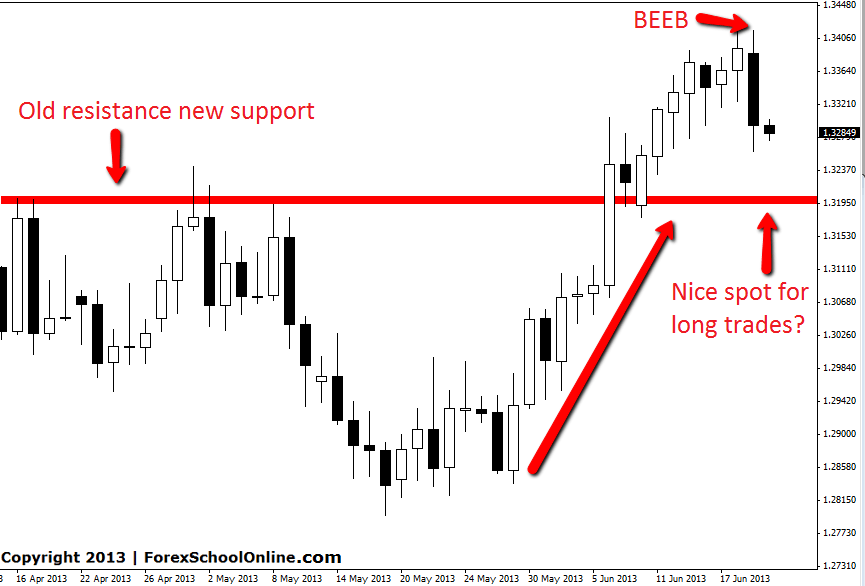

The EURUSD Daily chart has fired off a Bearish Engulfing Bar (BEEB) for price action traders. Whilst this is a clear bearish signal that the market may be looking to move lower, it has not come at the best possible spot for traders to take short trades.

The first worry price action traders should have with this setup is all the recent momentum and trend has been higher and taking a short trade into this market would be taking a trade straight against the trend. The trend is one of the best friends a traders has and we want to trade with it as much as we can and not against it.

The next worry is where this trade has formed. If this bearish engulfing bar breaks and moves lower it has a very solid support level it will run into that we could reasonably expect a pack of bulls ready to get long will be sitting and waiting. Of course the opposite could just as well happen and price could cut through this level like butter, but the chances are this level will hold and price will move higher from this support level.

The trend in this market is higher and this bearish Forex signal could provide just the perfect timing for the market to retrace back lower into support. If price moves back into support it could provide the perfect opportunity to get long with the trend and from a solid and logical support level. Make sure any trades are confirmed with a price action setup!

EURUSD DAILY CHART | 20 JUNE 2013

Very nice article, with a lot of information to be poured through. Thank you so much for this forex trading post.