Stop Loss Order: How to Use in Your Forex Trading (With Examples)

A stop loss order is an order you should be using on every single trade to protect your trading capital if price moves against your position.

Whilst we all want to make winners 100% of the time, this is simply impossible, and having a smart stop loss strategy ensures that we can minimize the times when we don’t get the trade right, so our winners make us profits.

An example of this may be; you buy the EURUSD at 1.3150 and have a profit target of 1.3250.

You may set your stop loss at 1.3100 so that if price goes against you, you are stopped out and the trade is closed, but if the trade goes in your favor you could make twice what you are risking.

The 3 major reasons you should be using a stop every single trade are;

– Preserve your trading account and always live to trade another day.

– Money management: minimize your losses so you can maximise your gains.

– Prevent one trade blowing your whole account or putting a major dent in it.

A stop loss is a complete waste of time if you continue to move it and you don’t actually let the market take you out for a small loss.

Before placing your stop loss, make sure you accept the risk of the trade you are about to place and where you could be stopped.

Be prepared to take a small loss on the chin so that when you make winning trades they can actually make you profits.

If you need to read about the different types of orders you can use, then checkout;

– Buy Limit and Buy Stop Order Explained With Examples

– Sell Limit and Sell Stop Order Explained With Examples

3 x Stop Loss Strategy Examples

With all stop loss strategies there are a few keys to remember that will really help;

Find and Read The Market Story and Structure

Every market has a price action story and structure.

Knowing if there is a trend, range, the recent momentum, swing highs and price action will help you when it comes to placing your stop loss.

Use the Price Action Trend and Story in Your Favor

You can use different stop strategies in different markets.

You can be more aggressive in some markets compared to others. This is the case when the market is strongly and obviously trending in one direction.

Take as Much Time With Your Stop Loss Placement as You do Your Entry

Don’t just ‘plonk’ your stop loss on where you always have and with little thought.

I bet you take great care to find your entries. Your stop loss could decide if you stay in the trade and if you do, how much money you end up making.

