The Best Forex Pairs & Markets to Trade

Two of the most common questions I tend to receive over email are; what pairs should a trader trade and is it better to concentrate on just one or two pairs or many.

Normally to answer the first question it can be difficult because every trader has a different broker and every broker has a different list of pairs and markets they offer and the spreads and commissions they charge can vary which can make some markets and pairs not worth trading depending on how much the broker is charging. I will be able to answer this first question much better by the end of this article.

The second question has an answer that is often debated between traders, but the truth is the different methods need to suit the different trading methods.

At Forex School Online we look to concentrate on the higher time frames such as the 4hr, 8hr and daily charts with occasionally moving down the 1hr charts, but the majority of our trading is done on the higher time frame charts.

For traders trading from daily charts it is far better to have many pairs to work from and then be able to take only the very best setups from the many pairs or markets.

Traders on the higher time frames want as many quality markets as possible to choose from as long as they can monitor them effectively so that they can then pick the best setups from the many.

Traders who trade on the very small time frames such as the 5 min or 15 min charts who are often referred to as scalpers would not be suited to this method at all. Scalpers would simply not be able to watch many pairs at once because price is moving too quickly on the smaller time frames. In this case, the scalpers would be much better off concentrating on one or two of their favorite pairs.

The other major difference is that for scalpers watching their 5 min charts price is moving really quickly. These traders have a potentially new setup forming every five minutes with every new candle close. The traders trading the daily candles however, only have one potential setup every 24 hours. It is far easier for traders to keep track and concentrate of many charts on the daily time frame that what it is on the 5 min or 15 min time frame.

Time to Get Cherry Picking

The oxford online dictionary defines cherry picking as;

– To selectively choose (the most beneficial or profitable items, opportunities, etc.) from what is available

In trading this basically means; if traders are to cherry pick, they would be taking the very best trades from the many pairs available, rather than forcing trades from concentrating on just a few pairs.

For price action traders who trade the higher time frames as described above, using the cherry picking method is the best approach  because rather than forcing trades and over trading where there really are no trades to take, the trader can take the very best trades from the many markets and pairs available.

because rather than forcing trades and over trading where there really are no trades to take, the trader can take the very best trades from the many markets and pairs available.

As I go into detail below; I personally trade 39 Forex pairs on the higher time frame charts and this takes me no longer than 1hr per day because of how I go through my daily Forex trading routine. Whilst at first glance this may seem a lot of pairs, it allows me to take the very best opportunities available when they arise. When price moves into a key area I can “cherry pick” the best trades right from the tree.

The List of Forex Pairs I Trade and the Criteria

To get back to answering the very first question I raised at the start of this article.

Whilst the list I am about to list below is the list I personally monitor for my Forex trades, that does not mean it is the set list that has to be followed by every trader. You may be trading with a different broker to me that may have bigger spreads and commissions, or you may be suited to a different set of pairs.

For traders wanting to know the broker I use for monitoring and trading these Forex pairs you can check them out HERE.

The three main criteria I use when looking to see if I will have a pair on my watch list are;

- Currency manipulation of currency too big of risk

- Too many gaps

- Spread too large

It is not uncommon for countries to manipulate their currencies.

The Japanese are regularly trying to intervene in the JPY to lower its value and the US are also regularly printing money, but in both these cases the JPY and the USD are strong and volatile currencies that are heavily traded and both give traders a lot of opportunities to make high probability trades. In both scenarios their is risk, but at this stage it is still worth placing trades.

