Swing High and Swing Low: How to Identify and Trade

Many trading strategies involve looking for the best price to enter, or looking for ‘value’.

These value areas are often referred to as buying cheap (swing low) when looking to get long and then selling expensive (swing high).

If we cannot identify these pullback and value areas, then we will often find ourselves entering just at the wrong times.

To help us find areas of value to look for potential trades, we look to identify a potential swing high and swing low.

In this lesson we will look at exactly what a swing high and swing low are, how you can identify them and how you can use them to find trades.

What is a Swing High?

A swing high is the peak price reaches after a movement higher before it falls back lower.

This move higher into the swing high is often an important level and will regularly be used by traders to hunt reversal trades.

Below is an example of a swing high;

In this example you will notice that price has made a series of swing highs. When price is making higher highs and higher lows it is in an up-trend as discussed below.

Swing points can be formed on all charts and time frames from the smallest to the highest time frames. This makes them incredibly useful when attempting to identify reversal trade setups, or looking to make a trend trade.

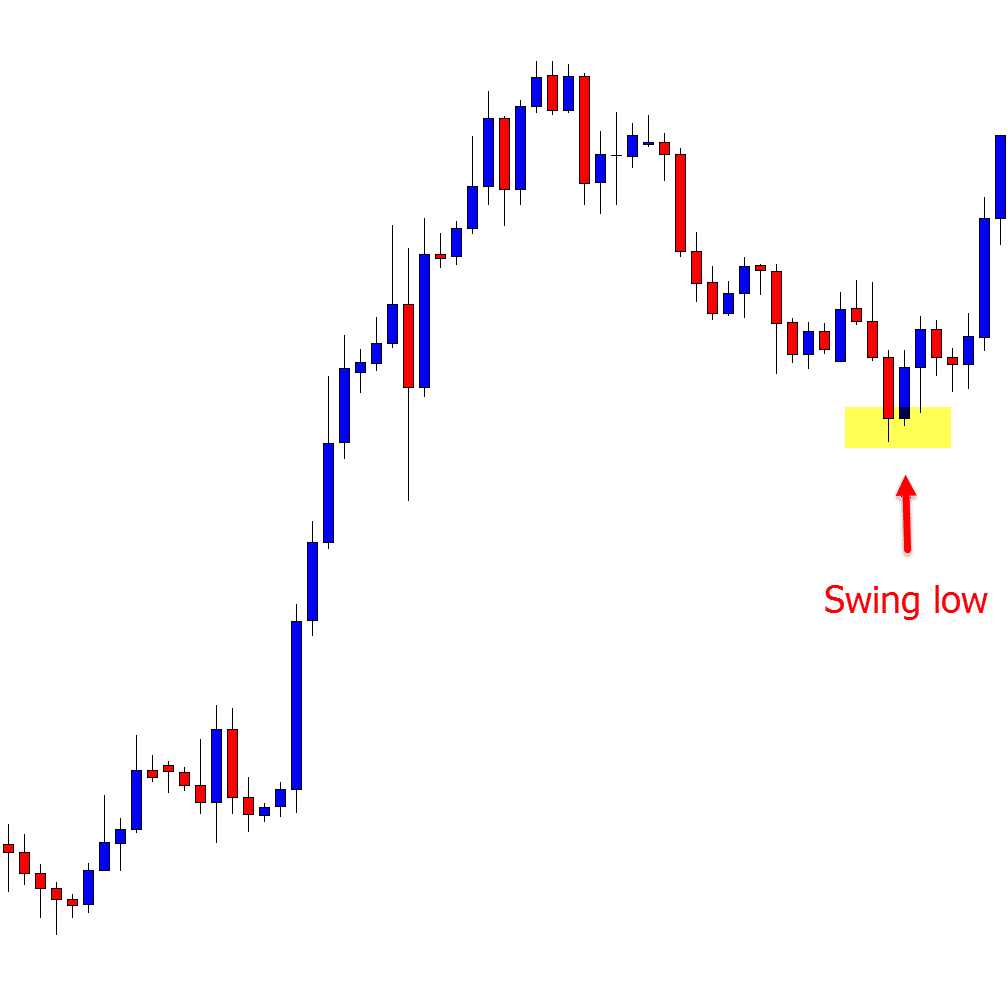

What is a Swing Low?

