The reason trading with price action can be profitable is because whilst the Forex market is random, the humans who trade it are not. The traders and organisations who participate in the market operate out of habit. Given similar situations, humans behave the same way because of their habits.

It is these habits that create the outcomes. This is the reason that the same patterns tend to repeat over and over again in the markets and also the reason that a lot of traders will tend to get stopped out time and time again.

Quite often in our educational articles here at Forex School Online we discuss the need for entering trades from value areas. We have discussed how to look for value in the market, but a lot of traders still email regularly not fully understanding why we look to enter from value areas, and why it is so important.

I hope by the end of this article you can spot value areas in the market and make higher probability trades. For this article we will refer to unprofitable traders as “retail traders”.

Stop Entering When the Pro’s are Taking Profit

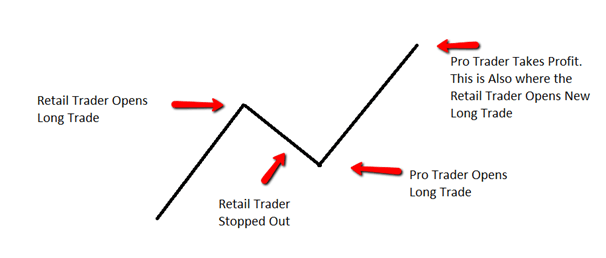

The chart below shows a very common pattern in the Forex market. Take a moment to study this chart and note the key differences of where the professional enters and where the retail trader enters. On the left you will notice the retail trader buys and takes a long trade when price is at an extreme high.

Soon after this the retail trader is stopped out as price moves lower from this high. At around the same time the retail trader is stopped out, the professional traders are entering the market in trades to get long. When price moves higher the professional trader will cover their long trades and start taking profit.

They professional traders will begin to leave the market after making solid profits. At the same time, the professional traders are leaving the market, the retail traders are starting to get long again.

The obvious difference in this graph above is from where each trader enters their long trades. Whilst the professional trader waits for price to retrace back lower, the retail trader gets long from the extreme high.

The graph above highlights why entering trades at extreme highs or lows without any retracement can be super dangerous. When traders enter from these areas that are at extreme highs or lows, the big guys are taking profit and leaving the market. Whilst the big guys are leaving and taking all their money out of the market, the retail traders are getting in.

Obviously getting into the market when the big guys are getting out is not a smart plan. The best way to avoid this scenario is to enter from value areas in the market or “Hot Zones”.

Taking Trades from Value Areas

So now we know where not to enter, the next question is where should a trader enter? The best entries are found from value areas. These value areas are where the professionals look to enter their trades.

How to Spot Value Areas?

Basically value areas are retracements of price from an extreme high or low in to support or resistance. Rather than entering from the very high or low of the market, value can be found when price rotates. Price never moves in straight lines and has to move both higher and lower no matter how strong a trend is.

A common saying for this scenario is; buy any weakness and sell any strength. What this mean is if price moves lower (weakness) from an extreme high then price can be bought from a value area, and if price moves higher (strength) from an extreme low, price can be sold from a value area.

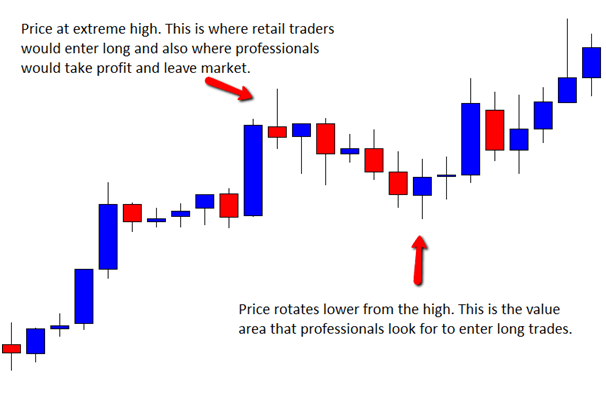

Below I have attached two price charts. The first chart shows price moving from an extreme high back lower. This is price showing weakness and moving in to value for a possible buy entry.

Notice if the trader had of entered a long trade from the high they would have been stopped. If they had instead bought a long trade when price showed weakness and moved back lower they would be entering around the same time professionals are entering from a value area.

