The market has made some large moves in the last 24 hours on a lot of the major daily Forex pairs. A lot of pairs have broken out of the ranges or tight wind up periods they were trading in and with this breaking out it opens up a lot of potential trading opportunities for either continuation trades or “Breakout – Re-test” trading.

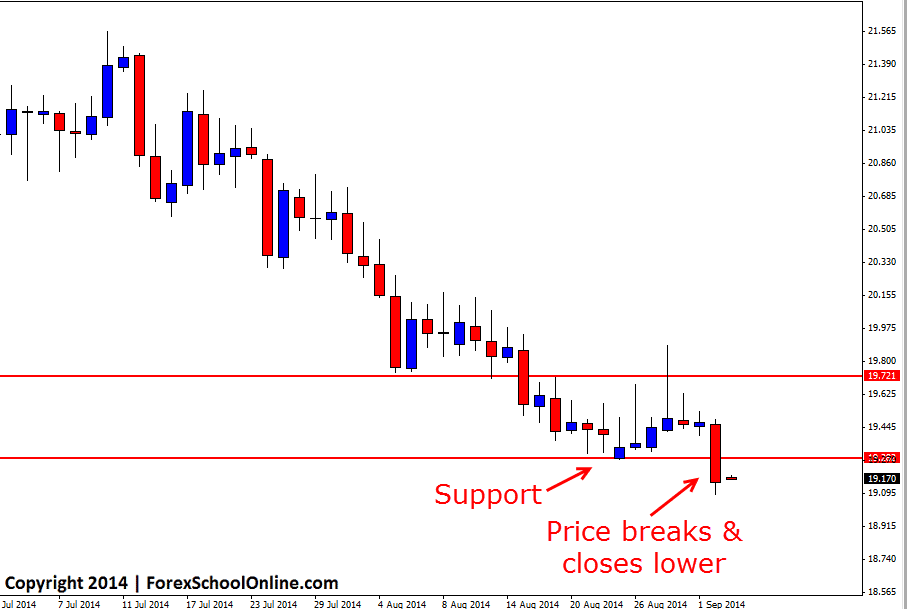

Once such market that made a large move in the last 24 hours and broke a key level was Silver. Price in the Silver market smashed lower and through the recent swing lows and as the daily chart below shows; price made a large move lower but importantly closed below the swing low support area.

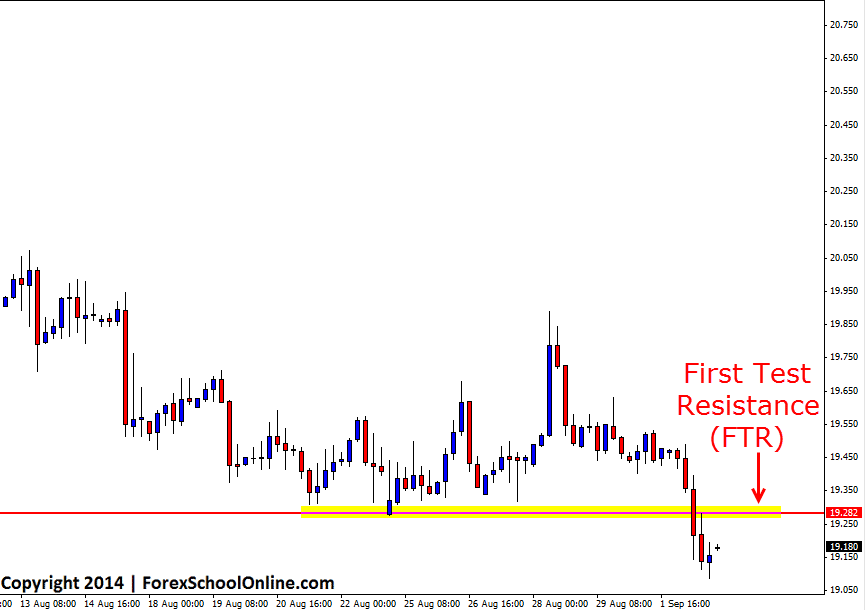

Traders now looking to trade with this new move lower could target the old swing low or old support area to act as a price flip area and for the old support to act as a new resistance level. Looking to take short trades at this potential price flip resistance area would be looking to take trades at the First Test of Resistance and as I discuss in the recent trading lesson Taking High Probability Price Action Setups at the First test Support/Resistance, taking trades at these first test areas is a high probability way of entering price action setups.

Traders would have to target potential setups on their intraday charts such as the 4hr or 1hr charts, but by doing this traders would still be trading from a key daily resistance level and with the recent momentum. For any potential short trades lower there would need to be a high probability bearish price action trigger signal such as the trigger signals taught in the Forex School Online Courses.

Silver Daily Chart

Silver 4hr Chart

Related Forex Trading Education

– Trade Like a Forex Sniper From Kill Zones & Price Flip Zones

Leave a Reply