Finding the best forex brokers is one of the hardest tasks for traders. The top brokers offer superior trading features and tools to their customers, making it easy for them to trade currencies and make money. With so many brokers available, we will help you choose the best forex brokers currently operating in the market.

4

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

€250

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

-

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

No

FCA

No

CySEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

-

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

1.3 pips

Leverage max

100:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECCFTCNFA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.5

EUR/USD

1.3

EUR/JPY

1.6

EUR/CHF

3.1

GBP/USD

1.9

GBP/JPY

3.6

GBP/CHF

4.2

USD/JPY

1.5

USD/CHF

2.0

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

1.3 pips

Regulation

No

FCA

No

CySEC

No

ASIC

Yes

CFTC

Yes

NFA

No

BAFIN

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Min.Deposit

€0

Spread min.

0.0 pips

Leverage max

2:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

0.0

EUR/USD

0.0

EUR/JPY

0.0

EUR/CHF

0.0

GBP/USD

0.0

GBP/JPY

0.0

GBP/CHF

0.0

USD/JPY

0.0

USD/CHF

0.0

CHF/JPY

0.0

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

No

FCA

No

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

Trading leveraged products such as CFDs involves substantial risk of loss and may not be suitable for all investors. 83% of retail investor accounts lose money when trading CFDs with this provider. Trading such products is risky and you may lose all of your invested capital.

Compare Forex Brokers Fees:

Use our side-by-side comparison table to compare Forex broker accounts, spreads and fees.

Recommended

8cap

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Forex.com

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

VantageFX

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

AvaTrade

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Top 7 Best forex brokers in 2020

Our top 7 brokers have been decided after intensive research to help you choose according to your needs.

- OctaFx is the best forex broker for clients.

- eToro is our best forex broker in 2020 because they were the first to implement social trading, and have a vast array of assets.

- Plus500 is known as the best CFD provider and they have low trading fees.

- 24option has four different accounts for different needs.

- AvaTrade offers islamic accounts and has many different trading techniques.

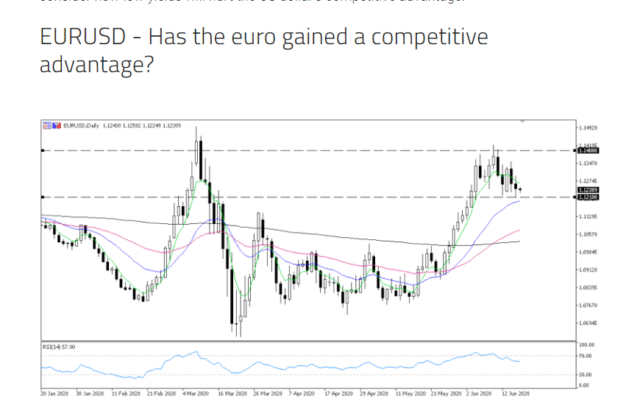

- Forex.com is the best forex broker for US clients, and they have many base currencies.

- Libertex has high maximum leverage and no rollover fees.