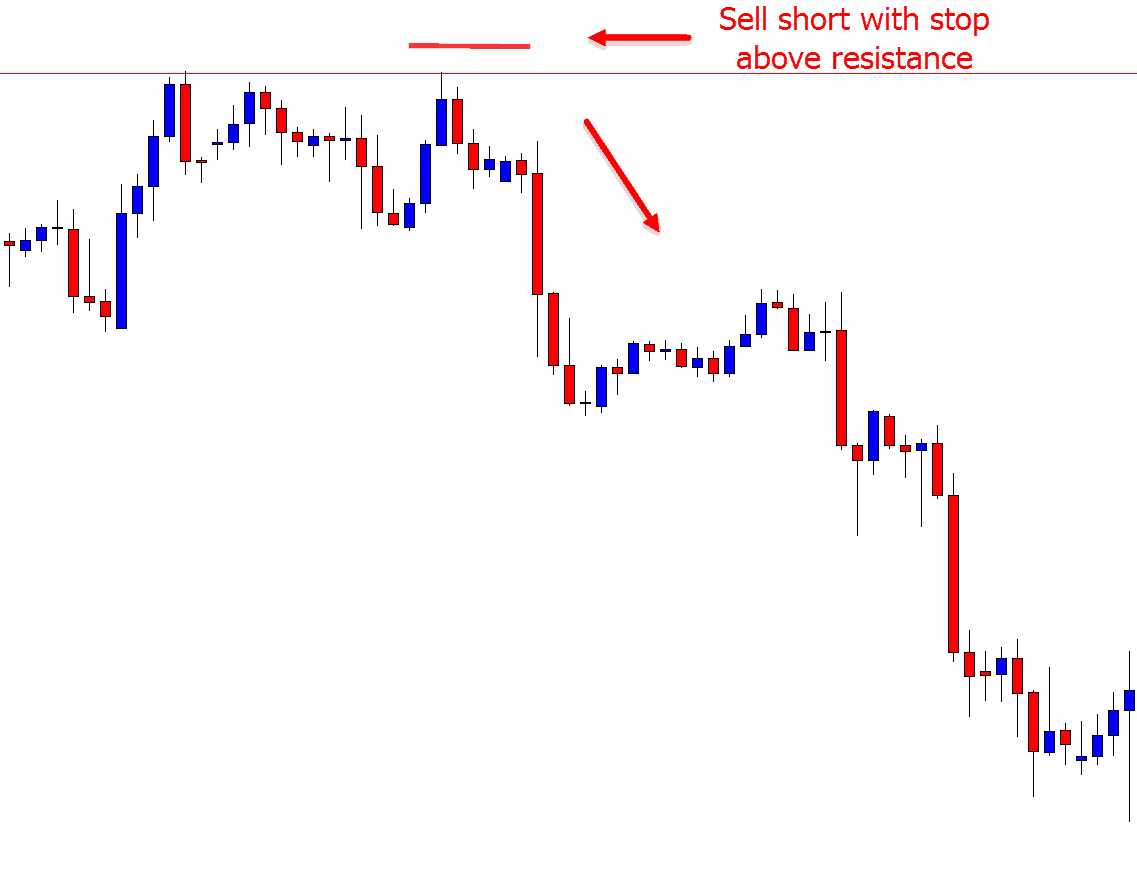

Major Swing and Support / Resistance Areas

This is a popular method of setting stops especially for swing traders who are looking to make profits from the larger swings in the market.

The good thing about this strategy is that it can be a solid method for not only setting your stop loss, but also for re-setting and trailing your stop loss as price moves in your favor.

When setting your stops using the major support and resistance areas you are using the major areas or supply and demand and support / resistance.

See a chart example below;

You MUST take a few things into consideration;

– Look at the overall price action story. This includes the market type and recent momentum.

– Price will often go just above or below a certain level and then reverse.

– Set your stop wisely where price is the highest chance of remaining in the trade and not being faked out.

