How You Can Adapt to High and Low Volatility Forex Markets

The markets are ever changing and with it the best traders are constantly re-evaluating their trading and adapting to ensure that they stay up with the changes and their trading edge stays profitable. In this article, I am going to look at some of the biggest changes in the Forex markets in recent times, how they affect you as a trader and how you need to prepare so that when the next changes come (and change is happening all the time), you will be able to continue profiting and being a success.

What is Volatility and Why is it so Important?

Volatility is super important to you as a trader because the more volatility there is in the Forex market, the more the price is moving and the more opportunity you have to make profit making trades. When volatility is low it means price is not moving as freely. The markets will tend to move into more ranges and start trading sideways when volatility is low.

For a trader to make money the one very simple principle they need is that price needs to go in the same direction for a sustained amount of time. For example; If trader Joe buys pair XYZ, to make money, he needs price to move higher to make a profit. It can become very hard to make a profit if volatility gets very low and price is making a lot of sideways moves, rather than sustained moves either higher or lower.

The reason why making profits in low volatility markets can be a lot harder than when price is moving freely is because when a trader enters their trade price is just as likely to go higher for a little while, then grind back lower, then back a little higher and then back lower etc.

These types of markets, where volatility is low are tricky for traders because even when they get the direction correct, they can still lose the trade by being stopped out with price first trading sideways and taking out their stop before slowing grinding in their direction.

Volatility at All Time Lows

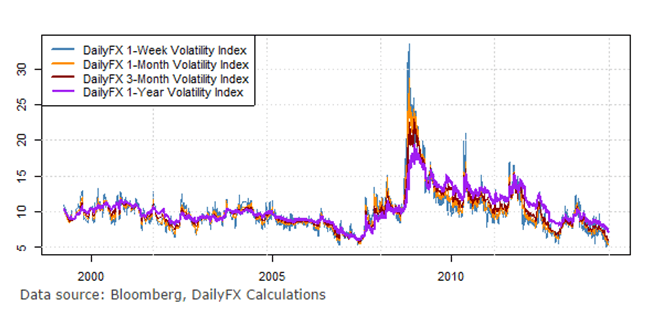

At the moment volatility levels have hit close to all time lows in the Forex markets. The days of 2009 where price was making large and volatile moves on every pair nearly every day are gone for the time being at least, but they could be back in the blink of an eye.

It can often be world events that ratchets up the market volatility levels because this can cause great unease and tension, but in 2014 there have been an endless supply of world events to get the markets unsure and potentially moving such as the Russia/Ukraine standoff, the fighting in the Middle east and the conflict of Israel/Hamas to only name a few.

On the flip side to the Forex markets; the overall equities markets have been flying higher in most parts of the world, with the S+P 500 and Dow Jones continually going on to post fresh all time highs. If however, at any stage these markets start to falter, it could potentially see volatility come back into the Forex market and in particular the USD for a sustained period of time.

The chart below from Dailyfx.com details the Forex volatility levels showing that price has now dipped down to the lows that have not been seen since 2006.

What Should Price Action Traders Do?

Although there have been a lot of whispers of late about the near record low volatility levels coming to an end soon such as Armada markets putting out this press release on Aug 21 2014, what is often the case is that low volatility levels create more low volatility levels and when the market is buzzing with high volatility levels it trades off of itself and more high volatility will follow. Accordingly until the low levels are snapped it pays to trade what the markets are showing and make changes and adapt accordingly as the market changes.

The lower levels of volatility are starting to bite the Forex trading industry and it is not just at the retail trader level that changes are going to have to be made. Just like you and I have to continue changing our trading and adapting to the markets, the big guys also feel it when the market slows just as Danske Bank A/S Chief Executive Officer Thomas Borgen discussed in this recent Bloomberg article online.

Low volatility markets still produce great quality trades for those traders ready and prepared. These markets just like all others, will redistribute the wealth to the traders who are educated and ready to pounce when the high probability trades form. Traders need to be mindful that they need to be always changing and adapting with the different market types. Knowing that the market is going through a slower than normal period is extremely useful because you can tailor how you go about your trading and the things you may change.