Recommended

8cap

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Forex.com

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

VantageFX

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

AvaTrade

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

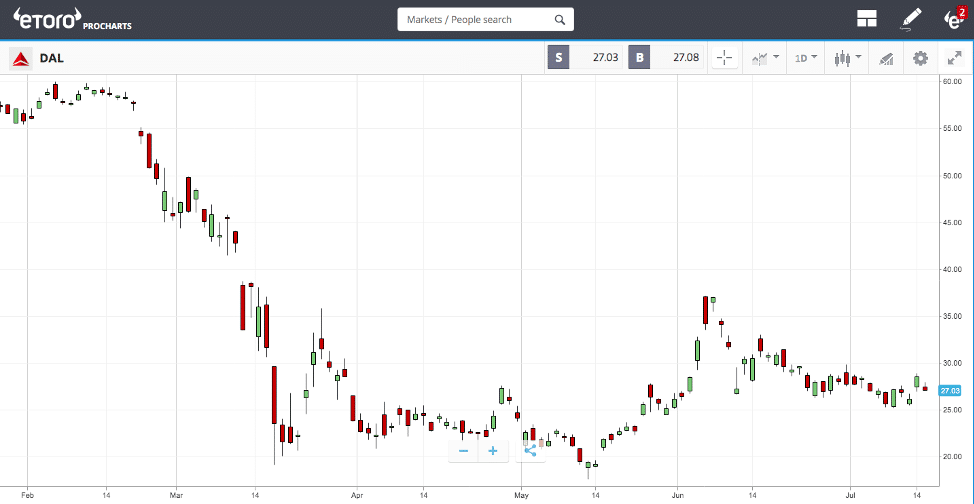

1. eToro – Best Broker for Copy Trading

eToro is one of the largest forex trading brokers in the world. It is regarded as perhaps the best social and copy trading platform currently operating. They also offer in-platform social sentiment data and automated client and portfolio copy trading. When trading with eToro, professionals enjoy negative balance protection. It is a regulated broker that is licensed by the Cyprus Securities & Exchange Commission (CySEC), and it complies with the European Securities and Markets Authority (ESMA) regulations. The broker is also regulated by FCA in the U.K. They have low commissions and trading fees and have a wide array of other assets, including cryptocurrencies and equities.

Pros

- Copy and social trading platform

- Excellent charting tools

- A wide array of other assets

- Regulated by two agencies

Cons

- No streaming news

- Poor customization

eToro Fees:

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | $5 |

| Conversion Fee | From 50 pips up to 2500 pips, depending on the instrument |

| Inactivity Fee | $10 monthly after 12 months of inactivity |

| Overnight Fee | Yes. On currencies, commodities and indices. |

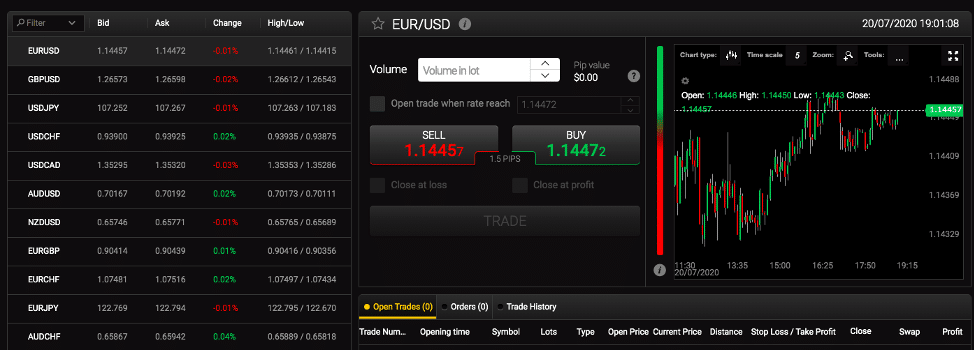

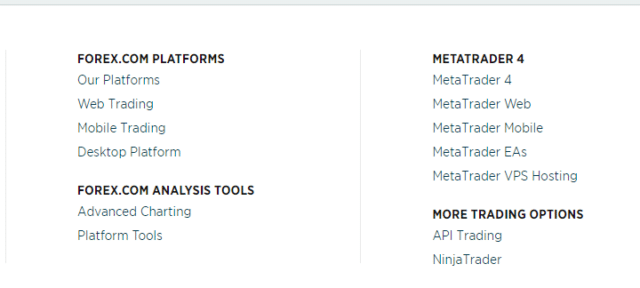

2. Forex.com – Best US Forex Broker

Forex.com has established itself as one of the leading brokers in the world, especially for U.S traders. As a leading broker, Forex.com offers spreads as low as 0.2 on commissions, offering people access to over 80 currency pairs. The MT4 platform on Forex.com comes with 20 free, easy to install EAs and custom indicators. By opening an account with forex.com, you will get access to the full suite of downloadable, web, and mobile apps.

Pros

- Low FX fees

- Numerous trading pairs

- A wide range of research tools

- Offers MT4 and other trading platforms

Cons

- Limited product portfolio

- High stock CFD fees

3. Pepperstone – Best MT4 Broker

This Australian-based broker is one of the top FX brokers in the world. It allows traders all over the world to trade CFDs on forex, gold, indices, equities, and more. One of the strongest features of Pepperstone is the availability of various trading platforms. You can choose any of the MT4, MT5, cTrader, and social trading platforms made available to the traders. They have a comprehensive education and analysis platform that covers market news, market analysis, economic calendar, guides, webinars, and more. Pepperstone has very narrow spreads and charges low commissions per trade. It is a global platform that is available to traders in virtually all parts of the world.