A swing low has the same facets of a swing high, but inverted.

With a swing low price will swing into a low point before moving back higher creating the ‘swing low’.

Below is an example of a swing low in an uptrend.

NOTE: There is no minimum amount of time or set number of candles that have to be formed for a swing point to be created. You do however have to take into account when hunting a trade if the swing point is formed at an area where you will have a big enough space to make a solid risk reward on your trade.

Why are Swing Points Important?

If you are a technical analysis or price action trader that makes trades within a trend or range, then understanding swing points is crucial.

If you are consistently entering trades from the wrong swing point areas, then the chances are you will be entering against the big money. It will also mean you will often be buying expensive and selling cheap.

An example of this is; if looking to get long, then you will be looking to find an area where price will swing lower into where you can either jump aboard an uptrend, or make a trade from a range low.

Below are examples discussing how you can use swing points to find trades in both trending and ranging markets.

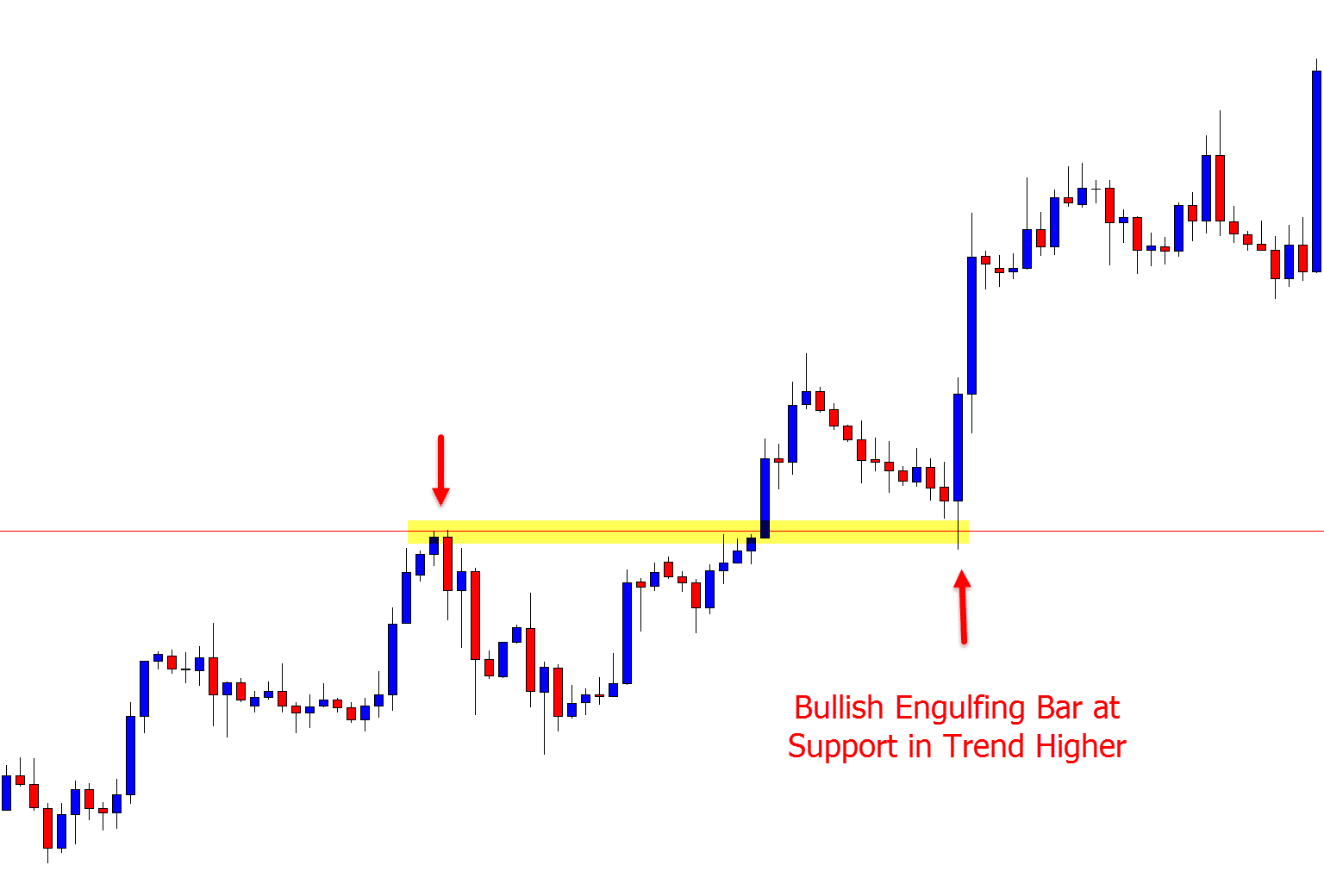

What is Swing Low Trading

When looking to trade using swing lows you are looking to buy cheap or from an area of value.

This is often referred to as looking for when price retraces or rotates back lower in an uptrend or when price rotates lower into a support when ranging.

Below is an example of how price moved lower within an uptrend into a swing low. This level was also a support level and was where price formed a bullish engulfing bar before continuing on higher with the trend.

