Professional traders all treat their trading the same way. They understand they are not trading for the love of it or for the fun of it and whilst they may enjoy trading and they may love what they do, it is not reason they enter into trades. The sole reason professional traders make any trade is to; make money. That’s it. There is no other reason. A professional trader does not enter a trade unless they think it is has a high probability chance of making them money.

Professional traders see all their trades this way and they view their whole trading method with a very systematic approach. Just like any real life business must make a profit at the end of the month and year to be successful, it is no different than trading and this is how successful traders must approach their trading.

Far too often amateur traders are looking for the fun and joy in trading when the markets are no game and they and most definitely not a tool to be used to quell boredom. In this article below I discuss some strategies you can start using right now to start treating your trading like a business and take your trading to the next level.

Clearly Defined Method/Strategy

All businesses need to have a clearly defined method and strategies for how they operate and for a trader this is even more important. Every trader needs to be able to know their method for entry, exit and trade management inside and out. Before a trader even turns a chart on and goes hunting for possible trade entries, they should know exactly what a possible trade entry  would look like, if they were to find a trade how exactly they would place stops and entries and finally how they would manage the trade once they were entered into the trade. The trader would need to know all this information for all the possible setups they are wanting to trade and this is where a clearly defined and detailed trading/business plan comes in which I will discuss below.

would look like, if they were to find a trade how exactly they would place stops and entries and finally how they would manage the trade once they were entered into the trade. The trader would need to know all this information for all the possible setups they are wanting to trade and this is where a clearly defined and detailed trading/business plan comes in which I will discuss below.

A lot of traders think they understand their methods or trading strategies, but the difference between the professional and other traders is that the professional trader has a clearly defined strategy. People who are well versed in my teachings at Forex School Online will know that my method is clearly defined. There are no ifs or butts. There is no bending the rules to make something it is not. One example of this would be the; Pin Bar reversal. You will often see a lot of people bending or twisting a lot of different candles on a chart to call a candle a “Pin Bar” when it really is not. Our method at Forex School Online is clearly defined. It either is a Pin Bar or it is not. We do not change or bend our rules to make something they are not and this is because our method is simple and clearly defined and this is very important for all traders so that they can go into the market and know exactly what they are looking for when hunting for trades.

Would a Business Buy Lottery Tickets and Expect to Make Money?

Would a business set itself up based on buying lottery tickets and think that it is going to be a profitable business? What so many traders do is open a demo account and they start trading. They make a few winners and they jump to their live  account. With no idea if they are a profitable trader or not they start trading their live account. This is basically gambling. It is risking money in a marketplace when you have no idea if the odds are on your side of the other sides. I hear so many excuses why people do this. The most common excuse is: “I have to risk real money to get the feeling of risking real money so I only risk really small amounts”. To get the psychological effect that comes with risking real money you need to risk an amount that means something to you and risking small amounts does not do this.

account. With no idea if they are a profitable trader or not they start trading their live account. This is basically gambling. It is risking money in a marketplace when you have no idea if the odds are on your side of the other sides. I hear so many excuses why people do this. The most common excuse is: “I have to risk real money to get the feeling of risking real money so I only risk really small amounts”. To get the psychological effect that comes with risking real money you need to risk an amount that means something to you and risking small amounts does not do this.

I see a lot of new traders when learning to trade lose money and then once they are profitable they are playing catch up because they should not have lost their initial capital. Please don’t make this mistake. Everyone thinks they will be different. There is no need to lose money when you’re learning to trade. The money you lose when learning to trade and perfecting your method is just money you will have to make back when you do become a successful and profitable trader.

Good Business Decisions with Brokers

It never ceases to amaze me how many traders are not concerned about the spreads they are paying or the commissions their brokers are taking off them through the trades they are playing. The one major cost of doing business traders have are broking costs and this can vary a lot from broker to broker quite dramatically.

Spreads can really add up and be a huge cost depending on the broker you are dealing with. Some pairs are simply not worth trading with some brokers because you start too far behind to make it worthwhile to even put the trade on. For example; whilst a competitive broker will offer spreads on the minor crosses such as the EURNZD and GBPAUD of around 3-5 pips, some brokers can get out to as wide as 20-30 pips making them simply untradeable on the daily and 4hr charts.

Obviously a difference of 25+ pips between brokers can make a huge difference at the start of just one trade let alone over many trades before any possible commissions have been factored into the equation and this is why it is so important for traders to take a very long hard look to make sure that not only are they using the best equipment, but also that they are getting the best possible deal.

Remember; trading is a business and the goal is to make money and every cent you give to the broker is another cent profit you don’t make in your trading business.

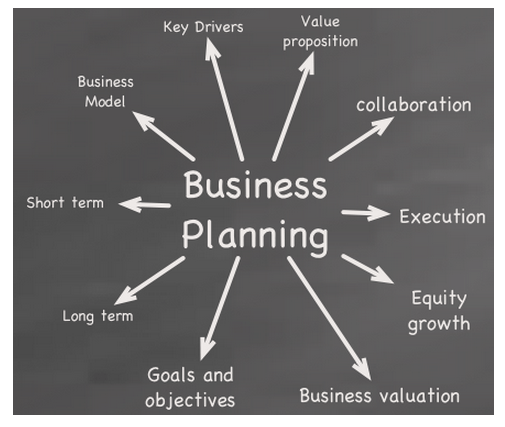

Business Plan/Trading Plan and Unwavering Discipline to Sticking to the Plan

A concrete step that you can take that will begin having effects on your trading immediately is making a trading plan. Trading without a trading plan is like wandering around in the jungle without a map. A trading plan is what every professional trader uses to keep them on track and making consistently good trading decisions.  The trading plan is what keeps them on track and in-line with their trading strategy. This is what ensures they stay consistent and trading the same way every time.

