Can You Learn to be a Professional Trader?

Can You Learn to be a Professional Trader?

With so many traders coming into trading every single day, the subject of learning to trade and learning to trade Forex successfully, is something I discuss regularly with traders. On a daily basis I have the pleasure of dealing with people from many different walks of life and who have a plethora of different capabilities and skills.

What makes someone a successful trader is not how smart they are or how much money they have or even the schooling they received. There are plenty of high school drop outs that are skilled traders and there are also plenty of skilled traders that reached the top of their classes that had the best benefits given to them growing up.

The point is; to become a successful Forex trader you do not need to have a certain education or to have grown up in a set country. If you are willing to put in the work required and make the changes to your mind so that it can think the way it needs to, to be a profitable trader, then you can learn to trade profitability.

That last part is where most traders struggle in their journey to becoming consistently profitable traders.

The human mind doesn’t naturally think as the trader needs it to, to make consistent profits in the markets and this can be a stumbling block to far for some traders to get over. For traders to be successful in the markets they need to be able to think in “uncertainty” and embrace it.

Traders need to be able to risk money on trades, knowing that nothing is certain and knowing that they may lose and knowing that they may have losing streaks. Being able to embrace this uncertainty is something that all traders need to adjust their mind to because the human mind naturally craves certainty in all things in life.

The Turtle Traders Story

Richard Dennis is well known as much for his famous trading skills as for his ability to teach a group of traders how to trade, some of whom had no trading experience at all to make millions of dollars. In the 1980’s Dennis was a raging success and had turned a stake of less than $5,000 into well over $100 million.

Dennis was of the opinion that successful trading could could be taught to anyone from any background and that all that  was needed was a clearly defined method and a disciplined trader to carry the trading method out.

was needed was a clearly defined method and a disciplined trader to carry the trading method out.

Dennis’s partner William Eckhardt was of the belief that Dennis had a gift and that trading could not just be taught to anyone.

To settle the debate an experiment was set up. Dennis ran advertisements in the Wall Street Journal and thousands applied to learn how to trade. In the end only 14 were chosen and from this first ad and only a few had any trading experience at all.

These first 14 students then underwent a two-week trading course. Dennis referred to these traders as his “Turtle Traders” because this two-week course could now be repeated by new traders over and over with new traders made each time.

On a previous trip to Singapore Dennis had noticed how efficient turtle farms are and how he can do the same by growing traders efficiently with his two week courses.

The results of the experiment were simply amazing. In less than five years the traders that Richard Dennis and his trading program taught earned $175 million dollars. Dennis went onto prove without a shadow of a doubt that trading can be taught to any trader with or without trading experience as long as they have the will and discipline to stick to the system or method.

Consistency is The Key – Start With Just One A+ Setup

If you can do something successfully once, then you have proven to yourself that you can do it successfully many times. If you can make a winning trade in the markets once, then it proves that it can be done again and whilst at first you may not have the skills needed to consistently make profits in the markets, making a winning trade in the markets proves that it can be done and it is possible, you just have to repeat what you did the first time.

What many traders try to do when they come to trading is either find a system that makes a hundred trades a day, or a method that they can use to trade many different setups all at once.

This is normal human behaviour and psychological thinking, but it does not work this way in Forex. As humans we are taught to believe that more equals more and when traders come to trading they are immediately looking for more trades thinking that the more and more trades will equal the more and more money. The missing link in this equation for Forex is quality.

Traders can play as many trades as they like, but if the quality of those trades is lacking in quality, then the results of the trades are going to be a drain on their account and this is what normally happens in most instances.

What traders would be far better off doing instead of trying to trade many setups is learning to trade only one A+ killer price action setup and then getting to know it like the back of their hand. The trader should then learn to trade this one A+ setup in every market situation and every scenario whilst learning every detail about this one setup.

The trader should become the subject matter expert on this one setup. Instead of being average at a bunch of setups like most traders are, the trader would have an abundance of confidence to trade their setup in any market condition and time frame because they have worked out the key criteria and context needed for high probability trading with their setup. The trader should make this setup their own and take complete ownership over this one setup.

Persistence and Commitment Can Pay Off!

With so many traders coming into trading every single day we have more traders trying to make money in Forex and Futures than ever. The traders who succeed are the traders who have a real determination and commitment to make it work. Forex & Futures trading like everything else in this world that is worthwhile takes time and commitment.

If you want to trade for the long-term and make a real go of it and not just be one of the many traders that gets lucky gambling with their account only to lose it when the losses come in, then you are going to have to work at the things we discuss on this site and this takes Persistence and Determination.

