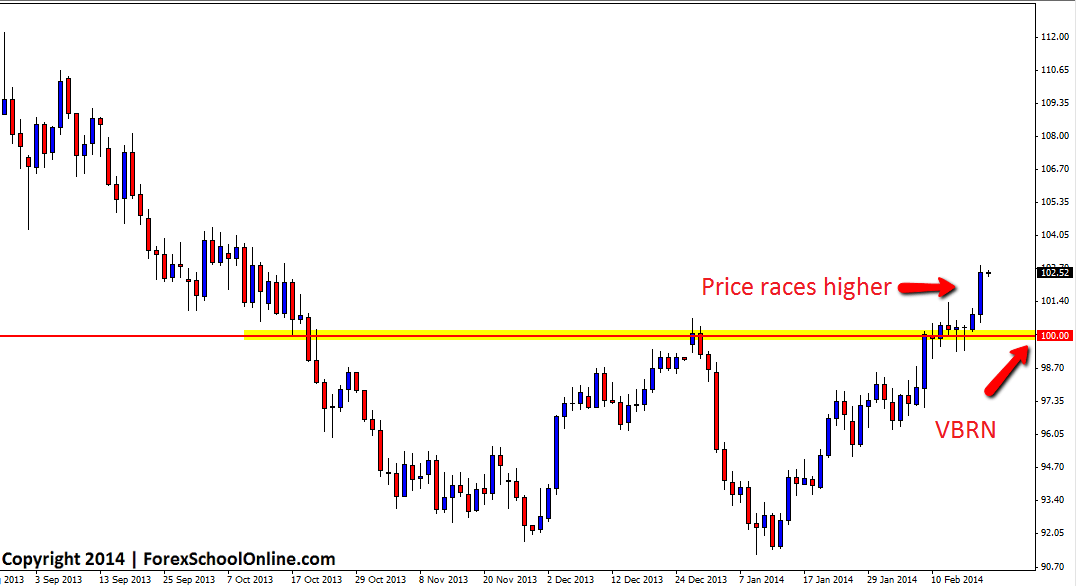

WTI/USD (Oil v USD) has smashed higher and through the recent resistance that was also the Very Big Round Number (VBRN) of 100.00 and is now on the march higher on the daily price action chart. After creating a double bottom in the middle of January, price has reversed steeply and this has seen price climb from a low of just above 91.00 to now be testing 103.00 at the time of writing, which is a very large and aggressive climb in just under a month.

The best play in these markets and all similar markets when price is moving so aggressively is not to try and fight these strong moves. Often the novice trader will look to pick the top and bottom of the strong move. What this means is they will see a strong move and then look to trade directly against it. In this market, that would mean seeing this strong move higher and then taking a short trade.

Whilst price does have to move back and rotate back lower at some stage, it is a very low probability game trying to pick tops and bottoms because for that one time you do get it right and price does move back in your favor, there will be four of five other times that price continues with the strong momentum and runs straight over your trade. Traders are far better off looking to trade with the strong momentum. To do this they can either look to trade on the same time frame charts or move to the intraday charts and look for price to rotate back into value as I discuss in this lesson here: Making High Probability Price Action Trades From Value Areas. Once price rotates back into value, then traders can look for solid price action triggers to get them into a high probability trade.

Oil Daily Chart

Leave a Reply