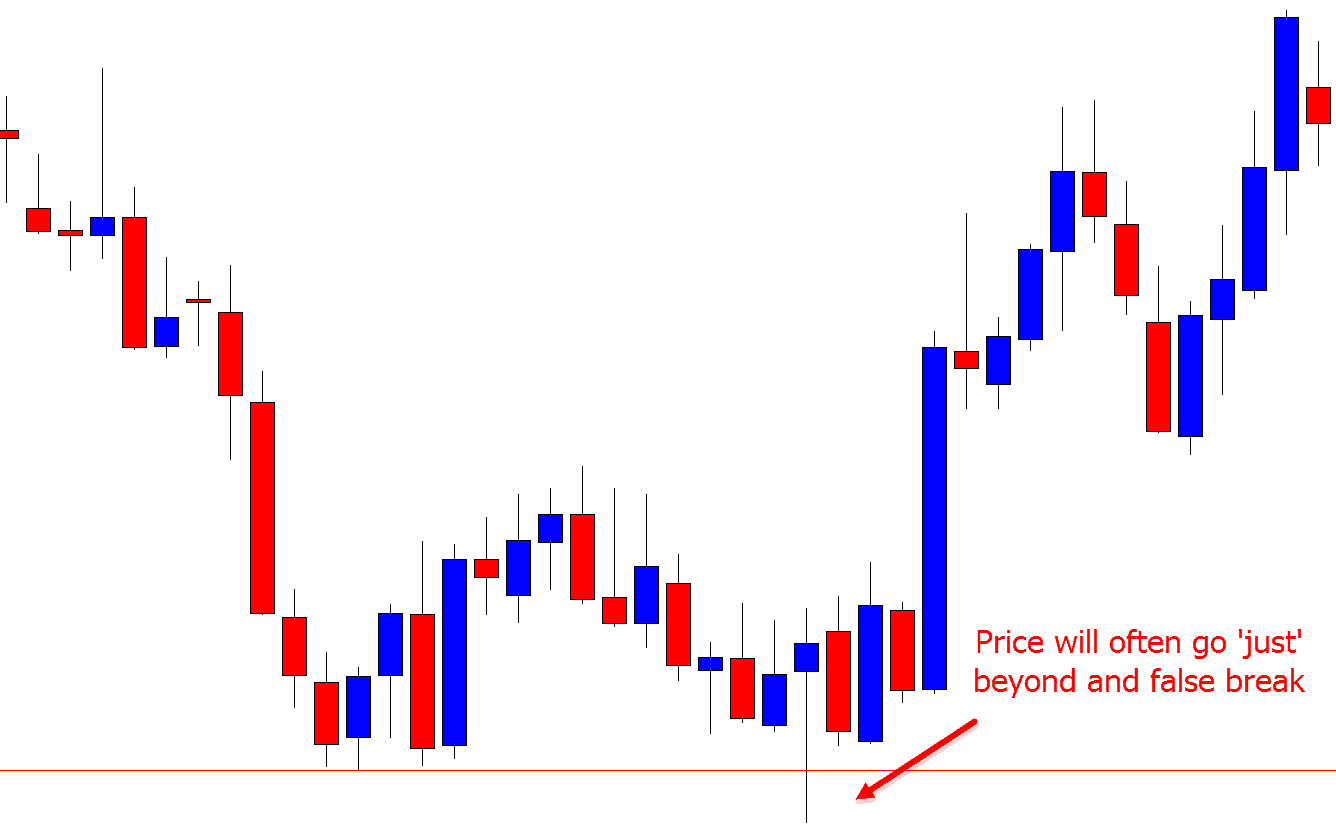

I am sure you would have noticed that price will often move just above or below a major support or resistance level, creating a false break and then reversing. You must take this into account if using this method.

See the chart below; the big players understand this and will move the market just beyond a level, before creating a false break.