Pepperstone Fees:

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Conversion Fee | From 0.4 pips. |

| Inactivity Fee | No |

| Overnight Fee | Yes. It will depend on the trade size, market price and overnight interest. |

Pros

- It is regulated by ASIC

- Offers various trading platforms including social trading

- Low FX, equity, and indices fees

- Excellent customer service

- Free deposit and withdrawal

Cons

- No investor protection for non-EU traders

- No fundamental data analysis

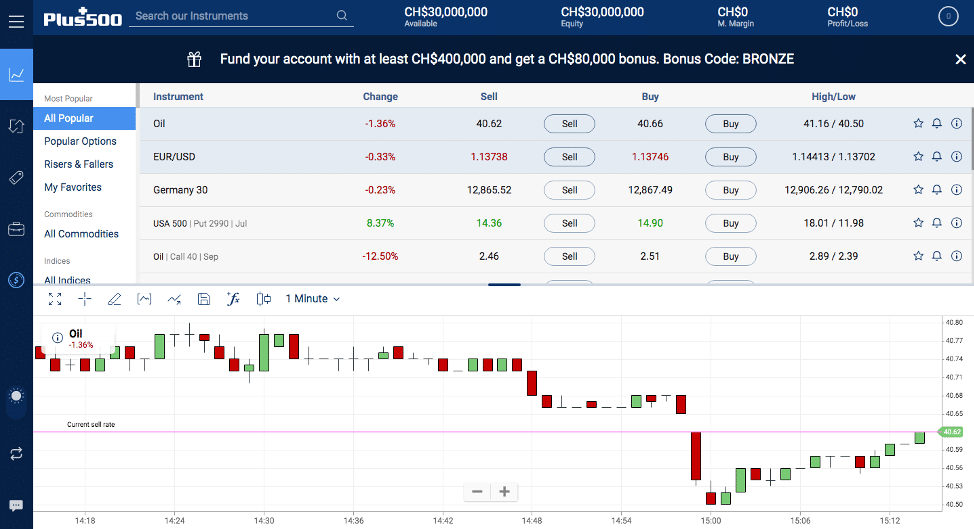

4. Plus500

Plus500 has become a global leader in the forex brokerage industries. It processes transactions worth billions of dollars to institutional and retail traders globally. The fact that it is listed on the London Stock Exchange boosts its reputation as one of the best brokers in the world. Traders can trade CFDs on shares, indices, forex, and cryptocurrencies. They offer tight spreads and zero commissions on all trades. However, Plus500 doesn’t offer MT4 or MT5 trading platforms. It only provides access to its assets via the WebTrader platform. The WebTrader platform is available to users via desktop and mobile (iPhone and Android).

Pros

- Easy to use platform

- Zero trading commissions

- Listed on London Stock Exchange and regulated by ASIC and FCA

- Offer various other assets

- Free deposit and withdrawals

Cons

- Minimal research tools

- Little educational materials

- No MetaTrader platforms

Fees on the Plus500 Platform

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Conversion Fee | Up to 0,5% of the trader’s realised profit and loss. |

| Inactivity Fee | $10 monthly after 3 months of inactivity |

| Overnight Fee | Yes. It will depend on the instrument. |

5. 24option – Good MT4 Broker Option

This Cyprus based platform CFDs and Forex trading regulated by the Cyprus Securities and Exchange Solutions. There is no more information on the company available on their website. It is not stated when they were launched, who the leaders are, the amount of clients they have or countries they are in nor do they specify how many assets they work with.

You can access cryptos such as Bitcoin, Litecoin, Dash, Ethereum, and Ripple. They use the MetaTrader 4 platform with their charting tools and real time market data.

24option offers 4 different accounts. Each one has a minimum deposit. The basic account will ask for $250, the gold account for at least $25,000, for the platinum account you must deposit a minimum of 100,000, and the VIP account asks for at least $250,000. You can also access a demo account.

Live accounts must be verified with an ID or passport and a bill or bank statement. The verification process takes from 1 to 3 days. Once you have opened a live account you can deposit using credit card, electronic payment or wetransfer. These methods are the same for withdrawals.

They offer live chat, phone, email and an FAQ section as a way to contact customer service or answer your doubts. They have a good educational section with eBooks and live webinars each month.

Fees on the 24option Platform

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | Yes. It will depend on your account type. |

| Conversion Fee | From 0.2 pips |

| Inactivity Fee | Yes. The amount is not specified on the FAQ section. |

| Overnight Fee | Yes. It will depend on the instrument. |

24option Pros and Cons

Pros

- They have different accounts for different needs and clients.

- Free deposit.

- A good educational section.

Cons

- Verification process to open an account is long.

- Inactivity fee.

- The information available on the website is not complete as other brokers.

