What is a Market Flash Crash?

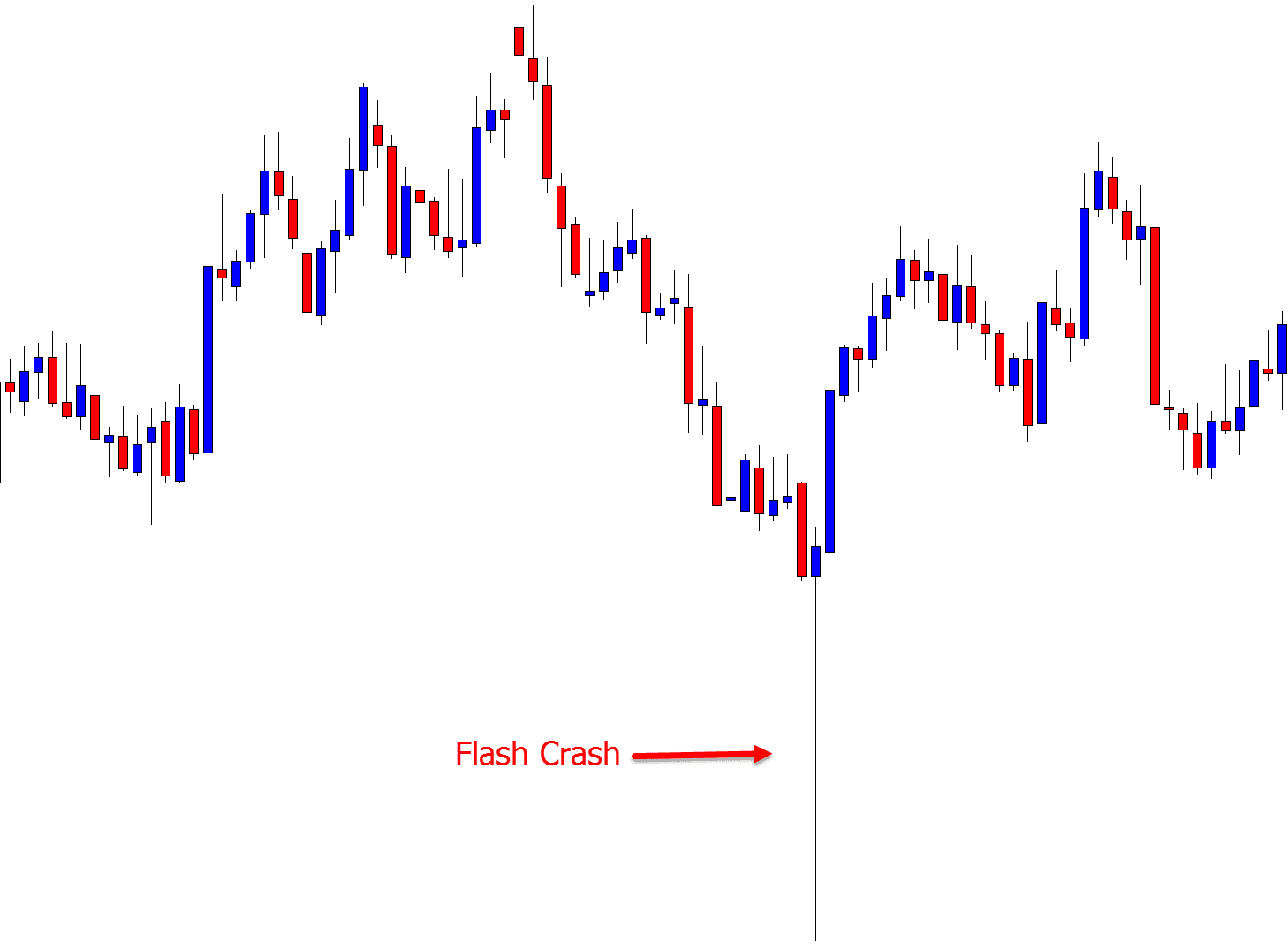

A market flash crash is a spectacular and aggressive sell off in prices of an asset or security.