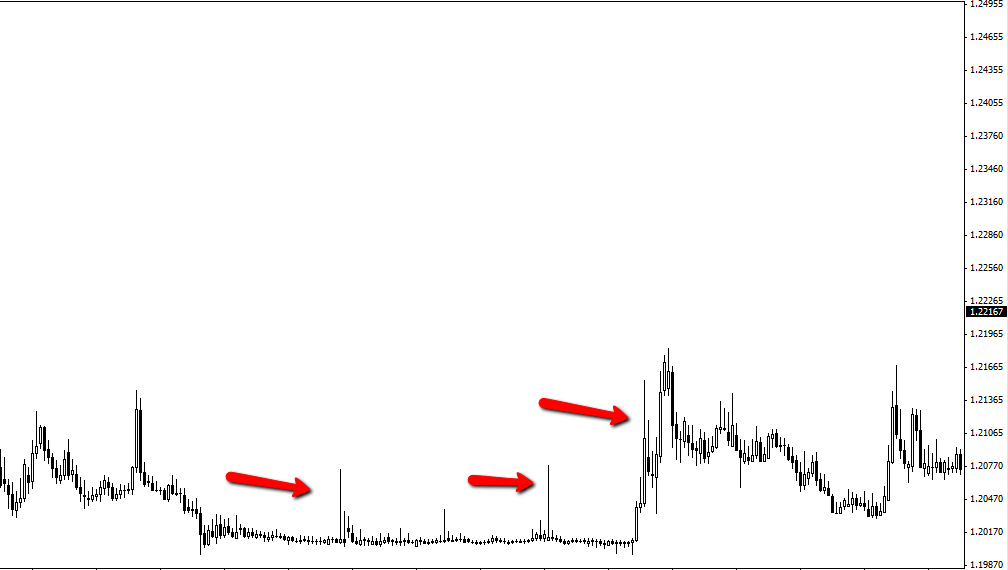

The EURCHF, however, is a pair I avoid and do not even have as a part of watch lists. Any trader can flick over to the EURCHF and see that price on this chart has a long history of being awkward for price action.

There is a high risk that making a trade on this pair could literally see the trader locked away in a trade for months at a time followed by a huge spike for no reason at all and that is because this pair is heavily manipulated by the Swiss.

A daily chart of the EURCHF is below which highlights how price gets locked into not moving for weeks on end and then massive spikes all of a sudden.

EURCHF Example Daily Chart:

The daily charts with the regular gaps should be avoided. If you’re trading pairs with a lot of gaps in them it means you’re going to run the risk of having your targets and stops not hit and that is a large risk to take on when you can flick to another Forex chart and cut out a lot of the same risk.

The problem with entering trades with spreads that are large is that you are entering a trade already behind and the bigger the spread the further and further behind you are starting. At some point there needs to be a cut off point where the trade is not worth putting on because the spread becomes too much of a disadvantage. This will be a different level for everyone and each different Forex broker will have different spreads.

The List of Forex Pairs I Trade

USD PAIRS

AUDUSD

USDCAD

USDJPY

EURUSD

USDSGD

USDCHF

JPY PAIRS

SGDJPY

SEKJPY

CHFJPY

AUDJPY

GBPJPY

CADJPY

EURJPY

CHF PAIRS

GBPCHF

NZDCHF

CADCHF

CHFSGD

EURO PAIRS

EURSGD

EURCAD

EURNZD

EURAUD

EURGBP

AUSSIE PAIRS

AUDSGD

AUDCHF

AUDCAD

AUDNZD

GBP PAIRS

GBPSGD

GBPNZD

GBPAUD

GBPCAD

GBPUSD

GOLD & SILVER

XAUEUR

XAGEUR

XAUUSD

XAGUSD

NZD PAIRS

NZDCAD

NZDUSD

NOKJPY

NZDJPY

I also trade other markets such as commodities, major indices and metals.

I am not going to list these because this is not a fixed list and they are always changing, however I will say that if you want to open up the markets you are trading and you want to start trading markets such as the major indices and commodities like Oil, Gas etc, then the brokers I recommend below offer charting for you to start demoing and trading these markets.

Get a Better Broker!

I have discussed this before in this blog, but one of the main costs in the business of trading Forex and Futures is in the broking costs and every cent you pay to the broker is a cent you don’t make in profit, so when traders take the attitude of “a few pips extra doesn’t hurt” it really makes me wonder how seriously they take their trading business and for that matter, how seriously they take making money.

The only reason a professional traders enters any trade is to make money. That is the only reason. Whilst they may enjoy trading, the enjoyment is not the reason they enter trades. I

f the professional trader is paying extra costs that they don’t have to such as extra spreads and commissions through their broker that they could possible cut down by going to another broker, it cuts into their direct profit.

A couple of pips extra can seem to be nothing to start with, but over time added onto every trade and as the trader starts to trade bigger and bigger amounts this can quickly start to add up to be a serious amount of money.

The simple fact of the matter is; when a trader first places their trade, they start behind in the trade because of the spread.

Straight away from the very start of the trade, the trader is losing money and will need to close this difference between the spread and market to just get back to break even, let alone start making any money.