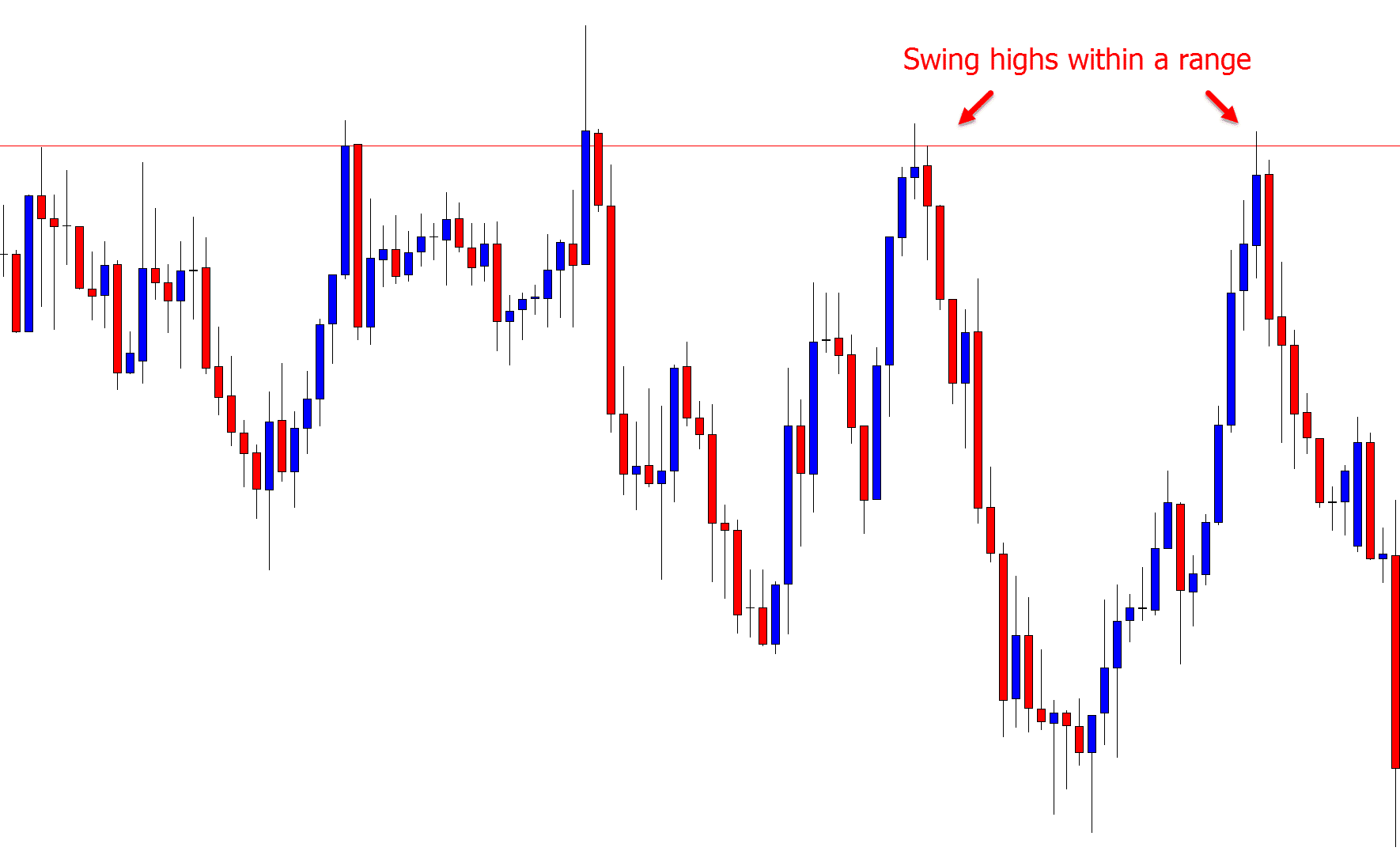

What is Swing High Trading

When trading from a swing high you are looking to sell short and make money when price reverses back lower.

An example of this is when price is moving in a downtrend, you look for a retracement back higher into a swing high and then you go short with the trend.

Another example is when price moves higher in a ranging market into a swing high and range resistance.

An example below shows how price moved higher into a range resistance before selling back lower.

Matching Swing Points With Key Support and Resistance Levels

Whilst swing highs and swing lows can be incredibly helpful to finding trades from value areas, they should not be used on their own to identify trades.

To increase the odds of making a winning trade other price action clues should be included.

The most common tool traders use to line up swing points at high probability market turning points is support and resistance.

An example of this in an uptrend is marking the major support levels and then looking for price to swing lower to jump aboard the trend.

Another example is marking your range support and resistance levels and waiting for when price moves into these key levels.