The best thing you can do during a period of low market volatility;

1: Add other markets and pairs to the watch lists

2: Add different higher time frames

3: Learn to become profitable on smaller time frames to pick up a extra potential trades

4: Use back testing during the slow periods to practice trading price action trading strategy

When adding other markets to your watch lists you need to make sure that the markets meet a few basic criteria. You don’t want to be trading other markets that are putting you at such a disadvantage before you start that it is not worth trading.

You need to make sure that the trading costs, the spreads & commissions if there are any are acceptable before making any trades. You also need to check the liquidity and volatility of the new market because you don’t want to be leaving one slow market to be trading another market that is going nowhere. The other major factor to watch out for is you don’t want to be trading markets with gaps in the charts everywhere. These are all major considerations when looking at new pairs or markets to add to your trading.

When thinking about adding extra time frames, a lot of traders trade on the MT4 platform and that has set time frames. These traders could think about adding other time frames, such as the 2hr, 6hr, 8hr or even 12hr charts to their watch lists. I have a tutorial on how traders can make any time frame candle they want on MT4 here: Changing MT4 Candle Time Frames.

Moving down to smaller time frames is tricky because traders need to first have experience and be proven profitable on the higher time frames before they can do this successfully. As I discussed in the recent trading lesson here: Trading Daily Chart Price Action Down to Intraday Time Frames moving down to the smaller time frames can open up a whole lot more trading opportunity for the price action trader who knows what they are doing, but this has to be done the correct way.

Using the Forex Tester 2 Back Testing Software can be a fantastic way to perfect your method and trading edge when the market is not pumping out the trades or you are taking a quick break. Just like a golfer goes to the driving range or practices their putts and chips, using the Forex Tester 2 is no different for the price action trader and it can keep you switched on and at the top of your game for when the next great setup comes along.

Will You Be Prepared For What Happens Next?

The market is ever changing. I don’t know what is going to happen next and to make money you don’t have to know what is going to happen next.

As a price action trader it is not your job to either know or try to guess what is going to happen. What is your job however, is to ensure that you are well educated and have a profitable trading edge and that you continually evolve with the markets over time using your trading journal and Forex trading plan so that you can stay on top of the markets.

Make sure that during market slower periods or periods of market change you stay positive and upbeat. There will always be change occurring in the markets, but remember; as long as trades are able to be made, the wealth will be redistributed to those traders who are well educated and ready to pounce when the high probability trades form.

You need to make sure that the trader who is well prepared and ready to take full advantage is you and that you are ready and focused when that next opportunity comes around.

Safe trading,

Johnathon

Awesome post Johno – Yeah, if you are watching around 40+ pairs and 5-6 timeframes and trading from solid S/R areas then finding a few trades per month is very doable. Even more, but only filtering the very very best ones. Even in the past week I have had 3 trades, all break even though.. gotta love break evens/protecting capital…hehe

Yes – Nice post David.

You are really talking like Jonathon Fox …..!

Hi Johnathon,

Another wonderful article. We know about the anticipated lulls in the market, depending on the various major “summer breaks” taken during the year. But having a good grasp of general volatility is another crucial skill to possess.

You have a wonderful way of distilling these topics down to make then easier to understand. Thanks!

Thanks Steve!

Yes, the summer break at this time of the year is always slower, but the markets over the last couple of months and years have gradually been getting slower. I don’t see this as a major problem for retail traders as long as they are aware of it and they factor it into their trading and they are not forcing or over trading..

Johnathon

Thanks for the follow-up Jonathon. On a related note, here’s an interesting article from BP: http://www.babypips.com/blogs/espipionage/forex-metrics-20140910.html

On an unrelated note, I have tried to contact you a couple of times regarding your PA course, via the form here, but I am not sure that my messages have made it through (often times I get blocked via my corporate network).

Would you be able to see if any of the messages have arrived?

Thanks!

Steve

Heya Steve,

firstly; I have no emails from you at all, otherwise I would have replied. The only correspondence I can see from you is that I can see you have signed up to receive the notifications to your email when the latest articles or videos are released.

To comment on the other article; a lot of other blogs and commentary are looking from the view point of picking the exact point the market turns etc What I am more looking at in this article is that not that the volatility has all of a sudden dropped off a cliff, but that it has been getting slower and slower since about 2009. This is not something that has all of a sudden just happened this year and I am guessing it won’t just spring back into life in one week either because as I discuss in the lesson; markets feed of themselves i,e fear breeds fear and greed more greed.

Safe trading,

Johnathon