CFD Trading Explained

CFD or ‘contract for difference’ trading can allow you some of the most flexible trading conditions in the markets.

Over the last ten years CFD’s have become incredibly popular and now allow you to trade in many different markets and asset classes.

When trading a CFD you are making a trade without actually owning the underlying asset. For example; if you are trading a stock market CFD you are trading on the price of that stock without actually owning the underlying stock.

When trading a CFD with a broker you are basically entering into a contract on the current price of the asset, Forex pair or whatever you are trading and where you finally end up closing out your trade.

The difference between the open and close price of the CFD contract will determine how much money you have made or lost.

Why Trade With CFD’s?

One of the reasons CFD’s have become so widely used and popular is because of how flexible they are and what they can allow you to achieve in your trading.

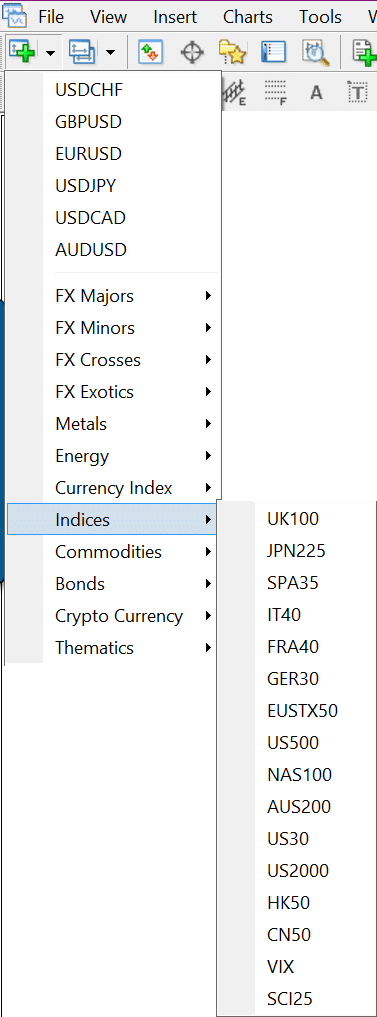

When using a CFD you can trade on many different global markets. These include markets such as stock indices, Forex pairs, Gold and many other asset classes.

When trading a CFD you have the ability to go long or short. That means not only can you profit from the price going higher, but you can also profit when the price moves lower.

With a cash based CFD there is also no expiry date unlike when you are options trading.

One of the major benefits of using CFD’s is that you have the ability to use leverage.

Leverage will allow you to open a larger position for a small initial outlay. Each broker has different leverage and margin requirements and the requirements will often be different for different assets. However; a simple example is leverage of 100:1 where you will only have to have an initial outlay of $1 for every $100 to open the trade.

Another major reason CFD’s are so widely used is because you have the option of trading 24 hours a day and 5 days a week in many different markets. You can use CFD’s to trade Forex 24 hours a day.

How to Trade CFD’s

Trading CFD’s is very straightforward after a little practice.

The first thing you need to do is choose the market you want to trade for example; the Forex market.

You then need to find a trading setup that you want to buy or sell.

Using your trading platform you will need to enter all of your trade parameters such as the amount you want to buy or sell, the type of entry and your stop loss.

You can then enter your CFD trade, monitor it for a profit or loss and finally close it.

Where to Trade CFD’s

There are a lot of different brokers offering CFD trading these days each offering very different standards and levels of quality.

You can read about and trade CFD’s with this broker here. It is important you have a fully regulated CFD broker who you completely trust and looks after you and also quickly and efficiently places your trades.

Leave a Reply