What is Risk to Reward Ratio and How to Calculate it in Forex Trading

Risk reward is a simple concept, but how you deploy and use it in your trading can be as advanced as you like.

At its most basic, risk reward is the formula for how much reward you stand to make for the amount you are risking.

For example; if you risk 10 pips on a trade and you have a profit target of 30 pips, then your risk reward or RR is 1:3. You are risking 1 (10 pips), but stand to make 3 x times your risk (30 pips).

Should You Use High or Low Risk Reward?

You have probably heard that to increase your chances of being a profitable trader you should have a positive risk reward. This means that if you are risking 1, you should be making 2 or more times your risk on your winning trades.

This is great in theory because the higher your risk reward the less winning trades you need to make to achieve a profit.

Below I have added a chart showing how having a risk reward of 1:2 can make you a profit even when only getting half of your trades right. In this example you are risking $100 when you lose and aiming for 1:2 reward or $200 when you win;

TRADE NUMBER | WIN AMOUNT | LOSE AMOUNT |

|---|---|---|

TRADE 1 | $200 | Cell |

TRADE 2 | Cell | $100 |

TRADE 3 | $200 | Cell |

TRADE 4 | $100 | |

TRADE 5 | $200 | |

TRADE 6 | $100 | |

TRADE 7 | $200 | |

TRADE 8 | $100 | |

TRADE 9 | $200 | |

TRADE 10 | Cell | $100 |

In the example given above; you are only winning every second trade, but after ten trades you have made $1,000 and lost $500, equaling $500 profit.

Whilst this is great in theory, the truth is that the higher risk reward and the bigger the winning trades you aim for, the more losing trades you will make.

This is simply because price is getting further away from your profit target the bigger the risk reward.

As we will discuss below; risk reward is important, but it is also only half the equation. You can have as big of risk reward on your winning trades as you like, but if your losers eclipse your winners, you will lose money.

Things to Consider With Your Risk Reward Strategy

Don’t Forget Spreads and Commissions

So far we have discussed straight risk reward. In the real trading world you need to factor in trading costs including spreads and commissions.

These play a very real factor in both the risk reward strategy you use and the trading method you will use.

If you are making a trade on the EURUSD looking to scalp a 10 pip profit with a 5 pip stop (1:2 risk reward), you will need to factor in your spread costs.

The spread could be 2 pips and you have a stop of 5 pips meaning you are really risking 7 pips. You are not actually achieving a 1:2 risk reward ratio.

Your Trading Strategy and Pairs You Will Trade

Spreads are not going to affect your risk reward as much if your not looking for very small pip profits on small time frames.

When thinking about the risk reward strategy you use in your trading you need to consider the trading method you are using and also the Forex pairs it is suited to.

Different pairs have widely different spreads. Whilst the major pairs such as the EURUSD and AUDUSD have far smaller spreads, the exotics can quickly have spreads that blow out.

If your strategy is intraday scalping you need to take this into consideration.

If however; you are trading daily charts and risking 50 pips to make 100 pips, then spreads will have far less effect on your overall bottom line.

Risk Reward is Only Half the Equation

As discussed above, what you average as your risk reward is only half the equation.

You can make money with a 1:1 risk reward (or less) and you can be a consistent loser with a 1:5 risk reward.

How? It does not matter if you have huge winners if these winners do not cover your losses. At the end of the week and month you are still losing money.

Your win rate must be factored into the equation when working out your risk reward strategy.

How to Calculate Risk and Reward With the Fibonacci Retracement Tool

Working out your risk reward is quite simple, but it can also be a time-consuming process.

Right on your MT4 or MT5 charts you have a tool that you can use to easily and quickly workout your risk reward to see if a trade is viable.

The Fibonacci retracement tool can be used to quickly calculate the potential risk reward.

To do this, go to your MT4 charts and open your Fibonacci tool; “Insert” > “Fibonacci” > “Retracement”.

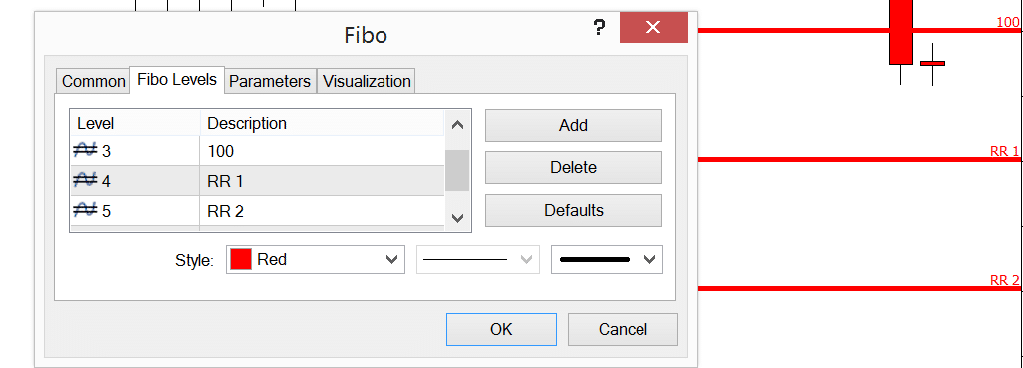

Next you’re going to make some slight adjustments to how the Fibonacci tool operates.

