Breakeven Forex Trading Strategy

The large MAJORITY of Forex traders all around the world make more than 50% winning trades.

The large majority of these exact same traders also go on to consistently lose money. FXCM recently carried out a study of 43 million trades from Q2 2014 – Q1 2015 to look at trader stats and some super surprising results came out.

You Can Make Profits!

I have discussed in the past how traders are A LOT MORE profitable than the wider trader population thinks and how the myth about only the elusive 5% making money is rubbish. You can read a lesson I published a while back on this at Is the 5% Myth True – Do 95% of Traders Fail?, which shows a list of brokers having trader profitability rates as high as 40%+ in some cases, but nearly all being over 30%+.

The problem with those figures is they do not show long-term profitability rates or follow the same account holders, so one account holder could make a large profit for months in a row and then drop off the edge into account draw-down. BUT it does show profits are being made all the same, and also illustrates how profits are not just for some special group of people with a secret access key.

It proves to you that you can make profits, showing how huge percentages of the markets are doing it every single day.

43 million trades is just enough to call a sample size ?. There are two super interesting stats that jump out right away from these trades:

Those are HUGE results right there to sit up and take notice of ? !

But still traders who know how to make winning trades lose money.

Note: You can find the full post written by the DailyFX’s David Rodriguez that looks at these 43 million trades HERE.

Bread, Milk, Oil & Houses = Business

The elephant in the room and obvious question is why do these traders getting winner after winner not make profits? The answer is simple: their wins are not covering their losses. The same as in any business right?

If you are selling bread or milk or oil or houses, if you charge less than what you paid you will very quickly find yourself out of business, because you will be losing money. Same principle right?

You know this already. What you do need to know though before we move on is that as a trader you have two options: will you be a high win rate or a high reward trader?

It makes a huge difference which you choose to be. Both have their positives and negatives.

As a high win rate trader you are going to aim for more wins with a smoother equity curve and potentially smaller risk reward trades. If you are a high reward trader you will look for high reward setups and be prepared to take on more losses in search of those rewards. I highly recommend reading the lesson on this to help make your decision at;

Is it Better to Use High Risk Reward or High Win Rate? HINT: High Profits Are the Difference

Flip of the Coin, or 50/50 Choice

It is really not all that surprising to see that traders with a bit of education are able to average a tick over 50% win rate. When you think about it, it is actually more surprising that traders lose as consistently as they do, even though they have what is a winning edge over the market.

If you take away the spread/commissions, then the only options are to go long or short; a 50/50 option. This is a flip of the coin choice. A monkey could take this coin and get 50% winners and so a trader with some education could increase that to above 50%.

Where it becomes more challenging and tricky is after the trade has been placed and you have to manage it. The best way to overcome this is by using a pre-trade plan that marks out exactly how you are going to manage your trade, so that once in it all you have to do is follow your plan.

I go in-depth about how to use a pre-trade plan in the trading lesson here:

How You Can Start Increasing Your Profits With Trade Management Planning

What is Breakeven Trading?

The online dictionary merriam-webster.com defines breakeven as:

Definition of breakeven

: the point at which cost and income are equal and there is neither profit nor loss; also : a financial result reflecting neither profit nor loss

The explanation above explains breakeven really well in general terms.

Breakeven in Forex trading works by you moving your stops from your first stop position into your original entry position once price has moved in your favor. If price then turns around on you and stops you out, it will stop you out at your new ‘Breakeven’ stops. Because this is set at the same price you entered at, you will not lose any money. Make sense? If not, comment below…

Breakeven is a trade management strategy that a lot of traders don’t learn soon enough. The basics of breakeven trading can be used in the rest of your trade management, as I am about to show you in the next section.

When Should You Use Breakeven Stops?

How do you normally manage your trades? There are many different market types and situations and breakeven stops can help you manage your trades to protect your crucial capital. They can also allow you to make ‘free trades’, looking for those bigger potential profit trades.

Below I have covered just a few of the different strategies you could look to implement and use in your own trading with the breakeven method. These will allow you to protect your capital in the different market types.

Protecting Capital

One of the best strategies for using the breakeven strategy is protecting your capital. As I explained when outlining how the breakeven works, the basic mechanics of this method are straightforward – you move your original stops into your entry position when price moves in your favor.

FREE TRADES – The Best of Worlds!

This simple act of moving to breakeven and protecting your trade from being stopped out could be a ‘Game Changer’ for a lot of traders.

The reason for this is because it will all of a sudden open up a whole heap of doors and opportunities that they have never seen or noticed before. What doors exactly?

