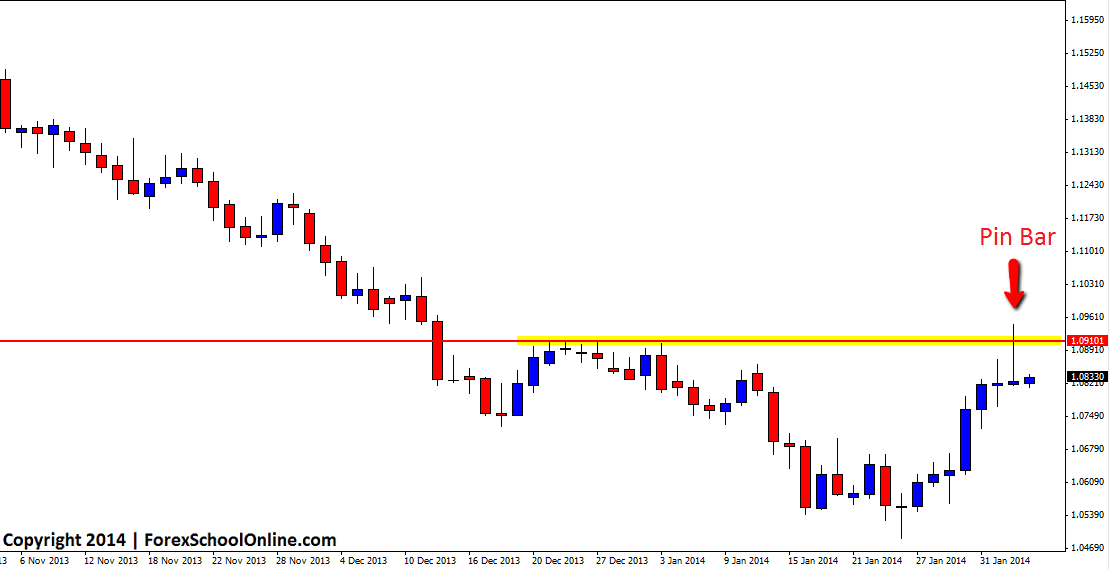

The AUDNZD has fired off a daily bearish pin bar reversal that is sticking out and rejecting a key resistance level. This pin bar has a long nose that is protruding up and through the key resistance level and is formed meeting the criteria to be a valid pin bar. Price on the AUDNZD in both the longer term and shorter terms has been in a raging down trend with price having fallen off a cliff in the last four months, shedding over 1,000 pips in the move lower, before this recent swing higher.

Price has since made a move higher and into a swing high where it formed this pin bar reversal. Traders can often make some crucial mistakes with the Pin Bar, but one of the biggest is not trading the pin bar from the correct swing highs and lows and as I discuss in this trading lesson here: Trading The Pin Bar From The Correct Swing Points, the pin bar is a reversal signal and if not traded from the correct swing points, the trader can very quickly find themselves entering at the wrong end of the market where the big guys are taking profits and getting out.

If this bearish pin bar can confirm by breaking the pin bar low and then gain momentum, the first near term low support area comes in around 1.07270. If price can break lower, the major support area is at the recent swing lows where price could not break any lower last time. If price moves higher and back through the resistance level and manages to close above the resistance, price may be looking to start a new up-trend. Price has already formed a base and created a new higher high. For this down-trend to stay intact, price needs to once again push back lower.

AUDNZD Daily Chart

I forgot to add this pair into my mt4…. thanks a lot Johnathon for the signal

Great! You can read all the pairs I trade here: https://www.forexschoolonline.com//start-cherry-picking-best-price-action-trades-forex-pairs-johnathon-fox-trades/

Johnathon