5. IG Markets

IG Markets is a UK-based regulated broker that processes billions of dollars in transactions daily. The broker has one of the easiest trading platforms in the world, offering users access to MT4 and WebTrader platforms. On IG Markets, you can trade numerous assets like FX, indices, shares CFDs, commodities, cryptocurrencies, and more. The other markets include weekend trading, volatility trading, and Knock-Outs trading. IG Markets provides other features such as news and trade ideas, strategy and planning, economic calendar, trading signals and alerts, and more.

Pros

- Regulated broker

- Offers FX, equities, cryptos, indices, and commodities trading

- Excellent trading platforms

- No withdrawal fees

- Low trading fees

Cons

- Inactivity fees after two years

- High stock CFD fees

6. AvaTrade

AvaTrade is an Irish broker that was launched in 2006. They are regulated by 7 jurisdictions which has allowed them to reach the over 200 thousand clients they have today including the UK, Singapore, Australia,and the Middle East, but not the US or Belgium.

AvaTrade offers a variety of assets and it is one of the best brokers for forex trading because it has 50 currency pairs that range from major, minor and exotic. You can also trade options, ETFs, bonds and commodities such as soybeans, gold, silver, platinum, corn, and many more.

Other assets clients have access to include margin trading, Vanilla Options, and cryptocurrency such as Bitcoin, Litecoin, Ripple, EOS, and more. You can use a variety of trading techniques such as scalping, hedging, autotrading, mirror trading and short selling.

AvaTrade has 30 different languages to fit their client’s needs, and allow them to trade on desktop, browser or download their app for iOS or Android. The maximum leverage will depend on the asset and location, but it is at 400:1, and for EU traders 30:1.

AvaTrade offers many different account types, and the availability will vary depending on the jurisdictions. The options are retail, professional, options, spread betting, and standard. A demo account, and Islamic accounts are also a possibility.

AvaTrade Fee Table

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Conversion Fee | Yes. It will depend on the assets. |

| Inactivity Fee | Yes. 50 pero quarter for USD, EUR and GBP. |

| Overnight Fee | Yes. It will depend on the trade size, market price and overnight interest. |

AvaTrade Pros and Cons

Pros

- They allow many different trading techniques.

- Many assets.

- 30 different languages.

- They offer Islamic accounts.

Cons

- Minimum deposits.

- Inactivity and overnight fees.

- US and Belgian customers are not accepted.

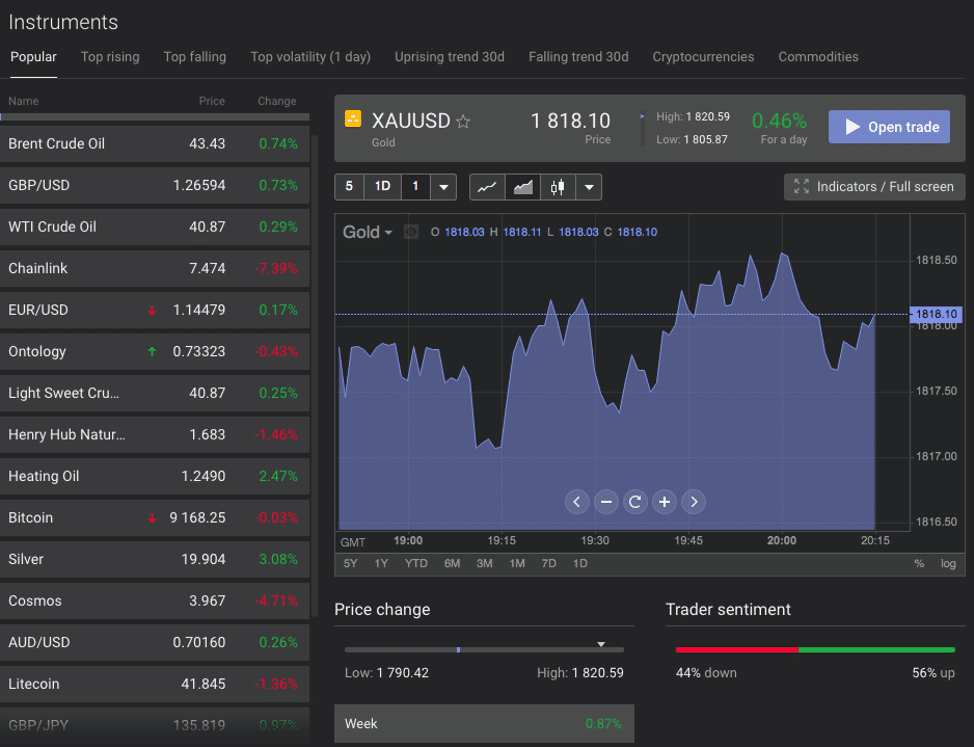

6. LiberTex

LiberTex is another of the top forex brokers on our list. They have been around since 1997, have over 2.2 million customers around the world, and have been granted 30 international awards.