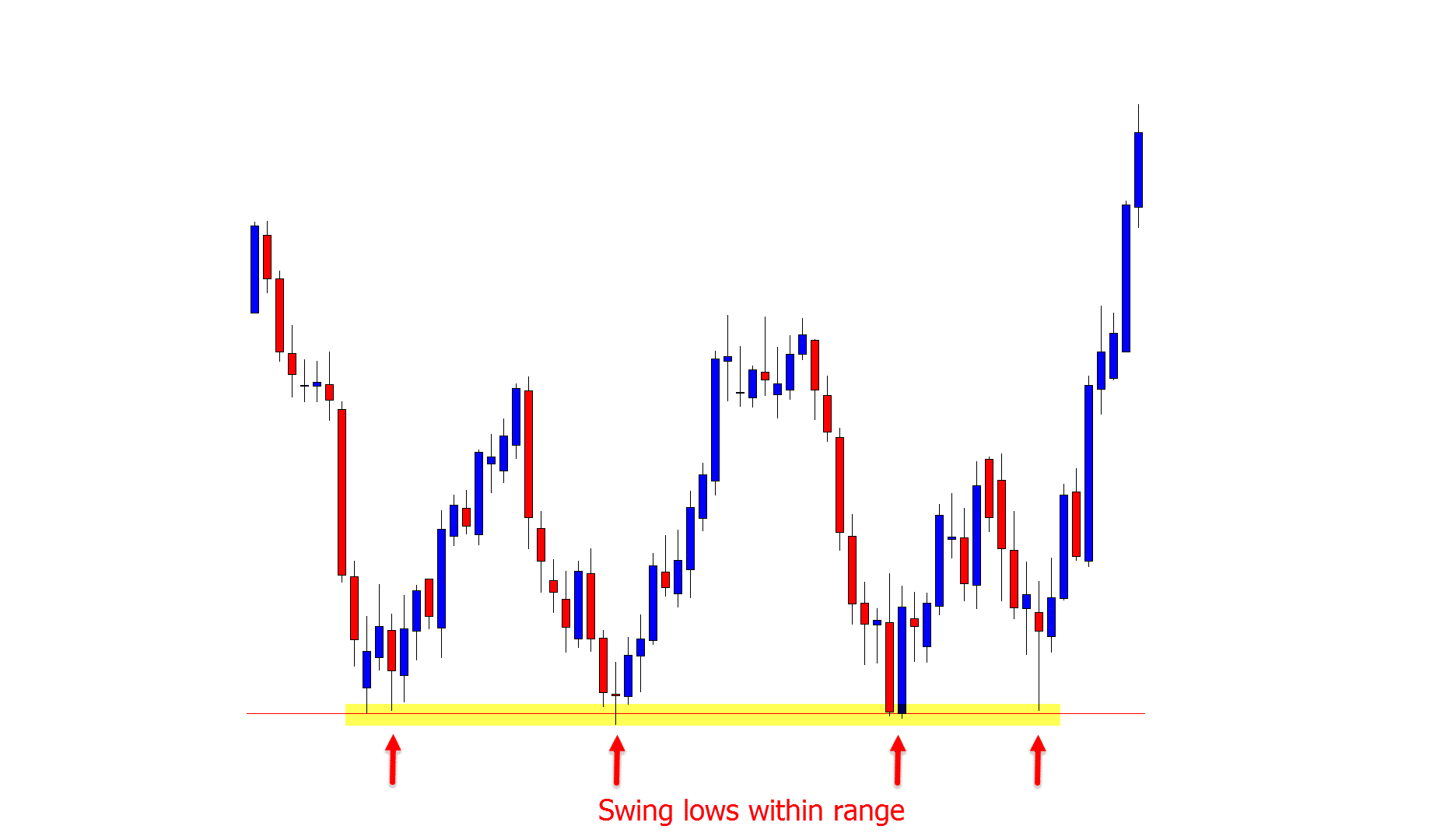

The example below shows price moving lower and into the range low support before rejecting and moving back higher on multiple occasions.

Trading With the Trend

Using swing points to trade trends can be incredibly powerful when done correctly.

We do need to keep in mind that not all support and resistance levels hold, the same as the trend does not continue on forever.

When using swing highs and lows you are trying to increase the odds in your favor of making winning trades, or managing your trades with more profits, not to make winning trades 100% of the time.

Lower Highs and Lower Lows – Higher Highs and Higher Lows

An example of using a swing point in a trending market is when the market is trending lower. Once we have identified the trend, we can begin to look for high probability levels we think price may swing higher into and where we may be able to get short with the trend.

These are the same areas discussed above, such as major resistance levels. When we have found these areas within the trend we can look for a swing high to form.