Click on the properties and when the settings box is open change the Fibonacci extensions to risk reward levels, for example 1,2,3 etc.

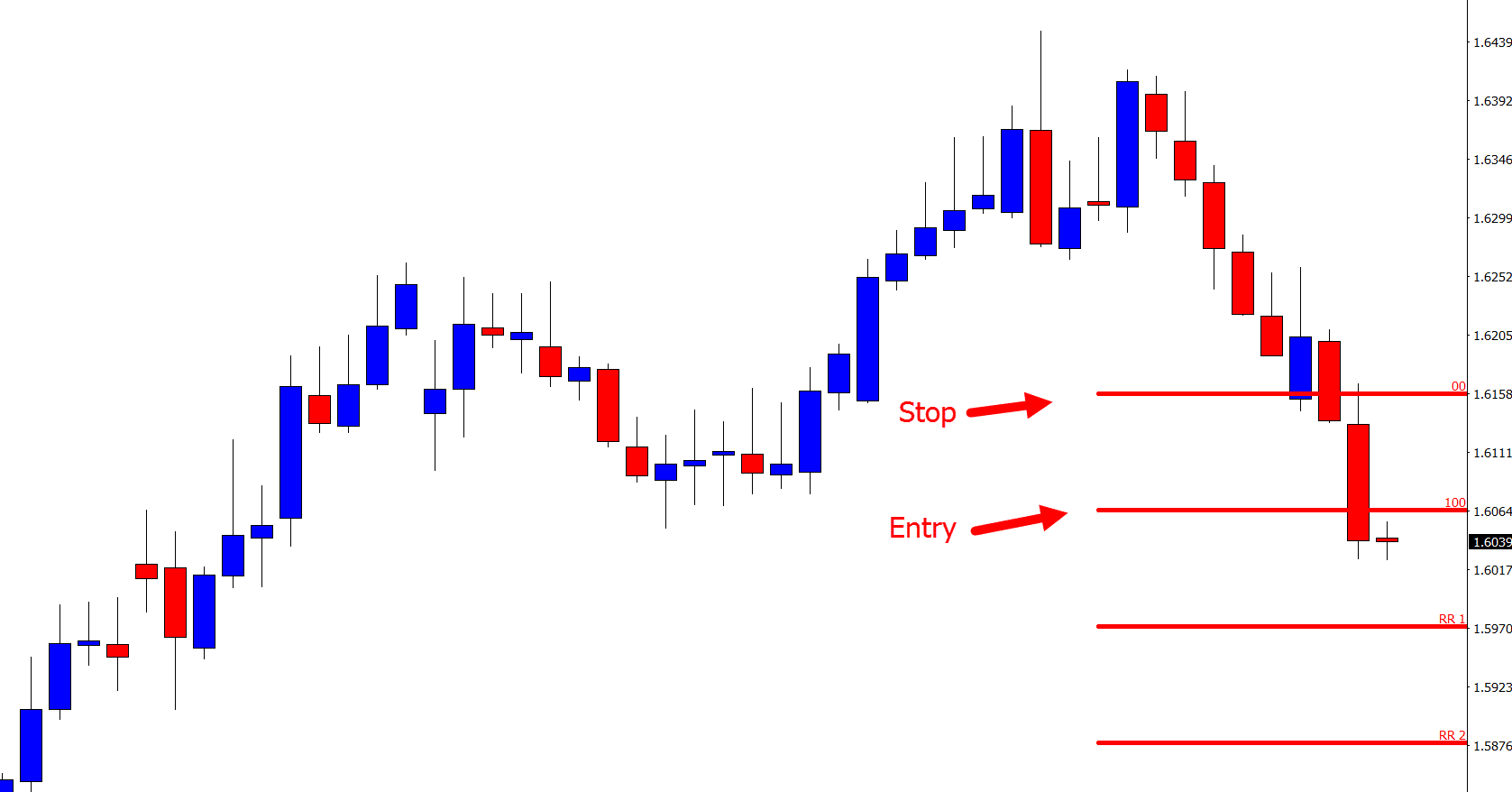

To use the Fibonacci tool to plot your potential risk reward you are going to use it upside down. This means that you start with level 100 as your entry and 00 as your stop loss.

Below is an example of how you could use the Fibonacci tool for risk reward with the entry, stop loss and targets as potential risk rewards.

Lastly

Risk reward is a crucial component of your money management strategy and overall trading success.

It is likely that the first risk reward strategy you try will not be the last, so practice the heck out of any new strategy and keep in mind your overall win rate in the equation.