This broker is regulated by Cyprus Securities and Exchange Commission (CySEC) and the South African Financial Sector Conduct. Some of the customers that are not accepted are USA, Japan, Brazil and the European Union.

LiberTex offers assets such as stocks, forex, ETFs, indices, cryptocurrencies and commodities such as oil, gas, wheat, soybeans, coffee, palladium, silver, gold, and many more. This broker has over 80 currency pairs including majors, minors and exotics.

They have a good variety of cryptos such as the well known Bitcoin, Litecoin, Ethereum, XRP and less common for some, such as Tezos, Cosmos, Ontology, and Maker.

As for trading techniques, hedging and automated trading are allowed. The maximum leverage is 500:1. For major currency pairs it can go up to 30:1, and 20:1 is for minor pairs, major indices and gold. You can use a trailing stop for risk management.

The LiberTex website only offers six languages, but on the positive side it has a live chat, email and an FAQ section. You can sign up for a live account, and apply for the professional account or try out their demo account.

This broker offers three platforms. MetaTrader 4, MetaTrader 5 and their own platform called LiberTex.

LiberTex Fees

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | $1 for credit and debit cards |

| Conversion Fee | From 0.006%. |

| Inactivity Fee | $5 per month after 180 days to account with a balance that have less than $10,000. |

| Overnight Fee | No |

LiberTex Pros and Cons

Pros

- High maximum leverage.

- Different platform options.

- No swap over fees.

Cons

- They do not accept clients from the USA, Japan, Brazil and the European Union.

- No copy trading available.

- Only two account choices.

Forex broker Fees table

| Type of Fee | eToro | Plus 500 | AvaTrade | Forex.com | LiberTex | Pepper

Stone |

24option |

| Deposit Fee | Free | Free | Free | Free | Free | Free | Free |

| Withdrawal Fee | $5 | Free | Free | Free | $1 for credit and debit cards | Free | Yes. It will depend on your account type. |

| Conversion Fee | From 50 pips up to 2500 pips, depending on the instrument | Up to 0,5% of the trader’s realised profit and loss. | From 0.9 pips up to 700 on Forex depending on the pair. | Up to 0.5% | From 0.006%. | From 0.4 pips. | From 0.2 pips. |

| Inactivity Fee | $10 monthly after 12 months of inactivity | $10 monthly after 3 months of inactivity | Yes. 50 pero quarter for USD, EUR and GBP. | $15 per month after 12 month of inactivity. | $5 per month after 180 days to account with a balance that has less than $10,000. | No | Yes. The amount is not specified on the FAQ section. |

| Overnight Fee | Yes. On currencies, commodities and indices. | Yes. It will depend on the instrument. | Yes. It will depend on the trade size, market price and overnight interest. | Yes. After 5 pm ET, and it will depend on trade size, market price, and overnight interest. | No | Yes. It will depend on the trade size, market price and overnight interest. | Yes. It will depend on the instrument. |

Forex Broker Comparison

|

Features |

eToro | Plus 500 | 24 option | AvaTrade | Forex.com | Libertex | PepperStone |

| CopyTrading | Yes | No | No | Yes | No | No | Yes |

| Demo Account | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Social Trading | Yes | No | No | No | No | No | Yes |

| 24/7 customer support | Yes | Yes | No | No | No | No | No |

| Charting tools | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Desktop platform | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Web platform | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Cryptos | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Maximum leverage | It will depend on the size of each trade. | 1:30 | 500:1 | 400:1 depending on the location, and 1:30 for EU customers. | 30:1 for forex pairs. | 500:1 | 500:1 |

| API | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

How to Choose a Good Forex Broker?

There are certain trading features to look for when determining the quality of a broker. The features and technologies they offer to their clients have to resonate with your needs as a trader. Hence, here are some of the features to watch out for.

Low spreads

When looking for a forex broker, look at the spreads it offers. We recommend you choose a broker that offers the lowest or one of the lowest spreads. The spread is the charges placed on trades by the brokers, which is the difference between the bid and the ask price. The best brokers have low spreads, ensuring that their customers make a profit from their trades.