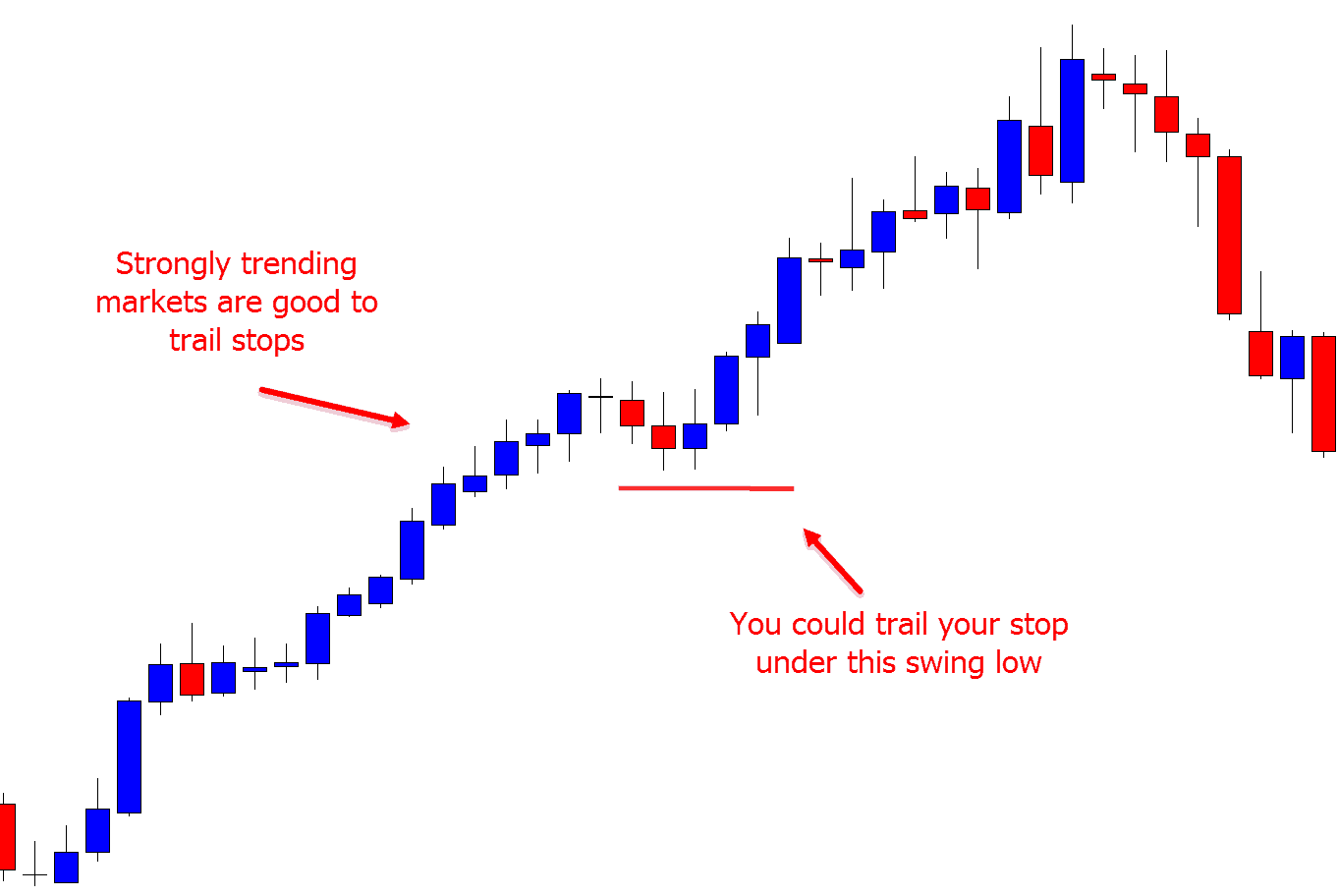

Trailing Stops

To trail your stop loss means you are continually moving your stop loss higher or lower to lock in profits.

If price was to swing against you, then you would be taken out with profits locked in.

You can choose to trail your stop loss either right from the start of your trade, or only once price has reached a certain point and you want to begin locking in profits.

An example of this may be that you want to wait for price to move to a certain target level and then look to lock in profits by moving your stop higher or lower.

The pros of trailing your stop loss are that you are continually locking in profits whilst also still giving your trade a chance to make further profits.

The cons are that you are moving your stop continually closer to the current price and risking having your position exited prematurely.

There are many different strategies to trail your stop loss including the two other strategies we discuss in this lesson; using price action and major swing highs and lows.

Another popular strategy is moving your stop loss above or below a certain number of candles. For example; price moves higher into profit by 100 pips and you now begin trailing your stop below the low of the 4th last candle.

Something to consider when thinking about trailing your stop is that it will work by far the best in a strongly trending market.

This is the case because you are continually moving your stop in behind price higher or lower. If price is in a ranging or sideways market you are far more likely to be taken out early. In a trending market you have a higher likelihood or trailing your stop with a larger move.