You don’t just have to move to breakeven and protect capital. You can look for ‘FREE TRADES’. What are free trades? These are the best sorts of trades available.

Say for example you are in a trade and you have taken profit target 1. You now move the rest of your position to ‘Breakeven’. You are in a ‘FREE TRADE’. You have cashed in part profit, you cannot lose on the rest of the trade and whatever happens is all profit, but either way – you cannot lose.

Chart Examples

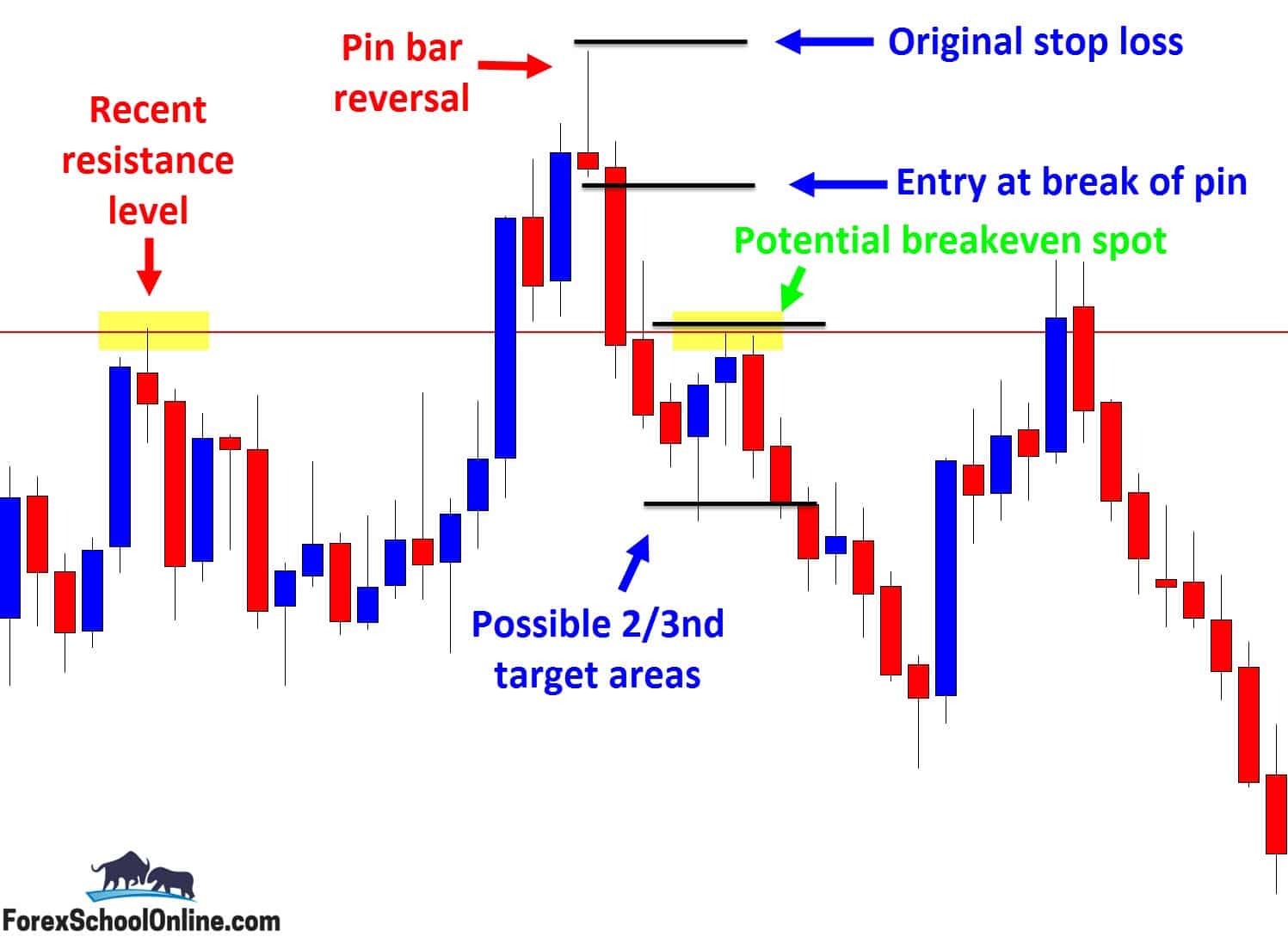

The chart below explains both of these two breakeven strategies. At the high sticking out and away from all other price we have a bearish pin bar reversal. To enter this pin bar we need to set our entries just below the low of the pin bar to enter when price breaks lower.