The trading plan is what keeps them on track and in-line with their trading strategy. This is what ensures they stay consistent and trading the same way every time.

Your trading plan needs to be a detailed check-list of your trading method. Like everything in your Forex trading business you are only going to get out as much as you put in and if you don’t want to put in the work and make a detail trading plan and check-list, there is plenty of traders right around the world who will. You should be able to get your trading plan and check list and give it to another trader and they should be then be able to enter the market and identify, enter, place stop and manage trades including working out money management. This is how detailed your plan should be.

Writing the plan is the easy part. The part that humans find incredibly hard because of their nature is following it. The reason professional traders are professionals are because they are super strict individuals. It is no fluke. They would not be professional traders otherwise or they would not be for long. The one trait that all professional traders all have in common is discipline. The markets have no rules. The markets do not tell traders when to buy, when to sell, how much to trade, how much money to risk, how many times trade to place, what times to trade, what pairs or markets to trade, how many positions to trade etc. The only rules the traders have are the rules that the traders impose on themselves and this is why if a trader lacks discipline, even only very slightly they will have problems following their own rules, especially when there is money involved!

The challenge is set for you as a trader. Make your plan and your trading checklist. Make it detailed. Put in the work and the time. Be a professional and treat your trading like a business. This is not a game so make a business plan and then once your plan is made, follow it. Like I just said; there is no point going to the effort of writing the plan only not to follow it and one reason traders fail is because they simply fail to follow their own well written plans.

Professional Traders Have a Set Routine – Stop Trading on Your Mobile

A very common theme with new and amateur traders is hanging around their trading screens all day like bees to a honey pot; they watch their computers/mobiles/Ipads at every waking moment they can get away from work and or family.

Professional traders prefer to hunt their trades and have set trading times. Professionals realise that it is about quality of trades and not quantity and that there is an optimum time to trade each day that is during the UK and US sessions. This is  when the best volatility occurs and when the biggest traders are in the market. Rather than sit and stare at computer screens all day and get headaches, professional traders stalk their trades and then strike with strategic trades.

when the best volatility occurs and when the biggest traders are in the market. Rather than sit and stare at computer screens all day and get headaches, professional traders stalk their trades and then strike with strategic trades.

One of the biggest problems and it is growing bigger each day is mobile phone trading. Mobile phone trading would be fine if traders used it to just check orders on already placed trades because they were out and could not get to their work station, but they are using it as an extension of themselves and now traders are turning into 24/7 traders and never ever tuning off and traders are becoming fully blown addicts who cannot switch off. Traders now are becoming so hooked of having to know the price they simply have to have their phone with them and watching the price.

NEWS FLASH: The brokers did not make the mobile broking platforms because they are really good guys and they wanted to do the right thing for traders. They are smart and knew that if they built something that traders could use and trade on their phones, traders would trade more often and this would make the brokers money through spreads and commissions. Obviously it is working because traders can’t switch off!

Trade like a pro! Hunt and stalk your trades, not staring at a screen all day. Get in and place the trade and then get out. Only use the mobile for trading when you need it. Don’t watch and monitor every price and trade on it. Only ever use it if you have a trade open and you are out of the office and you need to manage a stop or a trade and you need to change orders. Be smart about it and not a Forex addict.

Recap

If you want to make a living from trading the Forex markets you don’t have to reinvent the wheel. You don’t have to go and make some fancy new system that no one has ever thought of before. You do need some characteristics that humans find very hard to manage that are discussed above. You need to work out your strategy and then perfect it. Once it is perfected, write it all down so that it is clearly defined into a rule set. Once you have a clearly defined rule set, follow the plan!

Once you have the plan, carry it out. Don’t hang around your computer trading away your life. Stalk your trades. If there is a trade to place, then place it and if not, then go and do something else. Go and spend time with your family or go to the gym. If you want help taking the next step in your trading check out the member’s lifetime price action course page. Or you can contact me with anything you need or any questions HERE.

Safe trading,

Johnathon

I can honestly say that this site is the best source of Forex trading knowledge I’ve experienced.

Thank you so much for what you’re doing.

I’m looking forward to new articles!

You’re the best.

Heya Lukasz,

Great to hear you are getting a lot out of our tutorials and Forex lessons! If you are enjoying what you have been reading then keep an eye out in about two hours time for our next article because I think you will especially like it!

Safe trading,

Johnathon

Forex Trading Is Simple If U Wait And Look At The Market Closely Every Week Even U Trade On Data Coming Out One Can Make Living With Forex A Successful Trader Will Not Trade All Day But Will Look At The Market When U Waiting If Having Basic Knowledge Of Fundamental And Technical Even Using Few Indicators Enough To Trade I Go For Few Confirm Trades And My Target Every Week To Put Out Small Or Huge Pips Using This Simple Strategy Wait And See Always There Is A Confirm Chance Which Will Bring You Good Profits While Multiple Trades Will Result To Loose Your Money Control Over Hunger And Fear Is A Major Factor While U Trading.

like always, perfect , Thanks your very much

So very true, I had the broker on the phone for a while and found myself having it open on my desk watch daily positions tick up and down. Not even intending to intefere with the trade, just watching it lol, scary! It is well and truly uninstalled now and life is much better.

Yea it can start to overtake everything in your life. I started to get to the point where my weekly golf game that was supposed to be to get away from the office was becoming more trading then when I was at the office because the of the damn phone! Phone trading it breeding a generation of addicts and brokers are loving it! Turn them off and get rid of them and only use when really needed.

Thanks Johno this article is incredible! I'll read it again tomorrow just so everything sinks in.

Thanks Jon. Really like all your work.

Thanks Johno another great article!