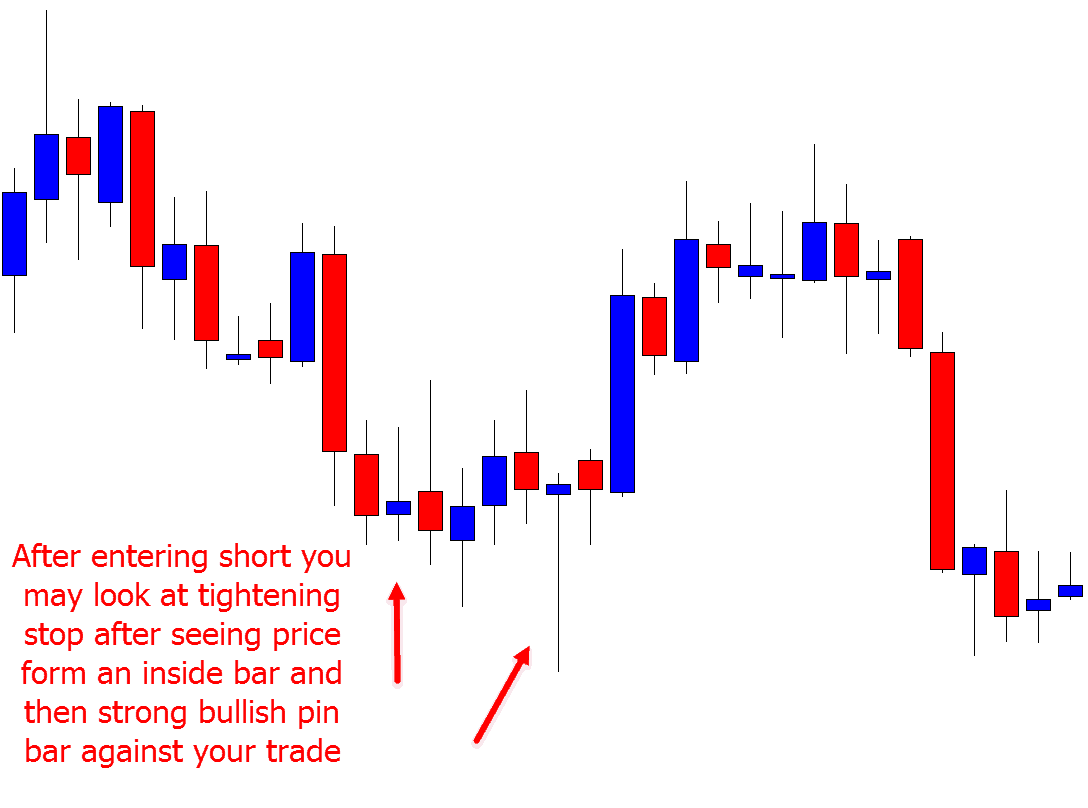

Reading Price Action to Set Your Stop Loss

This stop loss strategy includes methods such as;

– Using the candle high or low for your stop. For example; a pin bar high or low.

– Using the surrounding price action story.

– Reading other price action. For example; you may use the high or low of a recent inside bar that is at an important level.

This method to set your stop loss is the most advanced strategy discussed in this lesson because of all the strategies it requires a strong understanding of how to use the price action story.

When using recent swing highs or lows or using a trail you are using the same strategy for each stop loss. When using price action to read and also move your stop you are using what is actively happening in the markets, making it far more challenging.

I have attached a chart below showing how you might use price action to set your stop loss.

This method of setting stops is not recommended for new traders, but it could be used by advanced traders to find tighter stops and also help them trail to lock in profits.

I have found one of the best strategies for new traders to set their take profit and stop loss orders is to learn how to set and forget their trading.

Lastly

There are a lot of other stop loss strategies that are not discussed in this lesson.

Another popular strategy is using the break even stop which can be incredibly effective when used correctly, but would need a lesson of its own.

Make sure you take the same time and care with your stop loss that you do with finding your entries.

Your stop will help you get better risk reward and also could determine a winning or losing trade.

Don’t just plonk it on at the same place because that is what you have always done.

Make sure you practice any new stop method on a risk free demo account before risking any real money so that when it comes time to trade with real cash you have full confidence in what you are doing and carrying out the trade.

Practice finding where you can get the best returns for the smallest risk with your stop strategy. It could make a very large difference.

Safe trading,

Johnathon

Please leave your comments and questions in comments section below;

Johnathon,

How can ATR indicator be use to measure our Stop Loss ?

Thanks

Sir, you are a quiet but fantastic and great teacher. Pls kindly write on specifics of target management although I’m aware it’s for members ONLY. I do not have the money to register for your course but have the desire to learn. Pls do help me. Many, many thanks.

Thanks Paul and I will keep this in mind.

Johnathon

You are so good

I’m so excited

Great to have you 👍