Market flash crashes are quick and can often happen in seconds to minutes and will often be followed by a similarly quick rebound in prices.

There have been some well-known and famous flash crashes in recent times in stock markets, Forex markets and cryptocurrencies.

What Causes a Flash Crash?

There are a wide variety of reasons why the markets experience quick flash crashes. With program trading and computer software being used to trade the markets more than ever, a flash crash can happen at any time if there is a glitch.

Some of the other major causes of a flash crash are;

Fat Finger and Human Error

Have you ever tried to search for something on Google and hit the wrong key?

This is basically what a ‘fat finger’ error is. For example; instead of one million shares, a trader tries to buy one billion. Big difference.

Whilst these errors are often not serious and in today’s age there are many fail-safes in place, they have in the past caused some gigantic accidental orders to be passed through.

High Frequency Trading

With high frequency trading becoming more and more common in the financial market, errors caused by computers and high frequency trading are also becoming more common.

There will always be a risk attached to letting a computer run a strategy where it is making a high frequency of trades in an extremely small amount of time.

If something is to glitch or experience an error, then the program could sell off positions in the market extremely quickly.

Computer or Software Glitching

As with high frequency trading, any corruption in the data could cause a glitch and a flash crash.

This has happened in the past with automated trading systems and will likely happen again.

Recent Examples of a Flash Crash

Flash Crash 2010

On May 6, 2010 the Dow Jones was slashed by more than 1,000 points in minutes in a flash crash.

Although a large majority of this crash was clawed back by the day’s end, initially over one trillion dollars was erased from the markets.

The cause of the 2015 flash crash turned out to be a futures trader named Navinder Sarao who attempted to spoof the market by rapidly buying and selling futures contracts through the CME – Chicago Mercantile Exchange

S&P 500 Flash Crash 2015

On August 24, 2015 the S&P 500 opened and crashed 5% within 15 minutes.

As with a lot of flash crashes, these huge losses were mostly regained through the trading session, but surprisingly at the end of the session prices sold off lower again to finish with a 3.6% decline for the day.

The main reasons for the 2015 flash crash were a bearish sentiment leading into the 24th of August and large selling in other markets.

At the start of the week (before the US markets opened) the Chinese Shanghai Composite experienced a slide of 8.5%. This in turn fueled the bearish sentiment in the US with many cancelling any orders to buy before the market opened and instead looked to sell.

With a very thin market and most looking to sell, the market crashed.

Ethereum Flash Crash 2017

In 2017 Ethereum experienced an incredible flash crash.

Whilst trading at a price of $317.81 price was crunched to as low as 10 cents in minutes. Price has since regained these losses. This flash crash was originally thought to be market manipulation.

After investigations into the cause of the gigantic crash, it was proven to be a multi million dollar sell order that triggered an avalanche of stop loss orders to be hit. As price capitulated, traders who were trading on margin were also taken out seeing the price fall even more quickly.

Flash Crash 2018

In February of 2018 the Dow Jones crashed almost 1,600 points, ending the day down 1,179 points, the biggest session points loss in its history.

Whilst that is the biggest points collapse in the Dow’s history, it is far from the biggest sell off it has seen in percentage and one of the reasons that price had the 2018 flash crash.

This crash does not even register inside the top 100 largest daily falls for percentage.

Leading up to the flash crash the market had been on fire making record high after record high. As no market goes higher or lower forever, a correction was always due at some point.

Aussie Dollar Flash Crash 2019

In January of 2019 the AUDUSD and USDJPY experienced a sharp flash crash with more than 4% wiped from their prices in moments.

The Aussie Dollar collapsed more than three percent against the US Dollar and also experienced a large fall against the Yen.

Whilst this crash was severe, so was the correction with prices quickly snapping back to regain their losses creating a huge spike.

Summary

In this post just a few recent examples of flash crashes are listed, but there are a lot more.

When we take into account human trading errors and the invention and popularization of computers and algorithmic trading, there is a high chance that another flash crash will be just around the corner.

Make sure you understand the markets you are trading, you use a broker you trust, always trade with a stop loss and are prepared for what the market may throw at you.