Trading platform

There is a wide range of trading platforms offered by brokers, and the best one depends on the trader. To choose a broker, you need to know the trading platforms they offer and see if it matches your trading preference. We have various trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader, and more. A good broker will give you various options and allow you to choose one, based on your trading preference. Note: the MetaTrader platforms offer a range of resources and tools, such as risk management, advanced charting, technical indicators, leverage, financial news and analysis, and market data.

Trading software

In addition to the trading platforms, you also need to check the software they provide. There is various software that eases the trading process. You can check the charting software such as AutoChartist, robot trading, market analysis software like Trading Central, signal notification services, and trading tools like currency converter, economic calendar, and more.

Security

This is a no brainer. The best characteristic of a broker is offering a high level of security. Since you would be handing over thousands of dollars and your private information to a broker, it is mandatory that they provide a high level of security to protect both your funds and data. To know the brokers that usually offer high-level security, look at their regulatory status. It is recommended that you choose a broker that is regulated in the country or countries it operates.

Transaction fees

You have to pay for your transactions, either as spreads or commissions. Make sure that you choose a broker that offers tight spreads and low commissions, depending on your trading preference. Review your trading needs and choose a broker that offers affordable transaction fees.

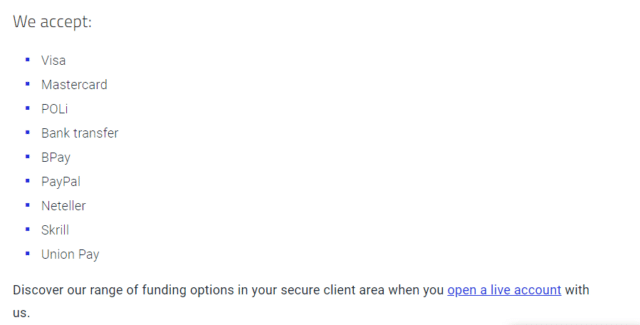

Payment methods

Choose brokers that offer excellent payment solutions, allowing you to deposit and withdraw your funds with zero stress. Brokers have no reason to make it difficult for traders to either deposit or withdraw their money. Hence, you should choose a broker that offers multiple payment options like credit/debit cards, PayPal, bank wire, and more. The broker should also execute transactions with ease and almost instantly.

Execution

It is crucial to your success as a trader if your broker fills you at the best possible price for your orders. The forex market is volatile, and failure to execute orders swiftly will make you lose valuable entry or exit positions. This is because a few pip differences can be the difference between profit and loss. Hence, it is best to choose a broker that executes orders almost instantly.

Customer service

It is inevitable that you encounter some challenges when trading forex currencies. When that happens, your broker should be available to help solve the issue on your behalf. Choose a broker that is available 24/5 and possibly offers customer service in multiple languages (for non-English speaking traders).

Why trade with the top brokers

Trading with the top forex brokers offers a lot of advantages to the traders. Here are some of the benefits you stand to gain.

Liquidity

The best forex brokers offer more liquidity than the smaller average ones. Most of the leading broker process billions of dollars in transactions daily. Their liquidity makes it easy for traders to buy and trade assets instantly. When it is time to withdraw your earnings, you won’t encounter any problems.

Swift order execution

Thanks to their superior technologies, the top brokers execute orders swiftly for the traders. This feature works to your advantage because you can enter and exit trades at exactly the point or near the point you desire.

Trading platform options

The top brokers offer users various trading platforms to choose from. They usually have their proprietary platforms and offer others such as the MT4, MT5, cTrader, or WebTrader. Thus, you get to choose any platform that you are comfortable with.

Lower spreads

To attract more traders, the leading brokers usually offer lower spreads. This means that the difference between the ask and the bid price is small. With lower spreads, you stand to make more profits from your trades.

Other asset classes

While this may not be a defining quality, the top brokers usually offer other asset classes in addition to forex. You can trade other assets like stocks, commodities, indices, ETFs, options, and more.

FAQs

What features should I look for in a broker?

There are various features to look out for when choosing a broker. They include; security measures, trading platforms, trading software, and other tools, security, spreads and commissions, order execution speed, payment methods, and more.

Are regulated brokers the best?

The regulated brokers follow guidelines approved by regulatory agencies to protect customer investments and private information. They are usually insured, which means that the traders can recover their money in case something goes wrong with the broker. Overall, they offer more secure services.

Should I stick to the major trading pairs?

Although it is recommended that new traders start by trading major FX pairs, you can go beyond them. The top pairs like the EUR/USD, USD/JPY, GBP/USD, and GBP/EUR are the most liquid, but you can also trade the other pairs.