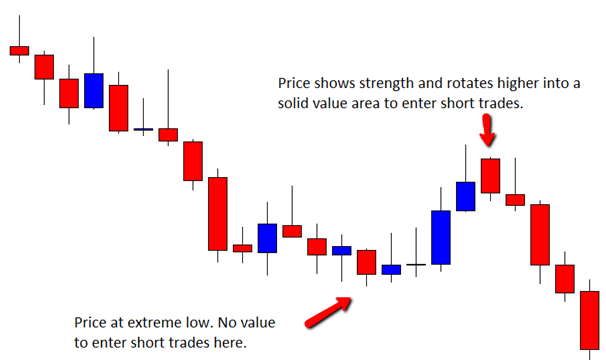

The second charts shows the same scenario, but with a short trade to sell. Price moves from the extreme low back higher. This move higher is known as a retracement back into value.

Trading “Reversal” Signals from Support and Resistance ‘Value’ Areas

After a trader understands why it is so important to enter reversal triggers from value areas, and how to identify them; they have to add a few other key ingredients to find high probability trades.

The next two ingredients to be added after the value area are;

- The price action signal used to trade

- Entering from support and resistance

The best trades are when there are many factors all pointing in the same direction. Obviously the more factors you can add as confluence for your trades, the higher chance they will have of working out.

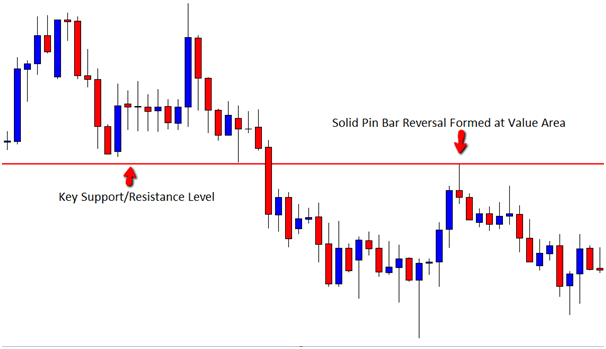

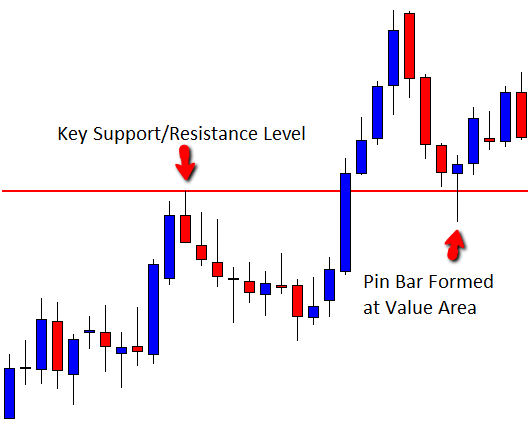

Below I have attached two examples of adding both key price action signals, solid support or resistance levels and formed at value areas in the market. Both these setups were high probability setups due to the many factors they had in their favor.

Lesson Recap

In life the only way to make money is to buy low and sell high or buy cheap and sell expensive. If you want to make money in Forex this same rule applies.

A very common trading saying that can get traders into trouble is “The trend is your friend”. Whilst this saying is very true, many traders don’t understand how to successfully trade with the trend and also enter from value.

I hope this article has helped you understand how you can to avoid entering the market when the big guys are leaving.

Trading with the trend can be the most profitable type of trading and even more so when trades are entered from value areas. In the members only price action courses we discuss many price action setups that traders can use to ensure they are entering the market at the correct times trading both with and against the trend.

If you have any questions just enter them in the comments box below.

Safe trading,

Johnathon

Let me know all your thoughts, feedback or any ideas in the comments section below. I love hearing from you!

Thanks Johnathan!

To me, this is the holy grail, and a strategy that educators have touched on before, but never, ever, elaborated on, or emphasised. It was just skimmed over. I now see waiting for a retrace as essential, in probably most cases, and certainly for me as a beginner. The secret is revealed! lol. Great stuff.

Greg

Heya Greg,

it is vital to enter at value swing areas because it is where the major proportion of the market are entering rather than exiting, whereas at the extreme highs and lows where a lot of retail traders try and pick tops and bottoms is where the market will often turn around after the big guys have just made a big profit and leave the retail traders trying to pick the highs and lows trying to cut their losses.

Johnathon

(y)

thank you value area.

fantastic superb

Hello Sir Johnathan

Great article

A well thought out article and easy to understand, thank you.

Good stuff bro easy to understand ,simplicity always is

Now I know where I have been going wrong – Thank you

Johnathon, Im sure this is the usual question…..Which is the best time frame to use for a daily trader ??

Thnankx Jonathon show me the way…..

Mantaf…

ngangge bhsa sunda we,,

sempurna.. sayang gak tahu artinya..pake bhs Inggris.. maklum orang kampung… hehehe..

One of the best secret of forex trading, I enjoyed it. thanks.

ha! veryyy…nice

great article as usual

beng har mren bos,,,,, mun,,, target mmah,,,,

nice