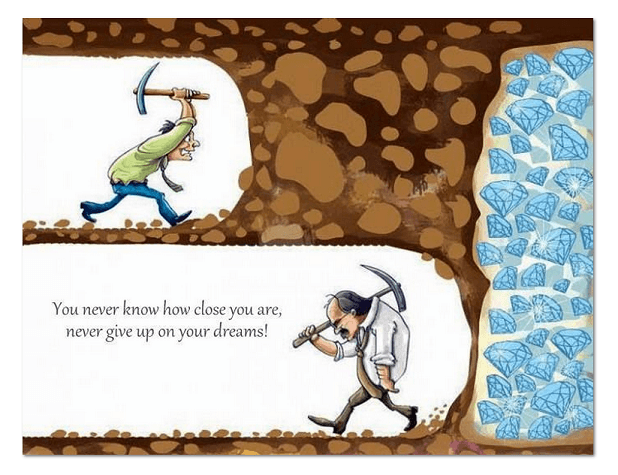

The picture below is a great illustration of this and it highlights exactly what many traders go through in their trading careers with the ups and downs. Some people are not cut out for trading and they have to realise this quickly before too much damage is done. This is normally because they have some sort of psychological scaring or problem that is holding them back and not letting them think in the way that they need to think to trade successfully.

For most traders in their trading careers it can be a series of ups and downs, battles and different experiences. At different times it can be a real fight until the breakthrough comes and the riches are the received.

The problem with giving up is if you give up, you will never know how close you were to succeeding. As the picture shows you may be just a few trades away from have a really big “AHA” moment and something clicks in your mind.

Recap

If you want to learn how to trade, then start small and work your way up.

If you have read any of our articles, then you will realise we do things differently than most other sites. Instead of trying to learn everything all at once and being no good at all of them, become a master at just one. Find a setup that really appeals to you and suits you as a trader and sticks out to you. Once you have mastered this one, you can take on others. You can apply this to time frames as well. Maybe you want to become the master of the daily time frame or the master of the 4hr time frame.

If you decided to master the 4hr charts then you would take only 4hr setups for a period of no less than 3 months and keep a journal of all your trades so you can look back and assess your progress. I had a friend who did this in real life with amazing results I think you will find interesting HERE. If you want help with your trading you can contact me with any questions here or check out the price action trading course page. Please post any question or comments in the comments section below.

Safe trading and all the success,

Johnathon

Leave your comments below…

Hi. A.S. again here.

One more question, i am planning on Mastering Pin Bar as a setup. Is this one of the best ones to master or do you recommend using a different approach?

Thanks.

A.S.

HI Jonathan,

I recently purchased your course, it is very nice product that you have put together. I read mostly all your articles and it has been a great help.

I started Forex about 3 months ago. I am planning on taking your advice just to trade 1 setup and master it. My question is should i stay with 4 hour timeframe or go to daily timeframe as i am new to this.

Thanks,

A.S.

Hello A.S,

I am really happy you are enjoying the members courses. Before I answer your questions; keep an eye out in the next two weeks as I am now completing a revision of price action course one and will be releasing it for members.

To answer your questions; I highly recommend you get into the members only articles and begin following the “Members Path” this will explain exactly the time frames to use and exactly how to set up your trading accounts etc You really need to start following this path as it will help you in a logical and methodical way start moving from the higher time frames down to the lower timeframes, but you don’t start to move until you are profitable and you don’t start funding your account until you are profitable.

The Pin Bar is fine. As long as the setup you choose suits you and you commit to it 100% and do not chop and change is the key. The problem is when two weeks down the track traders get bored and throw it in and start playing with another setup. You have to make your plan and journal and stick with the one signal. Perfect that one and then start adding the next one and repeat the process until you have mastered them all including all the advanced breakout and continuation setups!

In future if you have any other questions at all just email me anytime https://www.forexschoolonline.com//contact-us-html/.

Safe trading,

Johnathon

You are doing a great work on this website, just being introduce by a friend of mine back in nigeria , thanks and keep it up….

Thumbs up fox, very inspiring and eye-opening article. But jst wanna ask, from ur write up u said u had a friIend who stuck to 4hr chart time frame. Now the question is will u advise newbies to stick to the 240 minute or daily chart when starting out. Cos my own belief is that it is far easier and less stressful trading the daily than any other time frame. Many thanks fox. Keep up the good job.

Hello Victor,

definitely stay on the daily charts. Keep trading the daily charts until you are a profitable trader and then after that you can think about moving down to the lower time frames.

Johnathon

Another great article and very useful.

Thanks for the great article. One Setup Only and become a master!

Totally agree, great article!