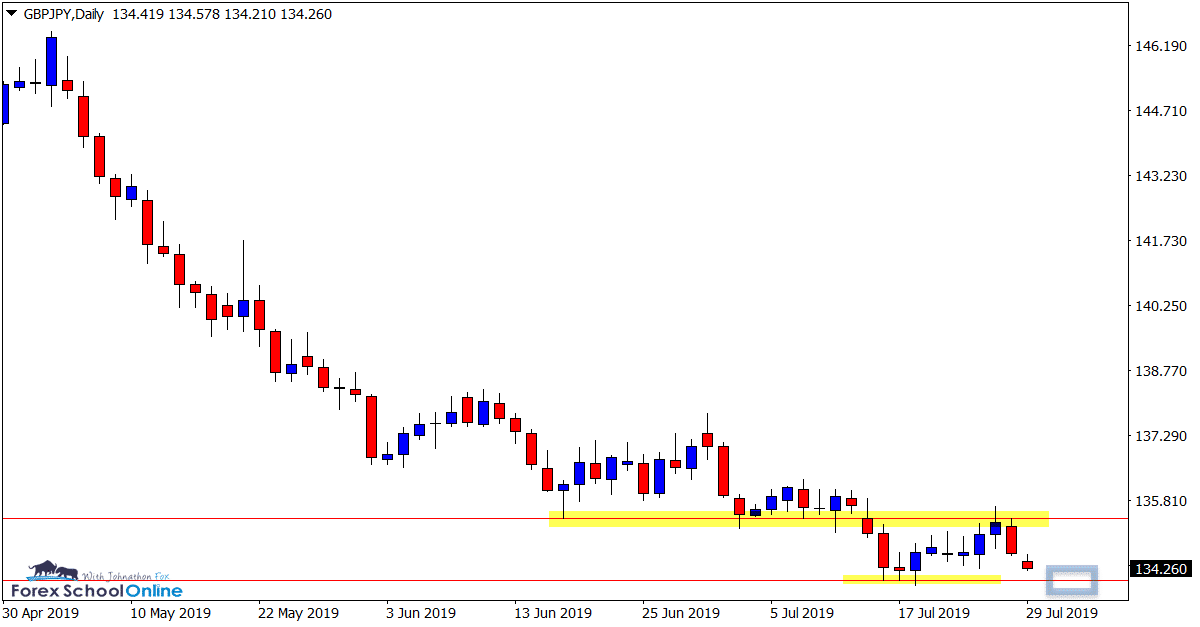

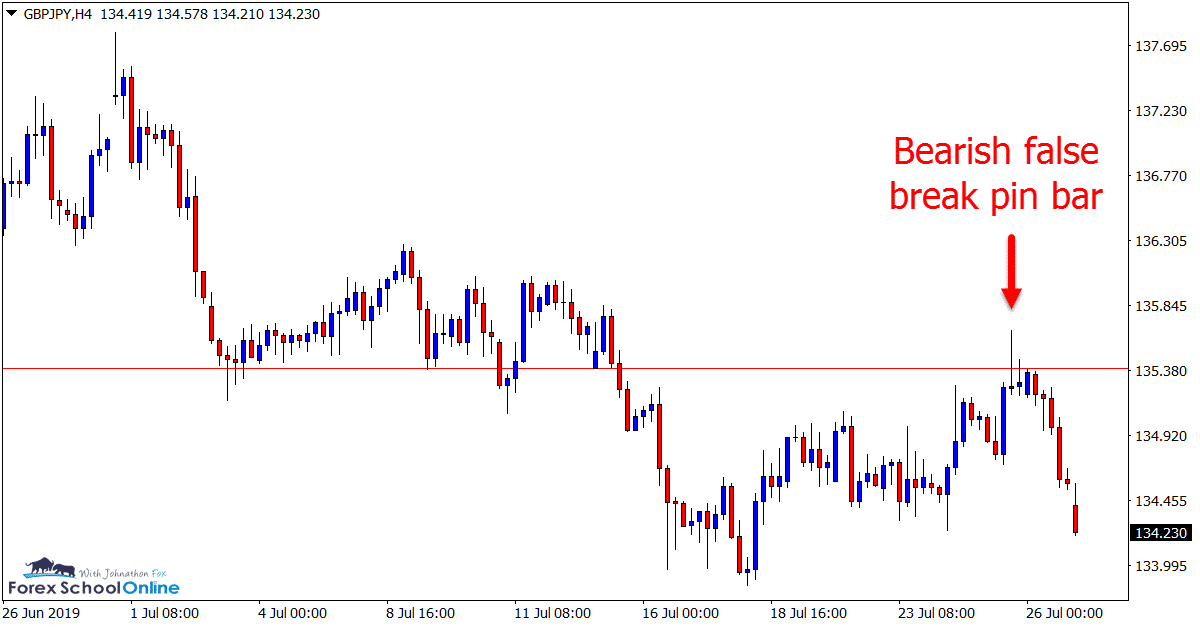

The example below is from a recent post in the trade ideas section discussing the GBPJPY. You will notice on the daily chart price is making a solid trend lower with lower highs and lower lows. On the 4 hour chart price swings higher into a resistance level and forms a pin bar reversal.

Daily Chart

4 Hour Chart

Trading the Range With Clear Highs and Lows

Whilst most traders are using swing points in trends, they can also be incredibly effective in ranging markets.

Ranging markets can be a lot more choppy and you can see price whipsaw up and down a lot more than in a trending market.

Using a clear swing high or swing low can help you find trades that have more potential to move.

Below is an example showing how you could look for trade entries at the key support or resistance level from the high or low of the range.

