Work Out Trading Profits in Money and Not Pips

It constantly amazes me when talking to traders and they work out profit or loss in pips. A common question I get asked is “how many pips should I make trading price action?”

Or another example is “should I have a minimum pip profit target each month?” What the traders asking these questions fail to understand is pips don’t determine whether you are profitable or not.

Negative Pips but Positive $

The reason traders need to stop working out profit and loss in pips is because pips are deceiving. Traders can be negative pips over a few trades but can still be making money. To some reading this they will be wondering what I am talking about so stay with me as this is article is definitely for you!

Before we enter trades we should be working out the correct trade size. We should always be risking the same percentage of our trading accounts on every trade. The only thing that will change is the stop size. Depending on how big or small the stop size is will determine how big the trade is we need to put on.

By doing this we will be risking the same percent every trade, no matter how big the stop loss is in pips. This means that every trade we enter will be a different amount.

Many traders simply see a trade and enter the same size trade regardless of the stop loss or pair they are trading. This is very dangerous because placing the same size trade every trade does not mean we are risking the same amount of money every trade.

The stop size for each trade will change dramatically. We could have a 20 pip stop on the 1hr chart but a 200 pip stop on the weekly chart. If for example we are entering both these trades with the same 2 standard contracts the amount of real money risked in both trades will vary massively. The loss the trader would take on the weekly trade is 10 times the size the loss they would take on their 1hr chart trade.

Correctly Calculating Positions Size

Most traders work out their risk per trade using the 3% method. What this basically means is each trade no matter what the pair or stop size, they are willing to risk 3% of their trading account capital. One trade may have 30 pips for a stop size but another trade may have 150 pips stop. In both trades using the 3% method the trader will be risking 3% of their account total.

Using this method the trader will have to open a different amount for each trade, but they will still be risking the same percentage of their trading account.

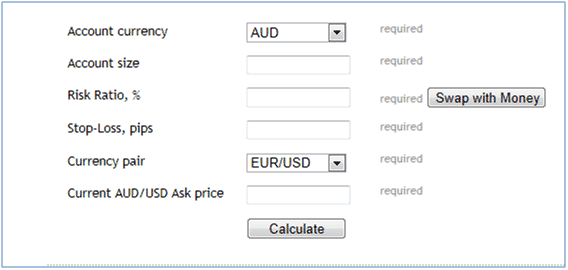

To work out the trade size the trader needs to put on for each trade I recommend using a position size calculator. There are many of these that can be found on the internet. Simply Google “position size calculator”. This tool will look like this:

Start Thinking in Money Terms

Now you have learnt how to open the correct size trade it is important you start thinking in terms of money and not in pips. As I said at the start of this article you could be negative pips for the month but making money!

An example of this is you place two trades. Both these trades are risking 3% of your account. On trade 1 you lose the trade that had a 200pip stop. You are now -3%. You then open a trade on the 1hr chart and have a stop of 20 pips. You win this trade and make 40 pips or double your risk which would be +6%. So whilst overall you are down 180 pips you are still positive 3% in your trading account!

As you can see from the above example working trades out in pips makes no sense. Start working out each trade using a position size calculator and never over risk on any one trade. It is still important to track your pips made and lost but it does not determine whether you make or lose money.

Now you have the knowledge of how to correctly manage your trade size there is no reason to ever over risk on any one trade. There is also no excuse to not place trades because the stop loss is too large.

As you have just learned it doesn’t matter how big the stop loss is because you will be simply altering your trade size depending on how large the stop is.

Safe trading,

Johnathon

I have not started trading with my live account due to fear of losing all my money but right now the fears are dissipating. Thank you.

Good move! Stick to a demo until you know you can make consistent profits and then move to the next stage with real cash.

Johnathon

Very good instruction, for the forex traders.

I used to trade 1-15M time frame a lot in past and i always wonder why i lost that much money, but after i found your site and started reading all of your great articles and trading with price actions in only daily timeframe , now I started making money …

Thanks a lot Johnathan ! you’re a savior for many people just like me.

I found that WHILE I'm in a trade, it is much less emotional managing the trade from a pip or tick perspective rather than how much $ I'm up or down. This keeps me focused on the price action rather than my pocket. The money will take care of itself…