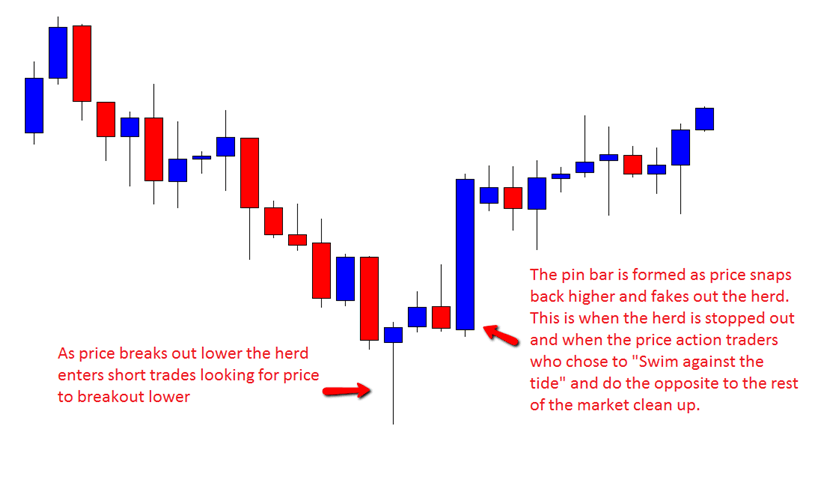

With the pin bar price begins to break out and make a move.

Traders jump into this move thinking that a breakout is occurring and this is where the herd behavior is at its most vicious and also where the contrarians who take the opposite trade can make the most money.

The pin bar forms because the breakout does not occur and price snaps back the other way. The herd of traders that were looking for the breakout start getting stopped out and these stops fuel a hard and fast snap in price movement back to create the pin bar. This example is fully explained in the chart below:

The pin bar below is a bearish pin bar. The herd are looking for a bearish breakout (price to breakout lower) and start trading short trades. Price snaps back higher and this is when the contrarian traders and price action traders can take a long positions using the pin bar.

All the breakout traders have been faked out and this quick snap back higher of the pin bar will see a lot of stops being taken out which will see a fast and aggressive moved higher.

Recap

For as long as the markets are traded by humans there will be mistakes made. Humans are simply not built to be traders. Humans will always have the same universal wants which in turn create mistakes and for as long as these create mistakes there will continue to be opportunities to make trades and money.

There will always be money to be made for the trader who has the strength to “swim against the stream” and go against what the rest of the market is doing.

It is a comforting feeling to be doing what everyone else is doing, but can be a far more profitable position to be doing the complete opposite!

If you are going to take anything away from this article, then make it this; everyone wants to feel like what they are doing is correct. Every trader wants to know that the trade they are placing is a good trade, but the next time you look for confirmation or you want to follow what someone else is doing, keep in mind that 70%+ of traders lose money.

The traders making money are the traders doing the opposite of what everyone else is doing. If you want to make money you need to be doing the complete OPPOSITE of what the 70% are doing and not the same.

Whilst it feels comfortable knowing that another trader is making the same trade as you, if it is not profitable, then you need to do the opposite.

I hope this has ignited some thought bubbles and really got you thinking about your trading. I would love to hear your comments or questions in the comments section below.

Safe trading and all the success,

Johnathon

The last part is a Million Dollar worth paragraph. Thanks a lot

This is so true. Thank you for sharing this wisdom.

thank you.

I read this, while waiting for my life membership to get active to sign in from the members log in and I am already sensing a complete change of mindset.

I am very excited about buying the membership. I hope it’s a good and a wise investment. Hope my account gets activated soon. 🙂

larn alot from this article , Mr fox, thank you.

Wow, thought provoking as usual. Fox is a real mentor any forex newbie should be looking up to as a role model. Thanx man ,keep it up. Will be looking forward to joining ur forum as soon as i come up with the membership fee.

Deep article,

The vast majority of people agree on anything,

they are generally wrong.

Otherwise no market would function because

there is simply no minority with money enough to make a majority rich!

Cheers Johno’