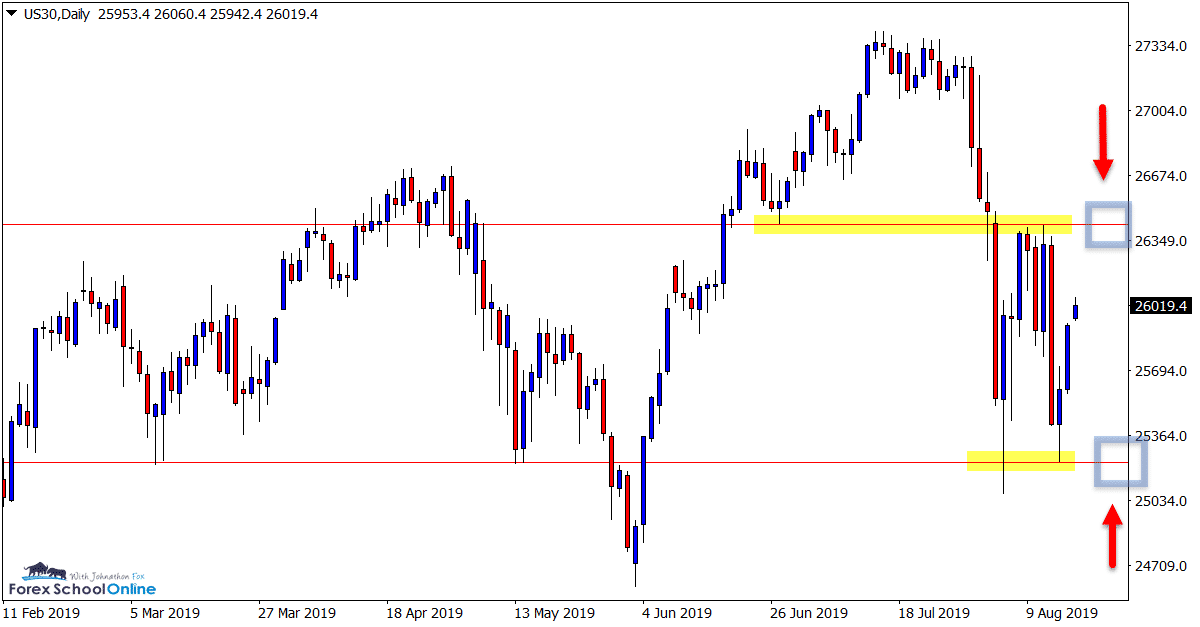

The example below is from a recent post in the trade ideas section on the US30 discussing the tight box and range that price was trading in and the two key swing levels that were important for the next price action move.

Daily Chart

Lastly

Being able to correctly identify swing highs and lows is crucial to playing high probability reversal trade setups.

If you are entering a reversal setup at the wrong area, then you run the risk of entering when the big money is exiting.

Very lastly; always use swing points with other price action clues like your major support and resistance levels and the overall price action story.

Safe trading,

Johnathon

Please leave your comments and questions in the section below;

hi in swing high and low indicator there are som dott line and some of them are short and long

what that means? (dott lines)

Hello,

Same question than Edward.

How do you concretely define swing points (number of candles before after)?

Thanks

Hi Johnathon, first up, thanks for useful, understandable and educational content…in a industry filled with BS and fakes, its refreshing to find a genuine trader !!.

Can you explain how you determine a swing point has formed? There seems to be several ideas when searching the net. However even though I only trade PA, I class myself as a rules based price action trader, utilizing the daily and 4h charts for analysis and setups, with sniper entries sometimes on a 1hr.

Up to now I have been using the DOW method with a potential swing candle having a min 2 lower candles on either side before it can be classified as a confirmed swing point. The colour of the candle is irreleveant, only that 2 candles either side are less ( or more) than the candle being defined as a swing point. IS this your method also, or do you use a different rule to establish a swing point? The reason i ask your valued opinion is I believe it is important to use rules to define swing points to confirm when the PA structure has changed and new trend is forming from a reversal point.

This really helping guys….. Guys i just need little bit of help on demand and supply , price action