As you can see on the chart, back to the left is a previous resistance level. Keep in mind when entering the pin bar at the time we would not have all the price action information that we have on the chart now. We would only be able to see that we are trading into a potential ‘price flip’ or support level.

This could be an area where you may look to potentially protect your capital. You could do this by moving your stops from where they were originally above the pin bars high into ‘Breakeven’, which is as we know the price you entered.

This is the beauty of the free trade and there are many combinations you can choose to work, depending on your style, comfort levels and particular trading temperament. You may choose you want to take 1/3 profit off the table at this level so as to cash in some profit and then move the rest to breakeven. It really is up to you. See chart below:

Chart Example 1

Different Market Types – Manage Differently

The last point I wanted to touch on with the breakeven strategy that I know would really help you is discussing the different market types. I want to make sure that when you are looking to implement your breakeven stops you take into account what sort of market you are trading in because this is SUPER IMPORTANT.

A major mistake a lot of traders make is treating all markets the same when managing their trades. Something we teach our members in the members price action trading courses is to manage their trades according to the different market types. That is what I want you to do with your breakeven strategy as well.

For example, if you’re making a trade in a tight and ranging market, then you’re going to need to protect your capital a lot closer than in a strongly trending and free flowing market.

Because price is ranging there are going to be a lot more support and resistance levels and price will be a lot more inclined to chop up and down, so make sure to keep this in mind.