The better the broker and the better the spreads, the far quicker the trader will start making money from their trades because they will not start so far behind in all their trades.

Because the spreads and commissions will not be so large, they will not be trying to chase up the spread cost just to get back to the break even before they can start making profits. To put it simply; the cheaper the spread, the quicker you start making profits. It’s that simple!

Whilst a lot of brokers charge around about the same with their spreads on the major pairs, where the big differences can lie are with the crosses and exotic pairs. This is where brokers can have differences of anywhere up to over 100 pips in the spreads they charge!

The other major differences in brokers come in execution of orders with things such as slippage and other factors such as how good the charting platform is and if the broker gets up to any funny business.

Traders will often find with a lot of market markets who are taking the other side of their trade and trading directly against their position, the broker will get up to all sorts of funny tricks to liquidate their position because when the trader loses, the broker wins. It is important you find a broker that does not have this direct conflict of interest and is not trying to make money from your losses.

If you are serious trader, you need a serious broker. It really is as simple as that. You need a broker who is well regulated so your money is safe and a broker who does not get up to funny tricks, but who also offers very competitive prices not only on the majors, but all the way through their cross pairs as well so you can cherry pick from a wide variety of markets and are not priced out from trading many pairs.

You can find who I recommend for a broker here;

Recommended Charts & Broker For Price Action Traders

Recap

Rather than concentrating one just one or two pairs and forcing trades where there are no trades to be taken, become a cherry picker and start taking the best cherries from the many pairs available.

If you follow my daily Forex trading routine and change it so suit your own schedule you should be able to make it suit your own life and get through all the Forex pairs in no longer than about 1hr per day.

I hope this really helps your trading and you can start “cherry picking” the best Forex price action setups.

If you have any questions or comments please leave them in the section below.

Safe trading,

Johnathon

Hi mentor john, this is informative, I love your site. Please do you know Olymp trade? This is because one of my neighbor blindly deposit 1000$ to them for over 3weeks now and they denied seeing any fund and his account was debited.

Hi Saint,

sorry to hear about your friend.

There are literally thousands of brokers out there and it can be tricky. I try to stay informed about a lot of them, but cannot say I am familiar with Olymp trade.

All the success,

Johnathon

hi Jonathan,

if after analyzing the charts, you’ve identified 2 potential trade set-ups. However, these 2 set-ups are positively/negatively correlated to one another, and would be counter productive to each other.

In this instance, how would you determine which trade to take and how would you manage them?

How would you normally avoid having trades that are correlated to one another?

James

Hi James,

in this scenario you have a few options;

You can either take the pick of your trades. So analyse the trades and find the one you like best. Work out which one has the most space, best risk reward etc and take that one by itself.

Or take them both/all of them and split risk accordingly. For example; just say I normally risk $100 each trade ( I risk money and not percentage, but you can do the same if you risk percentages), instead of doubling up my risk by taking both trades and risking $200, I would take my normal $100 and split it between the 2 trades, so risk $50 on each trade.

If you risk 3% per trade you could risk 1.5% each trade. Make sense?

Johnathon

Hi Johnathan,

Thank you so much . A very great article.

Note that you have 8 set of the 39 pairs.

John, if after analyzing the charts, you’ve short-listed 2 potential trade set-ups, however these 2 set-ups are positively/negatively correlated and the trades you initially planned would be counter productive to each other.

In this instance, what type of decision would you make and how would you manage your trade?

James

I appreciate this. Thanks for the informative article

Hi Johnathon,

I have been trading for a while using price action and a couple of moving averages.

Reading your articles gives me the impression that you are a stickler for precision, and being a surgeon, I find that very reassuring.

Could you suggest a broker and a platform that you think are good?

Looking forward to more stuff once I join your trading course.

cheers,

Anil S

Hello Anil,

great to hear you are trading price action! I would highly encourage to get rid of all indicators and commit 100% to price action and what the price is printing. The charts that are needed to be used and why can be read about here: https://www.forexschoolonline.com//new-york-close-5-day-forex-charts-change-time-frames-mt4/ and the broker that is recommended here: https://www.forexschoolonline.com//recommended-forex-broker-charts-price-action-traders/

If you have any other questions just let me know,

Johnathon

the best article i have ever read. thanks johnaton . i to trade the same pairs all major`s and cross 28 pairs

the hardest thing for a trader is…………patience

Excellent Article. Very informative.