Do 95% of Traders Really Fail?

One of the biggest myths spread around the Forex world is that 95% of traders fail to make money. Traders no matter how limited their experience, seem to all have heard the same myth! I have no idea where this started but I have a very good idea of why this myth continues on today and will continue on for a long time to come.

There is one major thing all unsuccessful traders have in common and that is they fail to take full responsibility for their trading. They may think they do, but when it comes down to it they are all looking for any excuse or reason as to why it is too hard to make money.

This is the same reason indicators are so popular in the Forex market. Indicators allow traders to pass the blame onto the indicator when the trade doesn’t work out. When the trade goes bad they can simply sit back and say “that indicator didn’t work”! Yet when the trade is a winner they are the smartest trader getting around.

All the traders that continue to lose money trading Forex love to spread the word to other aspiring traders just how hard making money is. This makes them feel better about their own lack of success. Before you know it the new trader who has just been told it is too hard by the losing trader is finding themselves giving up because they now think it must be impossible to become part of the exclusive 5% of winning traders! You can see how this cycle continues!

What do the Stats Say?

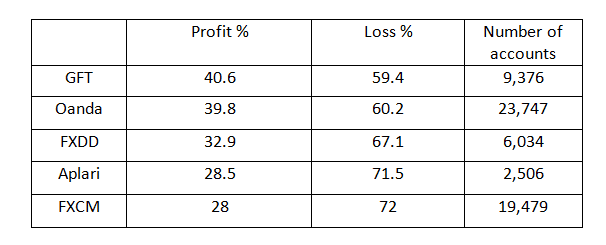

The first quarter profitability results have recently been released for the biggest brokers in the US. The graph below shows the 5 most well-known brokers and their trader’s profitability. This information has been sourced with the permission of Forex Magnates and the completed graph can be found here: Forex Trader Profitability Stats

As you can see from the above graph the best broker is GFT who had 40.6% of their traders who were profitable over the first quarter for 2012. The lowest profitability rate of the 11 brokers who released their results was FX Club who still had 27.3% of their traders who made money in the first quarter!

The above graph slams the myth that only 5% of all traders make money in the Forex market. Oanda had nearly 10,000 traders in the US alone who made a profit in the first quarter.

How Can I Become Part of The Profitable Group?

To turn your trading around you need to start doing things the way that profitable traders do them. Stop hanging around the traders who are negative and make everything seem hard. The best and fastest way to achieve success is to start talking and mixing with people that have done what you want to do. Stop letting your unsuccessful buddies tell you how hard trading is and how it can’t be done. Start watching and listening to the people that have done it and can show you how.

Making money in the Forex can be done. You can see from the above graph many people do make money from Forex. You just need to seek out the correct people and begin to learn the methods that they use to succeed.

What are the Major Differences Between the Profitable and the Not?

If I had to tell traders what are the 3 of the main differences I see between the people who make money and the people who do not, it would be successful traders have the following:

1. They have an edge and master it.

2. They are picky in their trade selection.

3. They approach the market with the correct mindset. They have learnt from their mistakes.

They Have an Edge and Master it

The traders that make money consistently in the markets year in and year out don’t do so with a random approach. Most successful long term traders have a method such as Price Action Trading. A method such as Price Action Trading allows the trader to clearly define when they have an entry signal present, and then how they need to enter and manage their trades.

Without an edge in the market traders may as well just flip a coin and aim for 1/1 risk reward. Not counting spread this would at least give traders an expected outcome of 50/50 of making money. An edge is something the profitable trader has committed to and has perfected so that they know in every scenario exactly what they should do.

There are literally thousands of Price Action traders in today’s markets and the successful ones are the ones who have taken the time to learn their craft and have perfected their chosen setups. Instead of trying to trade every single entry signal there is, they have learnt a few easy and simple setups that are repeated and have made them their own. You don’t need 20 different Price Action signals to make money, you just need to be excellent at the few you trade!

They are Picky in Their Trade Selection

This point is the absolute number one thing that separates the great traders from the rest. There is no doubt about this! The biggest account killer I have seen in nearly all losing traders is the need to always be in a trade and to over trade. The profitable traders never fall into this trap.

This goes with the previous point listed above. The successful traders have their few very reliable setups that they trade. They don’t then just trade every single setup that comes along. Because they have perfected their craft, they know exactly what an A+ setup looks like, and what criteria has to be met for them to enter a trade. When a setup meets their criteria they act fast and without hesitation.

Perfect your few chosen Price Action setups, and then wait for the very best setups to come along. When they do pounce hard, fast and without hesitation, like a tiger pouncing on it’s pray!

They Approach the Market With the Correct Mindset, They Have Learnt From Their Mistakes

Once the trader has an edge and has learnt exactly how their method works, it is vital they take time out to work on their trading psychology. I know a lot of traders will read this and roll their eyes, but I can guarantee you those exact same traders are the ones making a loss!

Are you trading with fear? Are you trading without money you can’t afford to lose? Are you risking too much money? Are you over confident because you just made a few winners? Do you think that you need a method that should be 100% correct all the time? Are you revenge trading? These are just a few of the very serious trading errors that traders can make because of the incorrect mindset.

Profitable traders have not just read about these psychological errors but they have experienced them and learnt from them. Most traders have experienced the feelings I have spoken of above. What have you done with these? Have you buried them away for another day so they can arise again when you are next in the same situation? Or have you set aside time to study and find a fix for them?

At the end of the day you can be a successful trader! How badly do you want it? You need to commit and then go about finding a way to achieve your goals.

Safe trading,

Johnathon

Interesting article, Jon! You may know me as Willy, the clumsy trader who had no idea about putting the pending order correctly?

Yes, I seriously considered joining your trade group here, but I have no cc or paypal. Can I still join if I pay via bank transfer directly?