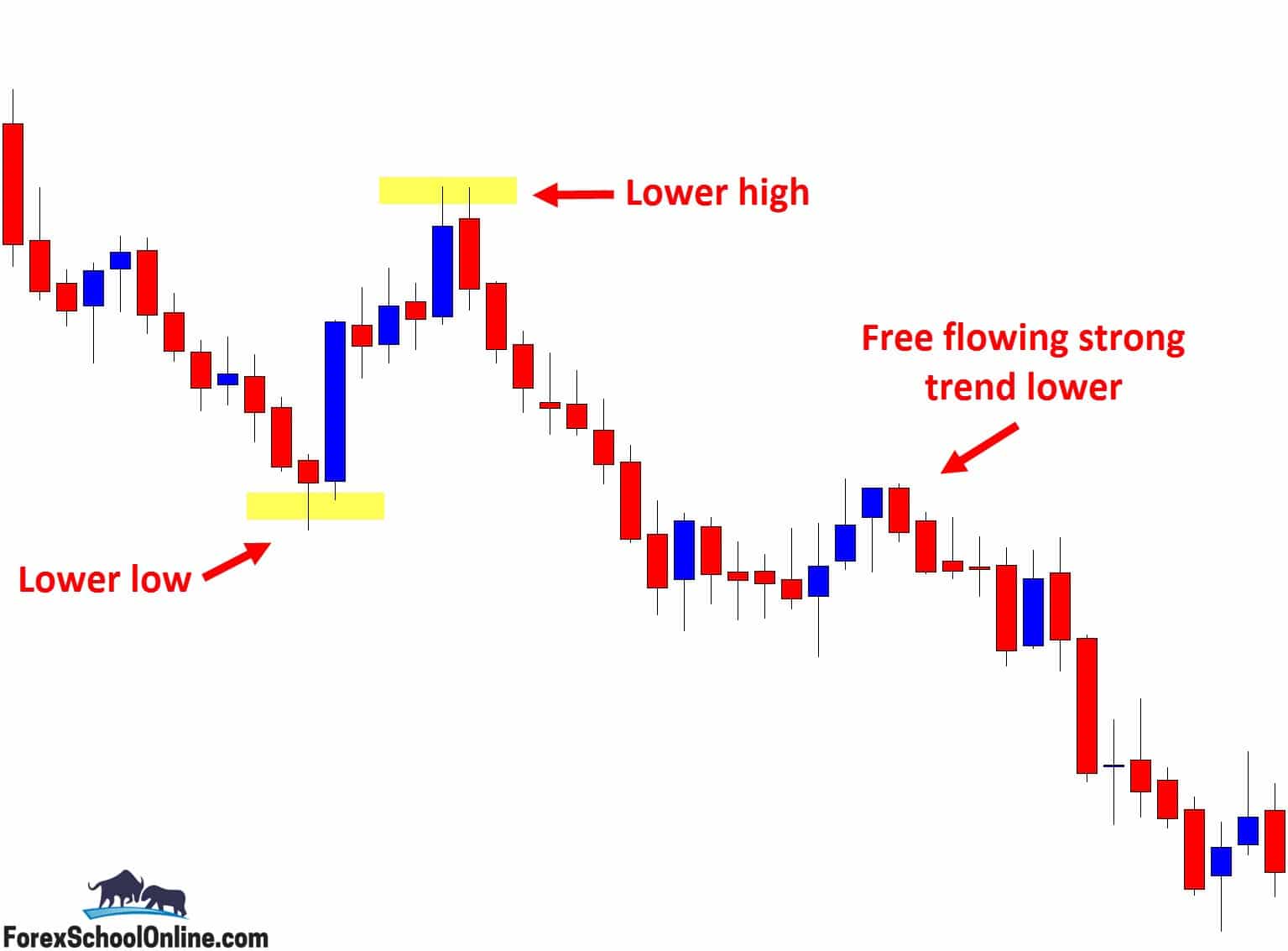

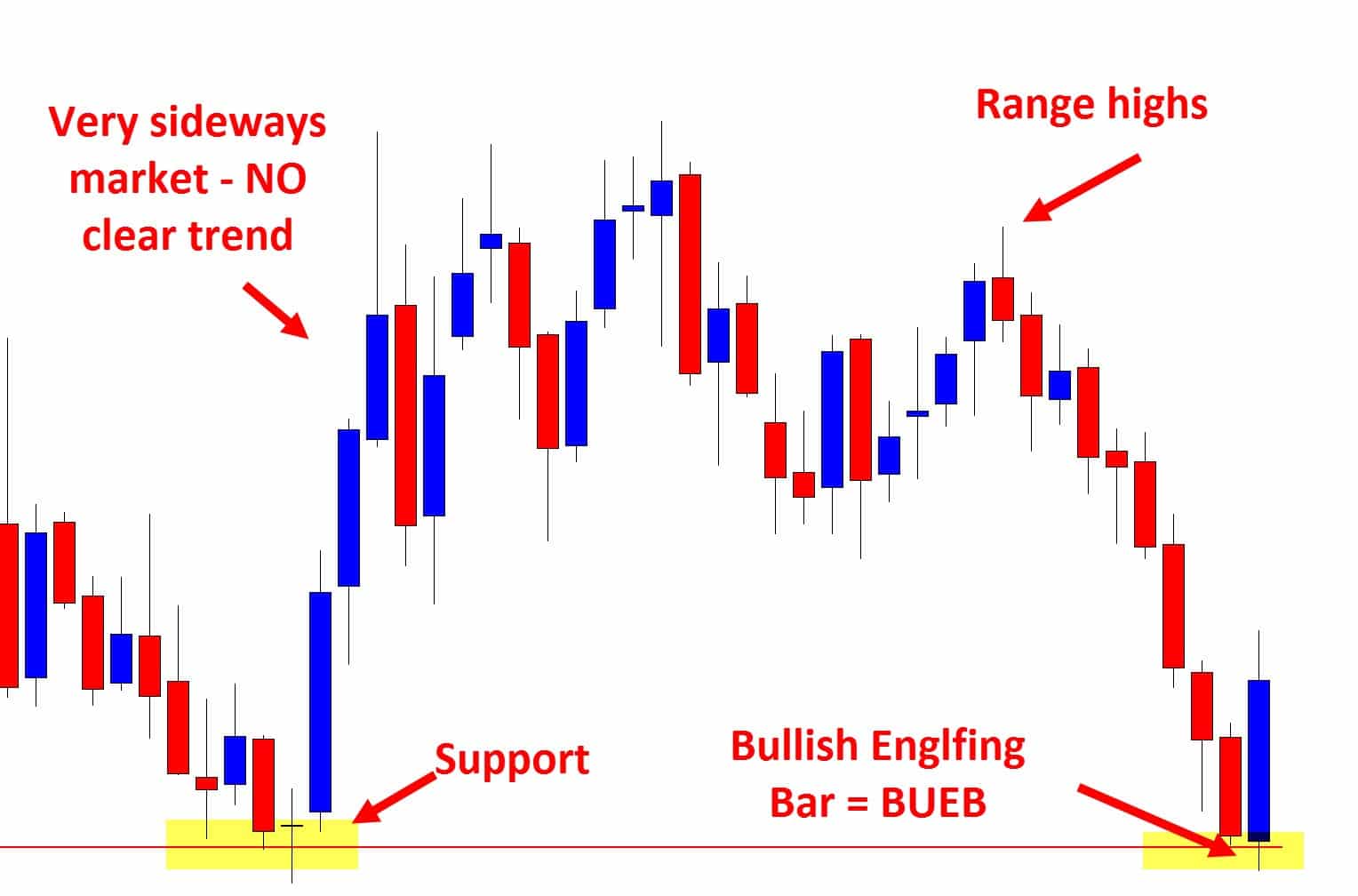

You will notice in the chart examples below the super obvious and clear differences in the price action stories of the two charts. The first chart is making clear lower highs and lower lows and the second chart is caught in a sideways range that is very choppy.

If you were to manage these two markets the same, with the same trade management methods you may just come out with really great results once or twice, BUT overtime those results would leave a lot to be desired and the reason for that is because as just discussed above and as you can clearly see from the examples below; there are clear differences between market types.

- YOU CAN set rules around these market differences and create plans pretty simply.

Chart Example 2

Chart Example 3

50%+ or Profits?

Could breakeven trading be just the thing you need to turn your trading around or lift you over the edge into profitability?

Trade management is something that we ALL have to continually work and practice on. The fact is that the trader who makes the best decisions on a consistent basis will come away with the treats from the cookie jar.

Think about it like this: if the majority of traders are averaging above 50% winners, then whoever makes the best decisions over the longest amount of time is going to come out on top EVERY SINGLE TIME.

If I can use Breakeven trading to protect my capital, make free trades & make big runners/profits and help manage trades in different market types, then I am most definitely going to do so.

If you need any clarification on anything in today’s trading lesson, you have any questions or you want to make any comments, then I WOULD LOVE TO HEAR FROM YOU in the comments section below!

Until next time,

Johnathon

Join The Telegram Group To Get Your Breakeven Forex Trading Strategy

- Instant Access To The Beginners Course

- FREE Trading Signals

- Start Making 700 pips per week

Hi Johnathon

If I remember correctly sometime back you provided a free download to a trade manager that moved stops to B/E or B/E plus profit. It seems this would have been a good article to include that link again. Or maybe you did & I somehow missed it.

Moving your stop to breakeven and taking some profit is good as it protects your capital but you have also reduced your lot size in case the market move further in your favour. How do you balance the two strategy?

Hi Sutiv,

thanks a lot for your comment. I

As I replied ti Kl above; there are a few ways you may look to take real advantage of this in your trading, however; this is something you need to work out as part of your trading rules and trading plan.

You can use the breakeven in different market types to manage trades differently i,e manage some trades a lot stricter than others.

Or you may look to use it as a strategy where you only look to make much bigger winners with it. For example; you take your first normal profit and then move to breakeven on a last portion of profit to see if it will run for bigger profits.

It also allows you to start making rules and plans around the trade management side of your trading.

Safe trading and all the success,

Johnathoin

I really enjoyed the lesson. I would also like to learn how to trade. Please equip me n become the best trader in the world.

Sizwe South Africa

Hello John,

When are you saying we should move our stop losses to breakeven? once price goes in our favour? Wouldn’t this prematurely stop us out before our trade could realise it’s full potential?

Thank you

Hi Kl,

this is something you need to work out as part of your trading rules and trading plan.

You can use the breakeven in different market types to manage trades differently i,e manage some trades a lot stricter than others.

Or you may look to use it as a strategy where you only look to make much bigger winners with it. For example; you take your first normal profit and then move to breakeven on a last portion of profit to see if it will run for bigger profits,

All the success,

Johnathon

Hello John,

Thank you for the clarification. Anyway, I am wondering, does news or other data affects forex like how it affects indices? Or is forex mainly demand and supply.

thank you

Hi Kl,

you can read about news/fundamentalk trading etc in this lesson at https://www.forexschoolonline.com//to-be-a-successful-price-action-trader-dont-follow-the-news/

Johnathon

Your dispelling the myth stating that only 5% of market participants actually make money is an eye-opener. Many people, including myself, consider this age-old myth true. Kudos to you for pointing this out in your article!

Heya Kua,

yeah this is one of the major Forex trading myths.

This study and the other lessons I reference show some contradicting information. It would be very interesting if that other lessons followed up traders much longer term, but it still shows higher profitability rates all the same!

Johnathon

In order to get to break even you are risking capital to get to break even. Therefore there is no such thing as a free trade.

Hi Chris,

good to hear from you.

A ‘free trade’ as in trading for free because we are in a trade where we are risking no capital, but we still have the potential to make much large profits exists when we can use the breakeven strategy to move our stops into our original entry position. As explained in the lesson; there are varities on this, such as taking part profits etc.

Safe trading,

Johnathon